7년 비트코인 고래도 갈아탔다! 이더리움 대폭발 임박…블랙록·피델리티 ’쌍끌이’

암호화폐 시장이 다시 뜨거워지고 있다. 7년 동안 비트코인에만 집중했던 대형 투자자들마저 이더리움으로 눈을 돌리는 중이다.

블랙록과 피델리티의 쌍끌이 효과가 시장을 주도하며 이더리움의 대폭발이 코앞으로 다가왔다. 파월 의장의 발언 이후 BTC가 뛰어오르면서 BNB와 ETH는 각자 사상 최고치를 갱신했다.

주말 시장이 다시 한번 암호화폐의 저력을 증명했다—전통 금융권이 여전히 규제와 레버리지로 허덕이는 사이, 디지털 자산은 또 한번의 역사를 써내려가고 있다.

The bad side of energy stocks

Energy stocks are a tough sell for conservative investors because they tend to rise and fall along with the price of oil and natural gas. The business swings that this sector goes through can be harrowing, given that commodity prices often swing dramatically and rapidly. Supply and demand dynamics, geopolitical events, and economic cycles all have a huge impact on the energy sector. But energy is also an important part of the global economy, and most investors should have at least some exposure.

Image source: Getty Images.

That's where integrated energy companies come in. This business model includes businesses in the upstream ( oil and natural gas production), the midstream (pipelines), and the downstream (chemicals and refining), all under one single roof. Since each segment of the energy industry operates just a little differently, having a vertically integrated business helps to soften the business swings that companies like(CVX 1.50%),,,, andgo through.

Those are the largest and most important public independent integrated energy giants. There are other large companies that use the same basic model, but they often have material government ownership, so they aren't as "independent" as you might think. Of the five companies above, Chevron is probably the most attractive right now for long-term investors who are seeking out energy exposure.

Why Chevron? Why now?

Every investment you make requires trade-offs. That's as true of Chevron as it is of technology giant. What you are looking for is the best balance between risk and reward. And Chevron offers a very attractive balance right now.

For starters, the stock is offering a 4.5% dividend yield. That's well above the market and the 3.3% yield of the average energy stock. The dividend has been increased for 38 consecutive years despite the industry's inherent volatility. Clearly, Chevron knows how to survive through the energy cycle while continuing to reward investors well for sticking around.

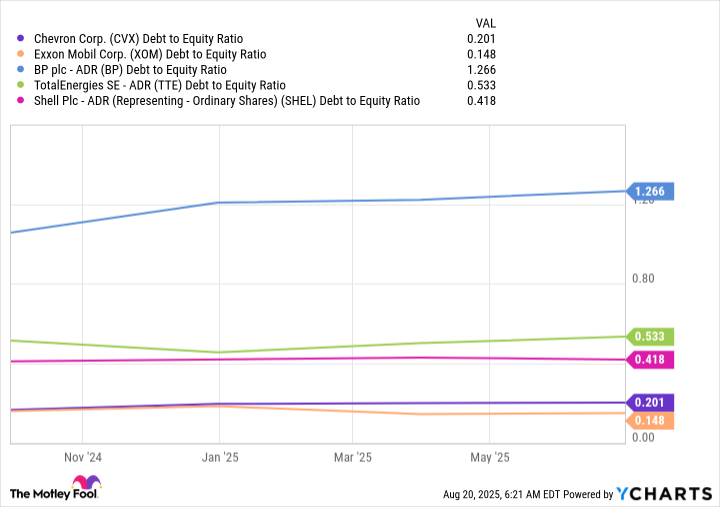

Data by YCharts.

A big part of that is the company's focus on maintaining a strong balance sheet. Right now, it has the second-best debt-to-equity ratio of its closest peer group at 0.2x. This allows Chevron to add debt during industry downturns so it can continue to support its business and dividend. When energy prices recover, as they always have historically, it simply reduces leverage in preparation for the next downturn.

That said, Chevron had been facing a couple of material headwinds in the recent past. But a difficult merger with Hess has finally closed. And the oil from Chevron's geopolitically contentious Venezuelan exposure is flowing again after, effectively, being shut down. So there are positives taking shape for Chevron despite broader industry weakness. And that should help to set Chevron up for even stronger performance when energy prices recover.

An all-weather oil stock

Chevron looks attractive right now for a couple of company-specific reasons. But the truth is that this integrated energy giant is always a pretty good choice for investors seeking energy exposure. So not only will a $1,000 investment get you around six shares of the stock, but it will also get you an attractive dividend yield with a growing dividend that is backed by a financially strong and well-structured energy business. Even for the most conservative investors, that's probably going to be an enticing risk/reward compromise.