This AI Stock Is Still a Rocket Ship – Don’t Miss the Next Leg Up After Its 2025 Surge

AI stocks are printing gains while traditional finance snoozes—here’s why this one’s just warming up.

The AI Gold Rush Isn’t Slowing Down

Forget blue chips. The real action’s in artificial intelligence, where one standout player keeps defying gravity—even after a blistering run this year. No, it’s not the usual suspect. This under-the-radar disruptor’s got institutional money chasing it like Bitcoin in 2017.

Why Analysts Are Still Bullish

Revenue growth? Check. Patent filings? Stacking up. Short interest? Crumbling faster than a crypto exchange’s ‘proof of reserves.’ The numbers don’t lie—this isn’t another overhyped SaaS play. It’s the real deal: AI that actually works, not just PowerPoint promises.

The Kicker

Wall Street’s ‘hold’ ratings look increasingly clownish as retail traders and hedge funds pile in. Moral of the story? When a sector’s this hot, even the suits can’t ignore it forever—though they’ll sure try to take credit later.

Image source: Getty Images.

Nebius' eye-popping growth is here to stay

Nebius has built its business by accumulating powerful AI GPUs fromand renting them out to customers. Developers can access a range of Nvidia GPUs such as the H100, the H200, and B200 at hourly rates from Nebius and run various AI models from,, DeepSeek, and others.

Nebius' full-stack AI infrastructure allows customers to train and fine-tune AI models, develop custom AI applications, and run inference tasks. Importantly, customers can increase or decrease the usage of Nebius' platform according to their needs. The company's latest quarterly results make it clear that its business model is a hit with customers.

Its revenue in the second quarter of 2025 jumped by more than 7x year over year to $105 million. Nebius also reduced its net loss by 49% owing to its focus on lowering the operating costs of data centers. Management points out that Nebius lowered its total cost of ownership by 20% by improving the hardware design of its data centers and investing in energy-saving solutions.

Looking ahead, Nebius is focused on aggressively expanding its data center capacity so that it can corner a bigger share of the fast-growing cloud AI infrastructure market. The company aims to boost its data center capacity to 220 megawatts by the end of 2025 before ramping it up to 1 gigawatt by the end of next year.

Nebius was sitting on $1.68 billion worth of cash at the end of the previous quarter, which it will use for capacity expansion. The company says that the demand for its solutions is outpacing supply, which is why it is important for it to keep investing in more capacity. Also, higher data center capacity will translate into more business for Nebius, which explains why the company has increased its annualized run-rate revenue (ARR) for 2025.

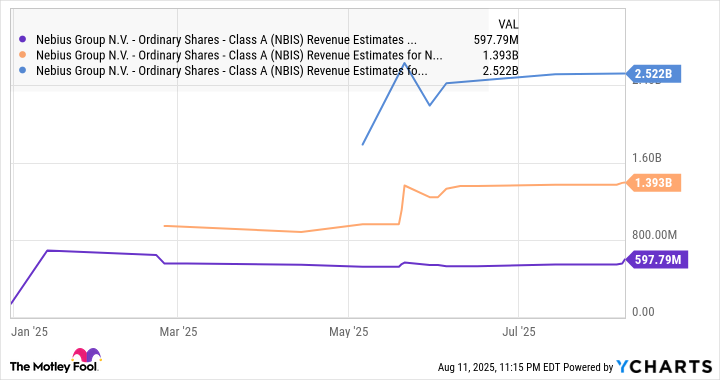

It now expects ARR to land between $900 million and $1.1 billion this year as compared to the earlier estimate of $750 million to $1 billion. Analysts, meanwhile, are expecting Nebius' top line to jump by over 5x in 2025, followed by robust growth over the next couple of years as well.

NBIS Revenue Estimates for Current Fiscal Year data by YCharts

However, don't be surprised to see Nebius blowing past analysts' expectations in the current year and beyond. The company was originally guiding for $500 million to $700 million in revenue for 2025, and the increased ARR guidance indicates that it could exceed the midpoint of its original guidance range. So, a stronger-than-expected performance going forward should set Nebius up for more gains.

The valuation is expensive, but investors should look at the bigger picture

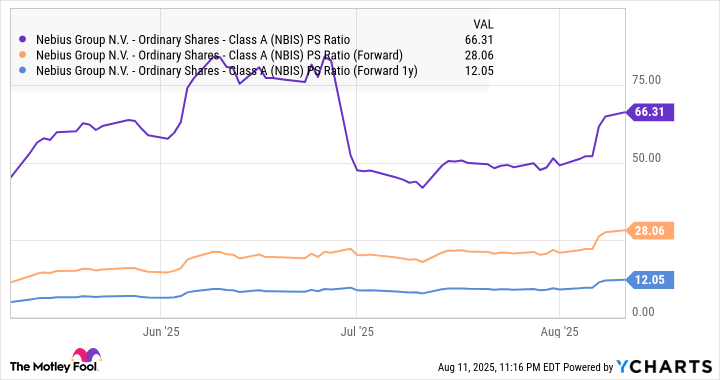

Nebius' remarkable rally this year has brought the stock's price-to-sales ratio to 66. That's well above the U.S. technology sector's average sales multiple of 8.7. However, Nebius' outstanding growth explains why it is richly valued. The company is growing at an eye-popping pace and is relatively cheaper than some other AI stocks.

What's more, the outstanding sales growth that the company is expected to deliver in the future is the reason why its forward sales multiples are much lower.

NBIS PS Ratio data by YCharts

Finally, investors shouldn't forget that Nebius is operating in a market that's expected to grow rapidly in the long run. Fortune Business Insights estimates that the cloud infrastructure-as-a-service market could clock an annual growth rate of almost 21% through 2032, generating more than $712 billion in annual revenue at the end of the forecast period.

Nebius is currently growing at a much faster pace than the end market, and its capacity expansion efforts should allow it to become a key player in this space. All this makes Nebius a top AI stock to buy right now as its phenomenal growth is likely to result in more upside.