A New Era of Investing: Can These ETFs Outperform the Market?

Wall Street's latest gamble just dropped—and it's betting big on the digital gold rush.

ETF Revolution Goes Crypto

Forget picking individual stocks. The smart money's flooding into exchange-traded funds that bundle crypto exposure with traditional assets. These aren't your grandpa's index funds—they're hybrid beasts built for the algorithmic age.

Performance or Hype?

Early movers are posting returns that'd make hedge fund managers blush—assuming they even understand the underlying tech. One fund's already clipping along at triple the S&P's pace, while another's quietly eating the lunch of legacy financial products.

The Fine Print Nobody Reads

Sure, the prospectus mentions 'volatility' and 'emerging asset class' about thirty times—but who's counting when the charts go brrr? Traditional finance finally admits digital assets might have legs, even if they're still calling blockchain 'that Bitcoin thing.'

Bottom Line: Outperform or Overhyped?

Either these ETFs mint a new generation of millionaires, or they'll become the financial equivalent of Beanie Babies—another case of Wall Street selling shovels during a gold rush. Place your bets.

Image source: Getty Images.

Generally, a stock or ETF's performance is measured against the performance of the, an index that tracks 500 of the largest public American companies, and is by far the stock market's most followed index. It's generally what people are referring to when they say "the market."

You can't predict how a stock or ETF will perform, but if you're looking to invest in a couple with market-beating potential, look no further than the(VUG -0.62%) and the(QQQ -0.38%). Each takes a different approach but is positioned to outperform the market.

These ETFs have a history of outperforming

The Vanguard Growth ETF (VUG) focuses on large-cap companies that are expected to grow their earnings faster than the broader market (hence, the "growth" in the name). Along with that, a company must show strong revenue growth, a high return on equity (a measure of profitability and financial efficiency), and a high level of capital investments.

The Invesco QQQ Trust ETF (QQQ) mirrors the Nasdaq-100, an index that tracks the largest 100 non-financial companies on thestock exchange. This index is essentially a subset of the larger Nasdaq Composite, so it's fairly tech-heavy.

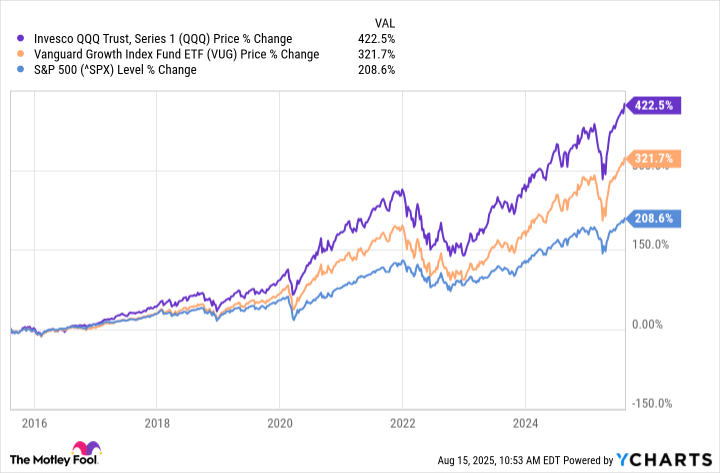

The criteria have worked out in both ETFs' favor, as they've noticeably outperformed the S&P 500 in the past decade.

QQQ data by YCharts.

Investing should always be about the future, but if you're looking for ETFs or stocks with market-beating potential, it helps to see if it has happened before. Past performance doesn't guarantee future performance but at least gives you a sense of what's possible.

Why are these ETFs built to continue outperforming the market?

To see why I believe these ETFs will continue to outperform the market, it's important to see the companies that are leading the way. Below are the companies that are in each of the ETF's top 10 holdings:

| NVIDIA | 12.64% | 10.00% |

| Microsoft | 12.18% | 8.74% |

| Apple | 9.48% | 7.83% |

| Amazon | 6.72% | 5.52% |

| Broadcom | 4.39% | 5.45% |

| Meta Platforms | 4.62% | 3.82% |

| Tesla | 2.69% | 2.75% |

| Alphabet | 6.01% | 5.16% |

Sources: Vanguard and Invesco. VUG percentages as of July 31. QQQ percentages as of Aug. 13.

These ETFs share eight companies in their top 10 holdings (nine if you separate both Alphabet classes). Since they make up over 66% (VUG) and 54% (QQQ) of the ETFs, they have a huge influence on their performances. They give the ETFs market-beating potential for three reasons: cloud computing, artificial intelligence (AI) infrastructure, and overall dominance in the digital ecosystem.

Amazon, Microsoft, and Alphabet are by far the cloud computing leaders (63% combined market share), and their platforms are the backbone of AI development. Nvidia's graphics processing units (GPUs) are the industry standard and go-to.

Broadcom supplies critical pieces to data centers and overall tech. Apple is still the world's leading consumer tech company (with AI momentum building), and Meta's scale gives it unmatched advertising reach.

Those are market leaders in industries that are primed for continued high growth for the foreseeable future. If I had to bet on ETFs to beat the market, it WOULD be ones with those companies leading the way.