Billionaire Bill Ackman Drops $1.3 Billion on This Genius AI Play—Here’s Why It’s Shaking Markets

Wall Street's watching every move—and Ackman just made a monster one.

The $1.3 Billion AI Bet

He’s diving into artificial intelligence like it’s the next oil rush. No slow plays, no cautious dips—just a billion-dollar conviction that this tech will redefine entire industries. Forget boring value stocks; this is a turbocharged gamble on machine learning, automation, and data-driven dominance.

Why It’s Genius—And Risky

Ackman’s not chasing hype. He’s placing a calculated bet on a company that’s built different—smarter algorithms, cleaner data, ruthless efficiency. It’s the kind of pick that either prints generational wealth or becomes a case study in billionaire overconfidence. But when a guy like Ackman moves this hard, the street pays attention. Even the cynics.

Timing, Tech, and Tension

He’s jumping in as AI goes from buzzword to balance-sheet bedrock. Every sector from healthcare to crypto infrastructure leans on AI now—sifting data, predicting moves, cutting costs. Ackman’s bet isn’t just on code; it’s on the entire engine of next-gen finance.

One thing’s clear: when a hedge fund titan drops $1.3 billion, he isn’t just investing—he’s sending a message. And honestly? In a world full of copycat traders and recycled plays, it’s refreshing to see someone put real money behind real innovation. Even if it makes the rest of Wall Street look like they’re still using spreadsheets.

Image source: Getty Images.

Amazon is seeing massive growth from two dominant segments

Amazon may be known for its online store and the various businesses that support it. Still, two other AI-adjacent business segments likely excite Ackman and his company. Amazon Web Services (AWS) and advertising services are two of the fastest-growing segments of Amazon, and make up the primary reason to invest.

Unlike traditional retail, both of these segments produce strong margins, which boost Amazon's profits.

AWS is Amazon's cloud computing wing, and made up 53% of Amazon's total operating profits in Q2. It's also putting up strong growth, with revenue rising 17% year over year to $30.9 billion. The tailwinds in the cloud computing industry are massive and driven by both AI and traditional workloads. AWS will continue to be a force behind Amazon's earnings for some time, and it's likely a huge reason why Ackman invested in it.

Another key part of Amazon's business that has emerged recently is its advertising wing. Unfortunately for investors, Amazon doesn't break out advertising's profit margins, but by looking at other companies that get nearly all of their profits from advertising, it's SAFE to say this is a very profitable enterprise for Amazon. It's also Amazon's fastest-growing segment, with revenue rising 23% year over year in Q2 to $15.7 billion.

Both these divisions are stars of Amazon's earnings report, and make for the primary reasons to invest in Amazon's stock. But does the current moment make for a great time to buy Amazon?

Amazon's stock isn't as cheap as it once was

We've known about the Amazon purchase by Ackman for some time. Back in May, he disclosed in a conference call that they purchased Amazon shares. However, investors didn't know the size of that move until now.

If you recall, Amazon's stock bottomed out around $167 in late April, which is likely around the time that Pershing started buying. Amazon's stock now trades for about $230, so it has likely made a solid profit.

But Ackman and his team aren't short-term traders; they're long-term investors, so they see something in Amazon's business.

Although Amazon's stock wasn't as cheap as it was four months ago, it's still at a level it has historically traded at.

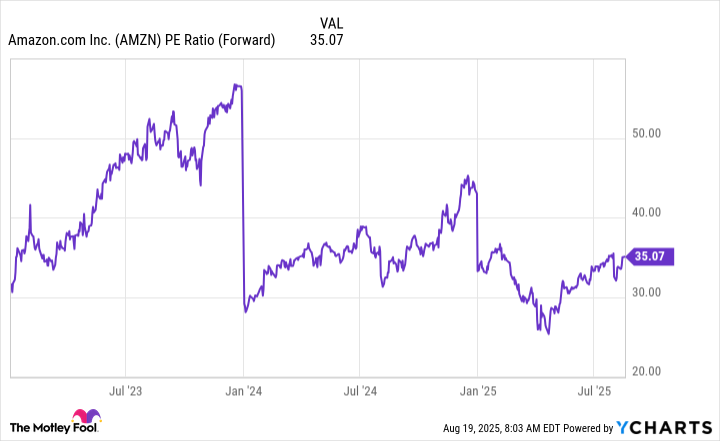

AMZN PE Ratio (Forward) data by YCharts

At 35 times forward earnings, Amazon's stock is far from cheap. But it's also not nearly as expensive as it has been in the past.

I think the long-term opportunity for Amazon is still attractive, and while I WOULD have preferred to buy shares at a cheaper price, today's price tag isn't all that bad either. I think Amazon is still a solid purchase today, and long-term investors will benefit from the growth of AWS and advertising.