UPS Stock in 2025: Still Trapped at Pre-Pandemic Levels or Primed for a Breakout?

Wall Street's favorite shipping giant is stuck in neutral—but is the market underestimating UPS's comeback potential?

The Pre-Pandemic Anchor

Three years after supply chain chaos peaked, UPS shares are trading like it’s 2019 all over again. Did the logistics titan blow its momentum—or is this a coiled spring waiting to snap back?

2025: Recovery or Repeat?

Analysts can’t decide if UPS is a value trap or a stealth rebound play. With e-commerce still growing (just slower) and automation cutting costs, the bulls see hidden upside. The bears? They’re too busy shorting drone delivery stocks.

The Cynic’s Take

Let’s be real—if UPS couldn’t moon during a global shipping crisis, maybe it’s just destined to be the ‘stable dividend payer’ in your portfolio. How… thrilling.

Why did investors get so excited about UPS?

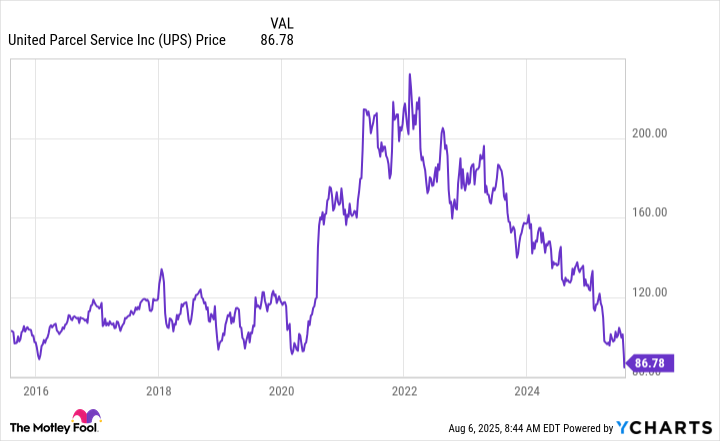

Wall Street has a really bad habit of getting a story in its teeth and then running with it. Investors usually run too far, leading to a DEEP snapback in the share price of whatever investments got caught up in the story. That is the backdrop for UPS' huge price advance in 2020 and 2021. And its subsequent crash in 2022, which is still ongoing today.

UPS data by YCharts

Essentially, the stock has made a full round trip from bull to bear, currently trading hands at around the same levels it did prior to the pandemic rally. What changed? During the pandemic, people were stuck at home and did a lot more online shopping. That led to increased demand for delivery services like the one UPS operates. Investors appear to have reasoned that demand WOULD grow forever. It didn't.

When the world moved past COVID, UPS realized it had to change things up. It started by slimming down and using more technology. At the same time, however, it had to deal with a new, more costly, union contract. As it started to get a handle on its business overhaul, it proactively chose to halve the low-margin business relationship it has with(AMZN -0.70%), its largest customer.

Image source: Getty Images.

The near term is likely to remain bumpy

Here's the problem: UPS' current efforts are all near-term headwinds, even though they are likely to be long-term positives. For example, slimming down has included exiting certain businesses, which shrinks UPS and leads to volatility and uncertainty on the income statement. Closing facilities and increasing the use of technology both increase costs in the NEAR term, even though they will likely reduce costs over the long term.

The union contract's pay raises increased costs. But it creates more stability over the long term, since the dispute is resolved. And while focusing on more profitable business will likely lead to improved margins, it might also result in top-line weakness. That's particularly true with UPS' decision to materially reduce its work with Amazon. However, less revenue that is more profitable is better than growing the business by leaning into mediocre delivery niches.

But, taken together, it seems like 2025 is going to be another transition year for UPS. That's likely to linger into at least 2026, as well, since the moves management is making are large and strategic in nature. Or, to put that another way, there are likely to be more bumps in the road for UPS before it sees a material recovery in its financial results or a big advance in stock price.

UPS is a high-yield turnaround story

At the end of the day, UPS is not going to be a great fit for most investors. There are a lot of moving parts, and the stock is likely to only interest turnaround investors. Yes, there's a huge yield on offer, noting the stock's 7.5% dividend yield. But sometimes turnarounds lead to dividend cuts, and the payout ratio has already risen to a fairly high 90%+, which materially increased the risk here for dividend investors. UPS is best suited to more aggressive investors who think in decades and not days, weeks, or even months.