This Beaten-Down Stock Plunged 40% in —Time to Buy and Hold for the Long Haul

Wall Street's latest casualty just became a contrarian's dream.

While traditional investors panic-sell, crypto bulls recognize the pattern: brutal selloffs often precede monster rallies. This isn't your grandfather's value play—it's a asymmetric bet hiding in plain sight.

The 40% nosedive? Classic fear-driven overcorrection. Fundamentals haven't changed, but weak hands got shaken out. Remember Amazon's 90% crash during the dot-com bust? Today's 'losers' become tomorrow's blue chips.

Here's why smart money's accumulating:

- Institutional inflows quietly rising despite price action

- Revenue growth outpacing sector peers (but who checks fundamentals anymore?)

- Short interest at yearly highs—prime setup for a squeeze

One hedge fund manager quipped: 'We buy when CNBC anchors start crying.' Meanwhile, crypto traders nod knowingly—40% drops are Tuesday in DeFi.

This isn't financial advice. But if you've ever FOMO'd into an altcoin at ATH, maybe try buying actual value for once.

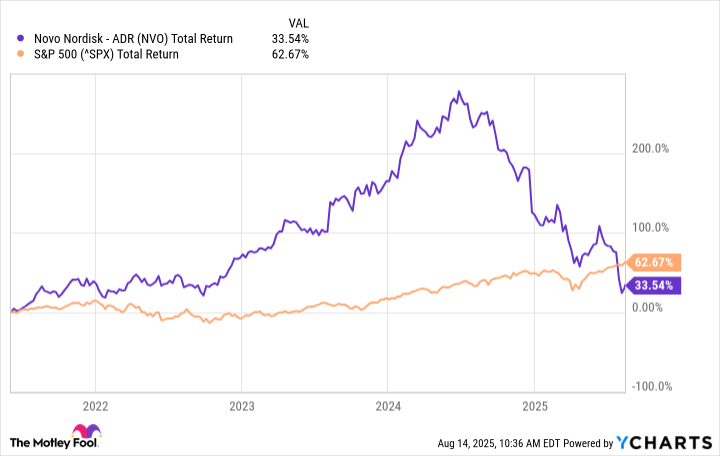

NVO Total Return Level data by YCharts.

The weight management opportunity

Novo Nordisk primarily develops medicines for diabetes and, in recent years, weight management. Its stock has plunged over the past year because its financial results haven't been as impressive as the market had hoped. It also faced some clinical setbacks, while its biggest rival in its Core markets,, earned some important wins.

However, there's more to the story. The market for anti-obesity medications could grow at an incredibly rapid rate. Some analysts estimate that it will be worth $150 billion by 2035, compared to $15 billion last year.

Image source: Getty Images.

Novo Nordisk still has one of the deepest pipelines in the industry. In fact, it's challenging to find a company other than Eli Lilly that has more promising products. Recently, Novo Nordisk expanded its pipeline through various licensing deals.

Here's one more thing that recently broke its way: Eli Lilly's oral GLP-1 candidate, orforglipron, did not perform nearly as well as expected in a phase 3 study. This opens the door for Novo Nordisk to catch up to its longtime rival.

The company's oral version of Wegovy is currently awaiting approval from regulators in the U.S. The oral version led to an average weight reduction of 13.6% in a phase 3 clinical trial, slightly higher than the 12.4% that orforglipron recently posted in its late-stage study.

While it's always hard to compare across clinical trials, the data at the very least suggests that oral Wegovy is comparable to orforglipron -- but only the former drug is closing in on approval. Novo Nordisk also has yet another promising anti-obesity candidate in phase 3 studies, amycretin, which the Denmark-based pharmaceutical giant is testing in both subcutaneous and oral formulations.

Why is the race to develop an oral weight loss option so important? Pills are easier and cheaper to manufacture, store, and transport. So, compared to injectable weight loss therapies, oral versions WOULD allow drugmakers to produce them more cost-effectively and to expand the reach of weight loss therapies. On top of that, some patients are strongly averse to needles. Because the current leading weight management drugs are administered subcutaneously, an oral option would likely take a decent share of the market.

Novo Nordisk is likely to be first to market. And the company could follow up that win with another oral product in amycretin.

The price is right

Let's go back to Novo Nordisk's recent and disappointing financial results. In the first half of the year, revenue ROSE by 16% year over year to 154.9 billion Danish kroner ($24.2 billion), while net profit came in at 55.5 billion DKK ($8.7 billion). Perhaps that's not quite what the market expected to see, but these are still excellent results for a pharmaceutical giant -- most drugmakers of that size would be happy to grow their revenue at high-single-digit or low-double-digit rates.

Meanwhile, the stock appears reasonably valued, trading at 13 times forward earnings, compared to the healthcare industry's average of 16.2.

What's the verdict? Novo Nordisk looks attractive at current levels, given the company's strong pipeline in weight management and a lineup that continues to deliver consistent profits. Despite recent setbacks, the stock is well-positioned to deliver excellent results over the long term.