This AI Juggernaut Skyrocketed 130% Since Marjorie Taylor Greene’s April Bet—Dan Ives Says the Rally Isn’t Over

Wall Street's latest AI darling is defying gravity—and skeptics. Here's why the smart money (and a certain controversial congresswoman) can't look away.

The AI Power Play That's Printing Money

When a polarizing politician and a top tech analyst agree on a stock, markets take notice. The artificial intelligence sector's runaway winner has delivered 130% returns since April—back when most investors were still debating whether AI was hype or holy grail.

Why the Bulls Aren't Backing Down

Dan Ives' latest price target suggests this rocket ship hasn't exhausted its fuel. Meanwhile, retail traders keep piling in—proving once again that nothing moves markets like FOMO and congressional stock disclosures.

The Cynic's Corner

Of course, if past performance guaranteed future results, we'd all be retired on yacht-filled crypto beaches by now. But for today? The algorithm gods are smiling.

Palantir is dominating the AI software agenda

At its core, Palantir develops a host of AI-powered software suites -- Foundry, Gotham, and Apollo -- each designed to solve complex data-driven challenges. These platforms are stitched together to FORM a broader fabric, integrating services across data analytics, real-time simulated modeling, and decision-making tools. Together, they form an AI backbone for both large corporate enterprises and government agencies around the world.

Image source: Palantir Investor Relations.

During the second quarter, Palantir generated growth of 47% and 49% across its commercial and public sector businesses, respectively. To understand just how impressive this is, consider that Palantir's Rule of 40 score now sits at 94% -- materially higher than any of its software-as-a-service (SaaS) peers and trails onlywhen benchmarked against the 25 largest companies by market cap.

Image source: Getty Images.

Can Palantir stock reach $200?

As of this writing, Palantir stock trades for $180 per share -- implying only an 11% MOVE to reach Ives' $200 target. Ives has been celebrating Palantir's "hyper growth demand," citing the "use case era of the AI Revolution" as Palantir's key differentiator -- suggesting that Palantir is uniquely positioned relative to its software peers.

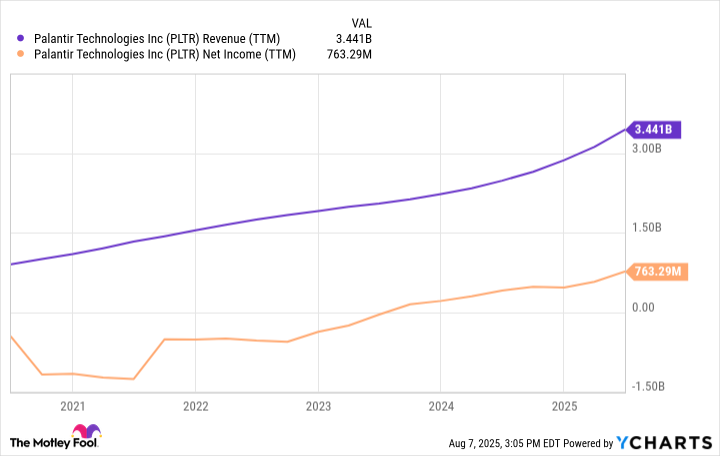

The steepening curves in both revenue and profitability imply a strong unit economics across Palantir's operation. Much of this momentum can be attributed to notable upsells with existing customers, as well as the company's leading position for emerging use cases at the intersection of defense and technology -- just as Ives implies.

PLTR Revenue (TTM) data by YCharts

Is Palantir stock a buy right now?

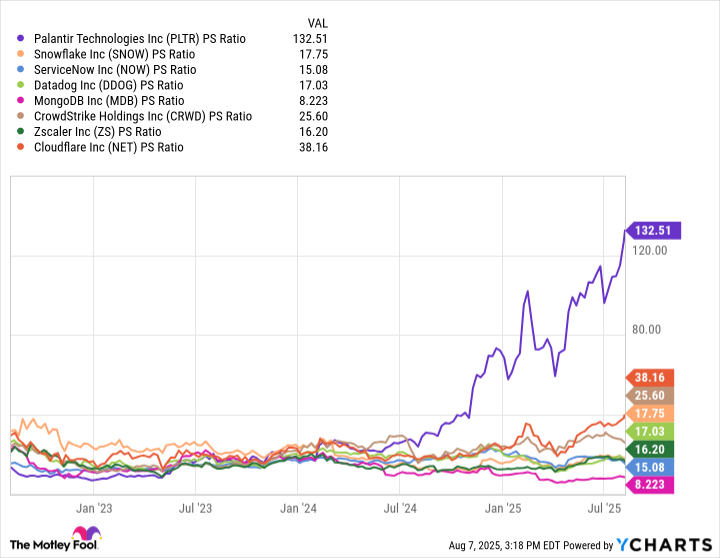

The chart below benchmarks Palantir against a peer set of leading enterprise software stocks on a price-to-sales (P/S) basis. With a P/S ratio of 132, Palantir is the clear outlier in this cohort.

PLTR PS Ratio data by YCharts

To me, Palantir's continued valuation expansion suggests that growth investors are looking beyond traditional metrics and increasingly buying into a greater narrative -- one that positions Palantir in a league of its own as a company on the cusp of prolonged periods of accelerating revenue, profitability, and outright domination in the AI software realm.

As a longtime Palantir bull, I'm both excited and optimistic about the company's future. While I do think Ives' forecast of $200 per share is achievable, it's also worth pointing out that Palantir stock now trades at a historically high valuation -- similar to levels seen during prior stock market bubbles.

For these reasons, buying Palantir stock today comes down to individual risk tolerances. If you are an investor with a long-term time horizon, the payoff from Palantir could be enormous as the AI narrative continues to unfold. But like most growth stocks, owning Palantir will not come without periods of extreme volatility.