$1,000 in VIG 5 Years Ago? Here’s the Life-Changing (or Crushing) Truth

VIG's rollercoaster ride—where'd your cash land?

The Setup: A $1,000 Gamble

Five years back, you tossed a grand at VIG. Smart move or regret waiting to happen?

The Math That Hurts (or Heals)

No crystal balls here—just cold, hard percentages. Did it 10X or flatline like a Wall Street banker's sense of humor?

Today’s Verdict: Show Me the Money

Spoiler: The number either fuels your crypto evangelism or becomes your go-to 'I told you so' for traditional finance snobs.

The Punchline

Funny how 'long-term hold' sounds heroic until you’re staring at a chart that looks like a cardiogram. Still, beats letting your bank 'safeguard' it at 0.01% interest.

Then and now

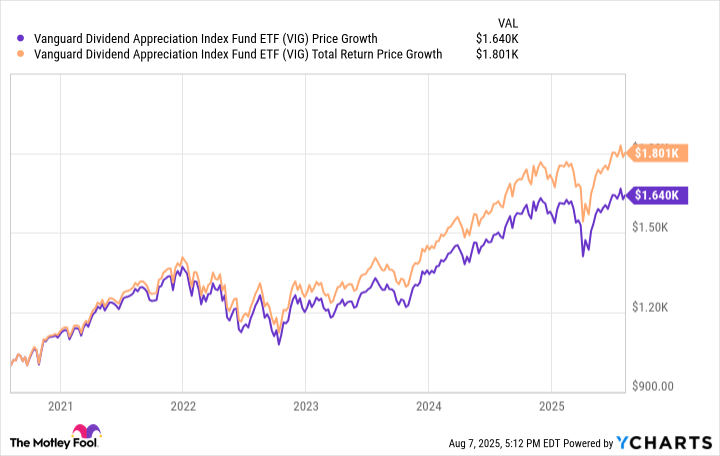

The graphic below tells the tale. Had you invested $1,000 in the Vanguard Dividend Appreciation fund in August of 2020, today you'd have $1,640 plus all the dividends it paid in the meantime. And if you'd reinvested those dividend payments in more shares of VIG, your $1,000 investment WOULD be worth $1,800 now.

VIG data by YCharts.

The dividend payments for this exchange-traded fund (ETF) have also grown during this time. July's quarterly payment of $0.87 per share is well above the same quarter's payment of only $0.60 in 2020, in line with this fund's actual dividend growth during this five-year period.

Not the best ETF for dividend income

In this vein, you should know that while this Vanguard fund prioritizes reliable dividend growth over high yields or capital appreciation, Vanguard Dividend Appreciation also offers the latter at least as well as most other dividend-oriented ETFs. Only the(VYM -0.27%) has fared better for the past five years, and only by a slight margin.

Credit a quirk of the Vanguard Dividend Appreciation ETF's underlying S&P U.S. Dividend Growers Index, mostly. It excludes the highest-yielding one-fourth of tickers that would otherwise be eligible for inclusion in the index. Standard & Poor's fears these high yields suggest their particular companies may be facing growth headwinds.

Removing these highest-yielding names from the mix, of course, also dials back this ETF's average dividend yield. VIG's trailing yield right now is a little less than 1.7%, which isn't much for anyone looking for above-average investment income. Point being, this fund is best used as a defensive, quality-capital-growth holding.