What’s Wrong With Chipotle Stock? Unpacking the Burrito Blues

Chipotle's stock just hit a speed bump—and investors are asking if the guac is extra for all the wrong reasons.

Growth Stalls Out

Same-store sales slipped last quarter. Inflation bit into margins. Expansion plans? Slower than a lunch rush line.

Competition Heats Up

New fast-casual players are stealing share. Digital ordering? Everyone’s doing it now. Chipotle’s moat isn’t as deep as it used to be.

Valuation Questions

Trading at a premium while growth cools? That’s a recipe for multiple compression. Street analysts are trimming targets—classic 'sell the news' behavior.

Maybe the problem isn’t Chipotle—it’s that traditional equities are just… boring. Meanwhile, crypto’s serving up 10x moves while burrito stocks trade sideways. But hey, at least you can still drown your sorrows in queso.

Slowing store traffic

Chipotle reported its latest quarterly earnings in July. Revenue grew 3% in the period to $3.1 billion, driven by more restaurant location openings. However, this was not the metric investors were focused on. What alarmed Wall Street was a 4% decline in same-store sales -- measuring year-over-year revenue growth from existing restaurants -- driven by customer traffic falling off a cliff. The company has even been implementing price increases, meaning that traffic declined even more than the 4% year-over-year comparable store sales decrease.

Comparable store sales growth is vital for a restaurant chain. If it cannot match or outpace inflation that is currently running at 3%-5% across various cost inputs, then it is going to see declining profit margins. That is exactly what happened to Chipotle in the quarter. Its restaurant-level operating margin was 27.4%, down from 28.9% a year ago.

What is driving these traffic declines? It is hard to pinpoint an exact reason, which is providing even more uncertainty for shareholders. Some may point to increased unemployment for young professionals, who have a higher share of spending at fast casual chains like Chipotle compared to older generations. It also could be broad-based trading down to cheaper options for consumers, which has helped other chains such asand.

Regardless, a 4% same-store sales decline is wrecking Chipotle's profits. If traffic problems do not get fixed, the company's profits will keep sliding lower and lower.

Image source: Getty Images.

A high starting valuation

Another issue with Chipotle stock was its high starting earnings multiple. Chipotle had a price-to-earnings ratio (P/E) well above 50 at the end of 2024. This implied high expectations for future earnings growth, which WOULD be driven by consistently strong comparable store sales growth.

These high expectations led to a collapsing Chipotle stock price after posting its recent comparable store sales figure. Today, Chipotle trades at a trailing P/E ratio of 38.5, which implies less future earnings growth but is still a premium to the.

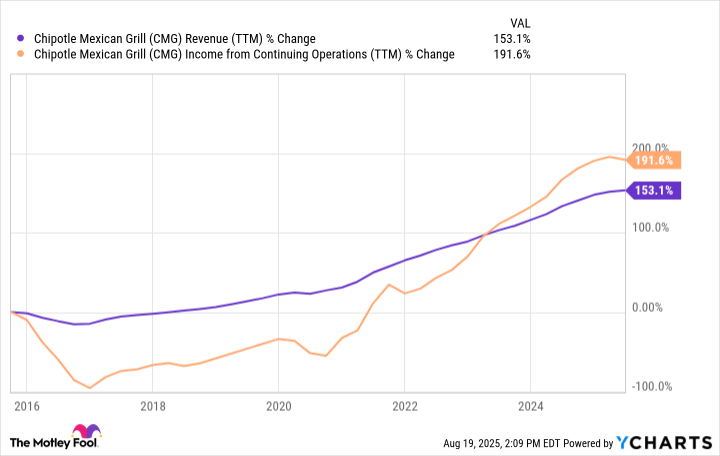

CMG Revenue (TTM) data by YCharts

Is the worst over for Chipotle stock?

At the end of last quarter, Chipotle had 3,839 company-owned restaurant locations. It has plenty of room to expand unit count around the United States and globally, at least if you compare it to other restaurant brands. With average annual restaurant sales of over $3 million, each new location that Chipotle adds can push revenue higher and higher. This is why the company's revenue is up 153% in the last 10 years.

Income from operations has grown even quicker at close to 200% over 10 years due to strong comparable store sales growth. If Chipotle can reverse these recent same-store sale declines and get them back at or above inflation, Chipotle stock will likely perform well even if you buy it at the current P/E ratio of 38.5. However, if the traffic and per store sales keep declining, the stock has a lot of room to fall further from here.