Warren Buffett Dumps 41% of Berkshire’s Bank of America Stake - Pours Millions Into Industry Titan That’s Soared 47,000% Since IPO

Buffett's big bet shift just sent shockwaves through Wall Street.

The Oracle of Omaha isn't just trimming sails—he's changing ships entirely. Berkshire Hathaway slashed its Bank of America position by nearly half while loading up on a proven market dominator.

From banking to bonanza

This isn't some cautious diversification play. Buffett's team executed a massive repositioning toward a company that's delivered staggering returns since going public. We're talking 47,000% growth—the kind of performance that makes hedge fund managers wake up in cold sweat.

The new crown jewel

While the old guard watches traditional banking stocks, Buffett's moving where the real growth lives. This industry leader has been crushing it for decades—and now it's getting the Berkshire seal of approval.

Because nothing says 'I believe in this company' like dumping bank shares to buy more. Just another day at the office for the guy who makes more before breakfast than most fund managers make all year—but hey, that's why he's the billionaire and they're not.

Image source: The Motley Fool.

Owning 605 million shares of any company is quite a bit, but this stake is much smaller than it has been in previous years for Berkshire. From July 2024 through the second quarter of this year, Berkshire has sold around 427 million Bank of America shares, or around 41% of its position.

Why have Buffett and Berkshire been selling so many Bank of America shares?

Bank of America hasn't been the only stock that Berkshire has trimmed its stake in. It's notably cut its stake inand a handful of other stocks, bringing its cash pile to a record $344 billion. Although Buffett hasn't said specifically why it's sitting on so much cash, there are a couple of reasons that make sense.

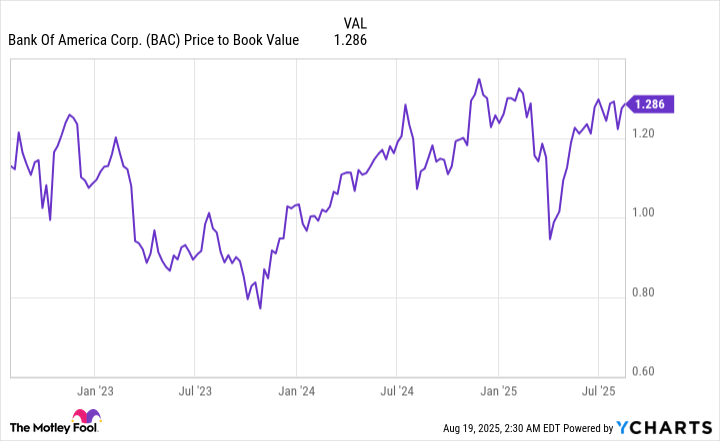

The first is that Buffett has said he expects the marginal corporate tax rate to increase, so selling shares now allows Berkshire to pay less in taxes than it might in the future if his assumption is true. The second reason comes down to value, which is something Buffett is known for chasing. At the start of August, Bank of America's price-to-book ratio was close to 1.29, meaning the stock was trading at around a 29% premium.

BAC Price to Book Value data by YCharts

This alone may not have been the reason why Berkshire has unloaded so many shares, but it seems fair to assume that it played a large part in the decisions over the past year.

What stock has Berkshire been loading up on?

In the second quarter, Berkshire increased its stake by around 136% in a company that the average person likely hasn't heard of:(POOL 4.89%). Berkshire now owns over 3.4 million shares of the company, valued at over $1 billion at the time of this writing.

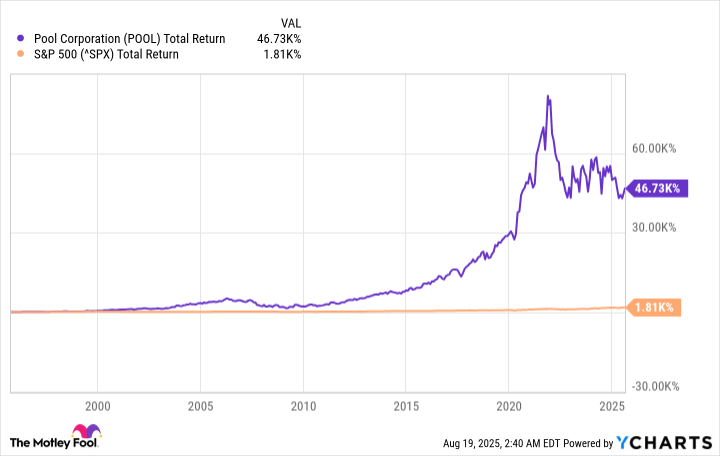

The appropriately named Pool is the world's largest wholesaler of swimming pool equipment, supplies, machinery, and other relevant outdoor products. It has been around for decades, and the stock price has returned nearly 47,000% since its Oct. 1995 initial public offering (including dividends).

POOL Total Return Level data by YCharts

Pool has a trifecta that Buffett often looks for in companies he invests in: a competitive moat in a niche market, consistent profits (though the business is cyclical), shareholder-friendly leadership, and an attractive dividend. Although the stock is down over 8.5% in the past 12 months, this decrease could have aided in the decision to load up on more shares.

I wouldn't advise you to blindly follow Berkshire's move and load up on Pool shares, but if you're looking for a dependable long-term investment, then it could be a good option. Don't go into it expecting the big tech-esque stock price growth that we've seen over the past few years, but instead focus on the steady income stream and shareholder value created.