If You’d Dropped $1,000 on Bitcoin (BTC) 5 Years Ago—Here’s the Jaw-Dropping Fortune You’d Be Sitting On Today

Five years back—a mere blink in market time—would have been your golden ticket to generational wealth. While traditional investors were still arguing about bond yields, crypto pioneers were quietly positioning for the ride of a lifetime.

The Math That Silences Skeptics

That initial four-figure investment would have multiplied into a sum that dwarfs most traditional returns—transforming everyday investors into portfolio champions. Bitcoin didn't just climb; it shattered ceilings and redefined risk-reward calculus along the way.

Timing Beats Timing the Market—If You’re Early

Getting in early meant bypassing the noise and catching the wave before institutional FOMO kicked in. No complex strategies, no options plays—just pure asymmetric upside.

Where Traditional Finance Still Doesn’t Get It

Bankers love to talk about diversification—while quietly missing the single greatest asset performance of the decade. But then again, most wouldn’t recognize disruption if it printed them a Lamborghini.

Hindsight is 2020—but foresight pays better. The next five-year window is already opening.

Image source: Getty Images.

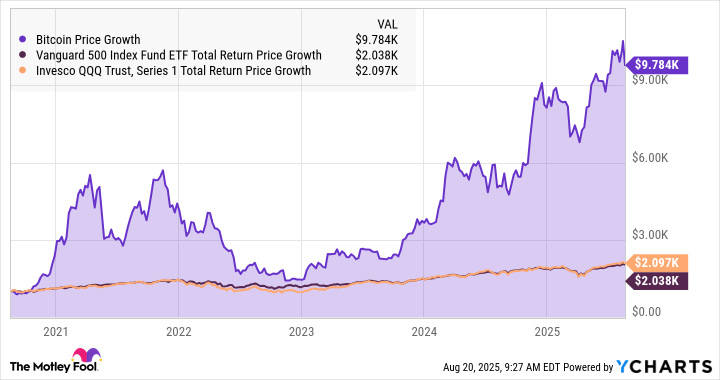

The tech-heavy(QQQ -0.21%) would have served you slightly better. The index fund, which tracks the performance of themarket index, showed a total return of $2,097 over the same period.

However, both wealth-building stock market trackers look sleepy next to the skyrocketing cryptocurrency(BTC -0.08%). A $1,000 Bitcoin investment in the summer of coronavirus lockdowns would be worth $9,784 today:

Bitcoin Price data by YCharts

How Bitcoin earned its returns

Bitcoin's path to these market-crushing returns wasn't smooth. The digital currency soared in 2020 and 2021, fell back a hair-raising 75% by the end of 2022, and found a second wind after that trough.

These days, bitcoin is exploring fresh all-time highs on a weekly basis, but in a nerve-wrackingly volatile way. Last year's halving event almost disappears in the ruckus of market-moving Bitcoin news. The introduction of spot Bitcoin exchange-traded funds (ETFs) had a calming effect on the underlying cryptocurrency, and recent support from the U.S. government also helped.

All told, Bitcoin ETFs sport a beta value of 2.8. That makes Bitcoin about three times as volatile as the(^GSPC -0.28%) stock market index, which underpins Vanguard's VOO fund.

Can Bitcoin keep beating Wall Street?

My time machine is in for repairs, so I can only speculate about the next five years.

However, Bitcoin's anti-inflationary design should combine with rising cryptocurrency usage, adding bullish weight to the supply and-demand balance. So the next half-decade probably won't see another ninefold price gain, but Bitcoin's squiggly chart should generally trend higher again.