Nvidia’s China Gambit: Why This Deal Could Reshape the Tech Landscape

Nvidia just played its China card—and the tables are turning. The chip giant's latest move isn't just another partnership; it's a strategic masterstroke that could rewrite the rules of engagement in the world's most contested tech market.

The Silicon Shield

By locking down this deal, Nvidia sidesteps export restrictions while planting its flag deeper in Chinese soil. No more begging for approvals—just raw silicon diplomacy at work.

Black Market? Try Gray Gold

While Wall Street analysts obsess over 'regulatory risks,' Nvidia's engineers are already shipping modified chips through loopholes big enough to drive a data center through. Funny how billion-dollar problems vanish when you're the only game in town for AI hardware.

The New Great Game

This isn't about selling GPUs—it's about controlling the infrastructure powering China's AI ambitions. And let's be honest: when has a little thing like geopolitics ever stopped a tech titan from chasing growth? (Answer: Never, unless the SEC starts asking questions.)

One cynical footnote: Watch how fast 'national security concerns' evaporate when institutional investors see the revenue projections. Principles are expensive—silicon margins aren't.

How big an opportunity is China for Nvidia?

According to accounting and consulting firm Deloitte, the global total addressable market (TAM) for semiconductors, as measured by sales, reached $627 billion in 2024. Deloitte projects that the market will grow at a compound annual growth rate (CAGR) of 19% over the coming decades -- ultimately reaching $2 trillion by 2040.

Outside of the U.S., China remains one of the most important markets fueling demand for high-performance chipsets, particularly graphics processing units (GPUs). Nvidia CEO Jensen Huang has estimated that the AI opportunity in China alone could be worth as much as $50 billion.

In 2024, Nvidia generated $130 billion in revenue, with China capturing roughly 13% of this sum. During the first quarter of 2025, Nvidia's $5.5 billion of China sales accounted for roughly 12.5% of total revenue.

This leveling trend underscores how the current administration's policies toward China have started to constrain Nvidia's growth potential in the region.

Image source: Getty Images.

Why is Nvidia's new China deal so important?

According to multiple news outlets, Nvidia has reached an agreement with Washington regarding its operation in China. Under the terms, Nvidia will pay 15% of its China-based sales to the U.S. government. In effect, the arrangement provides Nvidia with a pathway to penetrate this critical market through its tailored H20 chips.

While this might initially resemble a tax, investors should avoid viewing it through that lens. First, the agreement applies to sales of Nvidia's AI chips rather than to profits, unlike traditional forms of taxation. Moreover, the 15% rate does not appear to be variable in structure like a royalty, which is typically tied to intellectual property (IP) and subject to fluctuate.

While this deal might appear unusual at first glance, these structures are not without precedent in global business practices. For example, energy companies that extract natural resources or commodities in foreign countries often operate under similar revenue-sharing agreements with host nations in exchange for distribution rights.

In my view, dedicating a modest share of sales to secure access to China represents a strategic trade-off. In the long run, it allows Nvidia to preserve its dominant position in one of the world's most important AI markets and prevents domestic rivals such as Huawei from eroding its competitive moat.

Is Nvidia stock a buy?

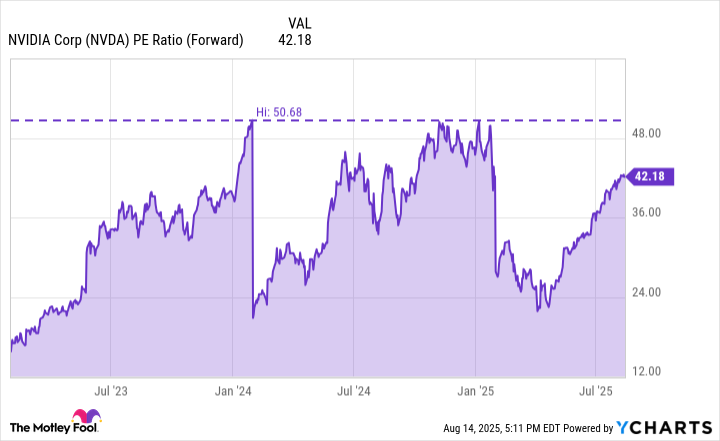

While Nvidia's forward price-to-earnings (P/E) ratio has been expanding recently, levels remain muted compared to peaks reached previously during the AI revolution. In my view, part of this multiple compression reflects concerns surrounding China -- perhaps overly so.

NVDA PE Ratio (Forward) data by YCharts.

Nvidia's new agreement in Washington offers the company renewed momentum, securing revenue in a critical market without forfeiting much in the way of profits -- even with the 15% remittance to the U.S. government.

Over the long term, I see this arrangement as a strategic mechanism for Nvidia to strengthen its position overseas and deliver durable growth across the global AI infrastructure market.

As these fundamentals take hold, I think the company's valuation multiples could expand further, potentially driving the stock to new highs sooner than many investors may be expecting. For that reason, I see Nvidia stock as a no-brainer opportunity to buy hand over fist right now and hold for years to come.