This ’Magnificent’ Industrial Stock Just Crashed 60%—Time to Load Up for the Long Haul

Wall Street's latest casualty just became your biggest opportunity.

The 60% Plunge: What Happened?

Forget the noise—this isn't some meme-stock hype train derailing. We're talking a foundational industrial player that got caught in the macro crossfire. Supply chain snarls? Check. Inflation eating margins? Absolutely. But here's the kicker: the core business remains rock-solid.

Why This Isn't Another 'Buy the Dip' Trap

Most investors see a 60% drop and run for the hills. Smart money sees blood in the water. This company's fundamentals haven't evaporated—they're just buried under short-term panic. Their industrial moat? Still intact. Their client list? Still blue-chip. This is a classic case of the market throwing the baby out with the bathwater.

The Forever Hold Playbook

Loading up now isn't a trade—it's a strategic positioning. Think quarters, not days. While day traders chase crypto pumps and AI hype, you'll be accumulating a legacy asset at fire-sale prices. The beauty? Industrial stocks don't care about Fed meetings or Elon's latest tweet.

Because let's be real—if your portfolio can survive a 60% haircut without margin calls, you're either lying or not taking enough risks.

What went wrong at UPS?

On one level, UPS did nothing wrong when the pandemic hit. It simply operated in a business, package delivery, that had a strong story. People stuck at home, socially distancing, shopped online more. That required packages to be shipped in greater numbers, at least for a little while. But investors have a bad habit of taking current trends and extending them out too far into the future. So the unusual conditions of the pandemic were treated as if they were the new normal.

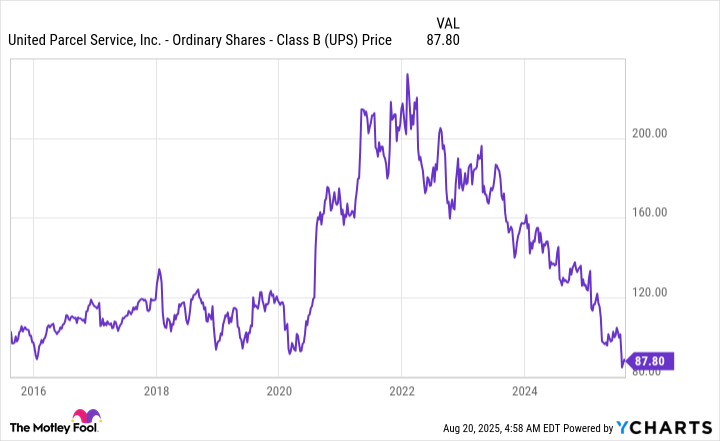

Data by YCharts.

The world figured out how to live with COVID-19. People went back to stores. Demand for package delivery returned to historically normal levels. And UPS' stock cratered, despite the fact that a bear market had turned into a bull market. At this point, UPS stock is trading down around 60% from its pandemic-era peak. In fact, the stock is now back to around the levels it traded at prior to the pandemic.

During all this upheaval, management did something important. It made the decision that UPS needed to update its operations. That process is ongoing, and it has investors worried about the future. The stock continues to languish and will likely do so for longer. UPS is a turnaround story at this point.

Image source: Getty Images.

There's good news in the bad news from UPS

The big-picture view of what UPS is doing is fairly simple. It is updating its operating systems, streamlining operations, and focusing on its most profitable business. These are the types of things you want a company to do. The problem is that there are costs associated with these actions, and those costs are weighing heavily on business performance and the income statement right now.

For example, in the second quarter, there were "after-tax transformation strategy costs of $57 million." That covers things like closing locations and reducing headcount. Even after an offset from an asset sale and other one-time benefits, this one-time charge still took $0.04 off earnings. Focusing on more profitable business has also meant reducing lower-margin deliveries, notably from UPS' largest customer,. That's a big hindrance to revenue, which fell 2.7% year over year in Q2.

However, not all the news is bad. Notably, revenue per piece in the U.S. market rose 5.5%. Customer and product mix accounted for 200 basis points of the improvement. That's exactly what you WOULD hope to see as UPS works to reduce lower-value package delivery volume. Notably, adjusted operating margin was flat year over year, despite lower revenue. Again, that's what you would expect to see based on what management is attempting to do.

UPS is making progress with a vital service

Delivering packages is a business that is likely to get more important over time, not less. So UPS' business is vital to the world. What it is attempting to do is update its operations so it can be as profitable as possible, which is the right MOVE to make. There are costs associated with this decision, but it looks like progress is being made. The one caveat here, however, is that the 7.4% dividend yield is increasingly looking less sustainable.

The dividend payout ratio in the second quarter was above 100%. Income investors need to go in aware of the risk of a dividend cut. But, for those interested in a turnaround story, UPS looks like it is making important progress. That could make the stock, backed by a delivery business that would be nearly impossible to recreate, worth buying and holding for the long term.