Is Vanguard Dividend Appreciation ETF the Ultimate Investment Move Right Now?

Dividend aristocrats meet ETF efficiency—Vanguard's flagship fund grabs attention as markets wobble.

Steady income in volatile times

While crypto swings 20% before breakfast, this ETF delivers old-school consistency—quarterly payouts from blue-chip giants that actually turn profits. No hype, no vaporware, just cold hard cash.

Defensive positioning meets growth

Healthcare, consumer staples, and industrial titans form the backbone—sectors that thrive whether the economy booms or tanks. Forget trading memes; this is capitalism’s bedrock.

The cost advantage

Vanguard’s razor-thin expense ratio laughs at actively managed funds charging 1% for inferior returns. Why pay a Ferrari price for a golf cart performance?

Long-term compound magic

Reinvested dividends quietly build empires while traders sweat overnight leverage. Slow, boring, and brutally effective—like watching paint dry on a vault door.

Bottom line: In a world obsessed with instant moonshots, this ETF is the anti-TikTok investment—rewarding patience over panic, substance over sentiment. (And it won’t crash because Elon tweeted a meme.)

What does the Vanguard Dividend Appreciation ETF do?

Technically speaking, the Vanguard Dividend Appreciation ETF is an index-tracking exchange-traded fund, so it doesn't actually do anything. That said, from a functional point of view, what the index does the ETF does, so they are somewhat interchangeable when discussing the investment approach. The index, for reference, is the.

Image source: Getty Images.

What the index, and thus the ETF, does is cull all of the stocks of U.S. companies that have increased their dividends for at least 10 years. The highest-yielding 25% are eliminated. And then the remaining 75% are bought using a market cap weighting methodology, so the largest companies have the biggest impact on performance.

Eliminating the highest-yielding stocks is clear evidence that the Vanguard Dividend Appreciation ETF isn't a good option for those seeking income today. Notably, the ETF's dividend yield is just 1.7%. You can easily do better than that with an ETF that is more focused on income. But dividends are still important here. The key is that the Vanguard Dividend Appreciation ETF is focused on dividend growth over time. This is a growth and income investment, and a pretty compelling one at that.

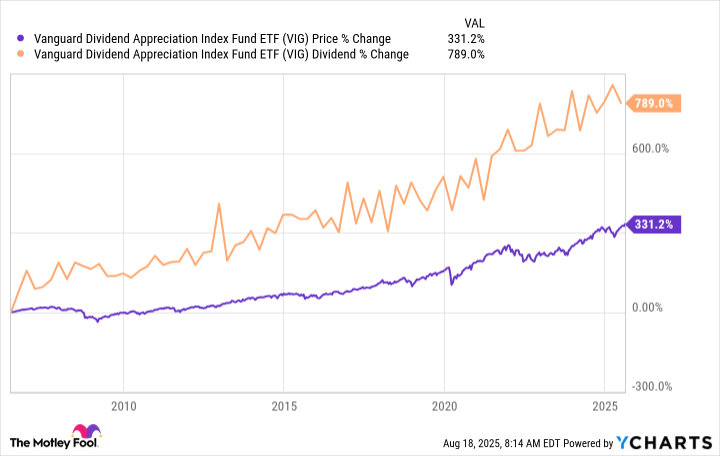

VIG data by YCharts

Why buy the Vanguard Dividend Appreciation ETF?

Notice in the chart above that the Vanguard Dividend Appreciation ETF's price and dividend have both moved roughly higher. So, as an investor, you WOULD have benefited from capital growth and income growth. That's the big story for investors to keep in mind. If you have a long time horizon until retirement and appreciate companies that have a history of increasing their dividends, this ETF is a great way to get exposure via a well diversified portfolio.

Notably, the ETF owns more than 300 stocks. It would be very hard for an investor to own that many companies without losing track of the portfolio. For a tiny expense ratio of 0.05% you can outsource all of that work to someone else. And the history here suggests that an upward climb in your wealth is likely to be the long-term result. This should interest growth-oriented investors.

But there's a nuance here that is important. The dividend has trended higher along with the price of the ETF. If you have a long time until you retire, you will probably want to reinvest the dividends to benefit from the compounding effect that has on total return. But when you retire, the dividend that the Vanguard Dividend Appreciation ETF throws off will likely be much higher than when you started to buy it. Your yield on the purchase price might actually be high enough that you don't need to switch into another ETF with a greater focus on income.

Go back to the price and dividend chart above. The dividend has increased more than 750% since the ETF's 2006 inception. That is, of course, a byproduct of focusing on stocks that increase their dividends. But it also means that buying and holding for a long time will likely lead to a much larger income stream than you might expect from the current 1.7% dividend yield. And that could make this one of the smartest long-term income investments you can make if you have decades to go before you retire.

The Vanguard Dividend Appreciation ETF is not for everyone

If you need income right now, the Vanguard Dividend Appreciation ETF isn't going to be a good choice for your portfolio. If you are looking for growth, however, the ETF uses dividends to highlight growing businesses. That could make it a wise choice for your portfolio if you like dividend growth stocks.

But it could also be a great income choice too, if you have a long time to go before you retire. Indeed, the dividend growth that is highlighted in the stock selection process could leave you generating more cash than you expect when you are ready to retire. So it could also be a wise income choice if you are planning now for the time when you aren't working anymore.