If You Dropped $1K on Nvidia When ChatGPT Exploded, Here’s Your Staggering Return Today

Nvidia's AI Bet Pays Off—Big Time

The ChatGPT Boom's Unlikely Winner

When OpenAI unleashed ChatGPT back in late 2022, nobody predicted the real cash machine wasn't AI chatbots—it was the hardware fueling them. Nvidia’s GPUs became the undisputed engine of the AI revolution, and their stock absolutely skyrocketed.

While speculators chased AI tokens and crypto projects slapped 'AI' labels on everything, Nvidia quietly vacuumed up actual profits. Their chips are the picks and shovels in this gold rush—and early investors hit the motherlode.

Fast forward to today, and that initial $1,000 investment? Let’s just say it’s grown enough to make traditional finance bros reconsider their entire portfolio strategy. Meanwhile, crypto 'AI' coins? Most evaporated faster than a meme token’s liquidity.

Nvidia didn’t just ride the wave—they built the damn ocean. And while Wall Street debates P/E ratios, smart money already banked the gains.

How has Nvidia stock performed since ChatGPT's launch?

When ChatGPT made its debut in late 2022, Nvidia's market cap hovered around $345 billion. Fast forward to today, and the company is valued at an astonishing $4.4 trillion -- making Nvidia the most valuable company in the world.

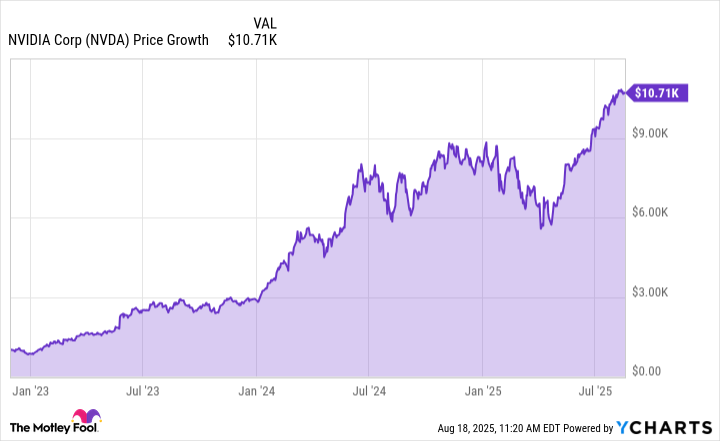

NVDA data by YCharts

To put this into perspective, consider the chart above. A $1,000 investment in Nvidia stock at the time of ChatGPT's launch WOULD now be worth roughly $10,700 -- nearly a 10x return in less than three years. On an annualized basis, this translates into an average return of 139% per year.

Are returns of this magnitude typical?

Over the last century, the compound annual growth rate (CAGR) of the S&P 500 index -- inclusive of dividend reinvestment and adjusted for inflation -- has averaged about 6.9%.

By comparison, Nvidia's joyride over the last few years not only dwarfs the long-run performance of the S&P 500, but it also stands out as an anomaly of historic proportions.

Of course, returns of this magnitude are anything but typical. Yet, there remain several compelling reasons to stay optimistic that Nvidia stock could continue climbing -- fueled by rising investment in AI infrastructure, continued robust demand for graphics processing units (GPUs), and expanding opportunities in new industries.

Image source: Getty Images.

Keep a long-term investing mindset

Following ChatGPT's debut, a wave of competing large language models (LLMs) has entered the market -- including Gemini from, Anthropic (closely integrated with), xAI's Grok, and Perplexity.

More LLMs inevitably means more competition and a greater demand for compute power. This surge translates directly into rising AI infrastructure spending from tech hyperscalers -- many of which rank among Nvidia's largest customers.

Beyond the private sector, Nvidia also has enormous potential when it comes to sovereign investment in AI ecosystems. The company plays a central role in Project Stargate, a $500 billion initiative led by, OpenAI, and, which aims to supercharge U.S.-based AI infrastructure and systems domestically over the coming years.

Internationally, Nvidia is becoming equally indispensable. The company is deeply involved in data center buildouts across the Middle East and recently secured an agreement with the TRUMP Administration that allows it to continue conducting business in China -- a market that CEO Jensen Huang estimates to be worth $50 billion on its own.

Meanwhile, emerging business opportunities in autonomous driving and robotics have yet to fully scale commercially. While neither industry is meaningfully moving the financial needle today, both represent massive long-term upside for Nvidia.

It's difficult to predict with any certainty whether Nvidia stock will 10x again from its current levels. What is clear, however, is that Nvidia remains firmly entrenched as a technological backbone for AI infrastructure. For that reason, I remain bullish on Nvidia's long-term growth prospects and see further gains ahead for the chip king.