Is Berkshire Hathaway Stock a Buy Now? Here’s What You Need to Know in 2025

Warren Buffett's empire faces its toughest test yet as traditional value investing collides with digital disruption.

Legacy vs. Innovation

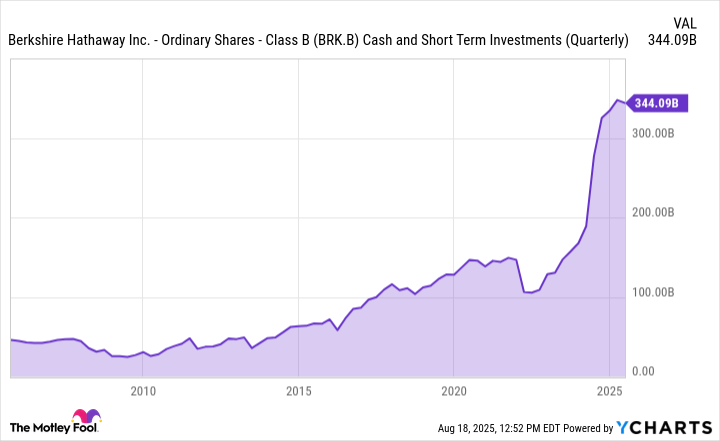

While Buffett famously avoids tech he doesn't understand, Berkshire's core holdings—insurance, railroads, and energy—look increasingly like dinosaurs in a DeFi-dominated landscape. The Oracle of Omaha's cash pile hit record levels precisely when crypto markets delivered triple-digit returns.

The Numbers Don't Lie

Berkshire's 20% annualized returns over decades can't compete with this cycle's altcoin performances. Meanwhile, the company's massive Apple stake exposes it to tech sector volatility without capturing Web3's upside. Traditional metrics like book value and earnings multiples feel downright archaic when NFT floor prices swing harder than entire blue-chip portfolios.

Regulatory Headwinds Mount

Increased SEC scrutiny on conglomerate structures could squeeze Berkshire's tax advantages. Meanwhile, blockchain transparency makes offshore reinsurance arrangements—a Berkshire specialty—look suspiciously opaque. The old guard's accounting tricks can't hide in an on-chain world.

Final Verdict: Pass

Buying Berkshire now is like investing in rotary phones during the smartphone revolution—a nostalgic bet on obsolete infrastructure. Smart money's stacking satoshis while Buffett hoards cash waiting for a 'margin of safety' that'll never come in this macro environment. Sometimes the trade isn't value versus growth—it's analog versus digital.

Image source: Getty Images.

Berkshire Hathaway has a diverse array of cash-generating businesses

At its core, Berkshire owns insurance operations like GEICO, Berkshire Hathaway Primary Group, and a global reinsurance division. Its insurance operations are a significant chunk of Berkshire's business. Last year, Berkshire's insurance underwriting segment generated $9 billion in operating earnings. Meanwhile, its investment income was $13.7 billion. Together, these were 48% of its earnings last year and 40% in 2023.

Berkshire's investments historically include a greater proportion of equity securities than is typical for the insurance industry. Its investments tend to be highly concentrated in a few companies and held for long periods. In addition, with interest rates elevated in recent years, Berkshire has enjoyed a significant increase in interest income.

In addition to that, Berkshire owns assets across various other industries, including transportation, manufacturing, service, and retail. It owns Burlington Northern Santa Fe (BNSF), one of North America's largest railroads. It has an extensive utilities and energy profile serving millions of customers in the U.S., Great Britain, and Canada.

Its manufacturing holdings include industrial, building, and consumer products, featuring subsidiaries such as Precision Castparts, Clayton Homes, Shaw Industries, Duracell, and Forest River. Finally, its service and retail segment includes Pilot Travel Centers, McLane (wholesale distribution), NetJets, Dairy Queen, multiple auto dealerships, furniture stores, and diverse specialty retailers.

Berkshire is undergoing a transition

Berkshire Hathaway is set to undergo a significant change next year. That's because Warren Buffett, the legendary investor and longtime CEO of Berkshire Hathaway, is preparing to retire after decades at the helm. Buffett's departure marks a historic transition for the conglomerate, as his leadership and investment philosophy have shaped Berkshire's identity and success over the past six decades.

With Buffett stepping down, new faces are set to take over the company's operations and investment decisions. Greg Abel, Todd Combs, and Ted Weschler are key figures poised to lead Berkshire Hathaway into its next era as Warren Buffett prepares for retirement. Greg Abel, currently Vice Chairman of Non-Insurance Operations, is Buffett's chosen successor to lead the company and oversee Berkshire's vast empire.

Meanwhile, Todd Combs and Ted Weschler are the investment lieutenants that Buffett and his right-hand man, the late Charlie Munger, tapped to guide Berkshire's massive investment portfolio. Before joining Berkshire, Combs ran a hedge fund, Castle Point Capital, from 2005 to 2010. Combs also has experience in the insurance industry and has led GEICO for the past five years, reshaping it "in a major way."

Ted Weschler has an impressive track record managing his investments. In a public statement, Weschler reported that, over 28 years, he had grown an initial Roth IRA account balance of $70,385 into $131 million -- or a 31% annual return on investment.

Together, Abel, Combs, and Weschler represent the carefully planned succession team intended to maintain Berkshire Hathaway's culture and focus on long-term value creation.

A massive cash pile and a reasonable price tag

Berkshire Hathaway's cash and short-term investment position is exceptionally strong, providing the company with substantial capital and flexibility for future investments. A significant factor is its insurance operations, which generate a massive amount of float that Berkshire can invest.

For now, Berkshire has parked a significant amount of its capital in treasuries and other short-term holdings, as the conglomerate takes advantage of higher short-term rates while equity valuations sit at a historically high level.

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts

As of June 30, Berkshire held $340 billion in cash and short-term investments in U.S. treasury bills. This massive cash pile is generating Berkshire investment income to the tune of $5 billion in the first six months of 2025, an increase of 11.3% over the same period of 2024.

Following Berkshire's lackluster performance in recent months, the stock is reasonably priced at a 16.3 price-to-earnings ratio and a 1.5 price-to-book value.

Berkshire faces an impending leadership transition. However, the company's diverse business model and cash-rich balance sheet ensure it is well-equipped to pursue new investments -- making it a good buy for investors today.