Wall Street Warns: Dump This Overhyped AI Stock Now—17% Drop Looming (Spoiler: It’s Not Nvidia)

Another day, another 'sure thing' AI play getting the side-eye from analysts. This time, it's not the usual chip darling—but the smart money's bailing before the floor drops out.

Here's why the suits are hitting sell.

The numbers don't lie: A 17% haircut's coming for shareholders clinging to this 'next big thing.' Meanwhile, hedge funds already rotated into crypto miners—because nothing screams stability like proof-of-work volatility.

Remember kids: When Wall Street 'discovers' a sector, the early birds already cashed out.

Image source: Getty Images.

A great business with accelerating growth

The underlying business of Palantir is doing remarkably well. Revenue growth accelerated to 48% last quarter, hitting $1 billion. That is around $4 billion when annualized to a full year.

Some of its other segments are doing even better. United States commercial revenue grew an astonishing 93% year over year to $306 million, with 157 deals closed worth more than $1 million in the period.

On the whole, Palantir signed on $2.27 billion in contract value for the period, up 140% year over year.

Profit margins are increasing even though revenue growth is accelerating, which is atypical due to increased costs needed to support fast-growing sales. Palantir had a 27% operating margin last quarter, or $269 million in operating earnings. Annualized, that is more than $1 billion in operating income for the company.

At the end of 2023, Palantir had a market cap of just $13 billion, making it a great time to scoop up shares when you compare it to the business' current earnings output.

So what's the problem? It is not what Palantir's business is doing, but the stock getting way ahead of itself.

Limited addressable market versus size of the stock

Palantir offers businesses and the government analytical and monitoring solutions, custom-built for each enterprise. This is a valuable asset for organizations with tons of data to parse.

However, it does not have a limitless addressable market. For one, Palantir is only valuable for very large companies, and it's only available to use for the U.S. government and its allies. This cuts down the long tail of addressable customers, at least today.

Second, the company's current market cap does not justify even the largest addressable market assumptions.

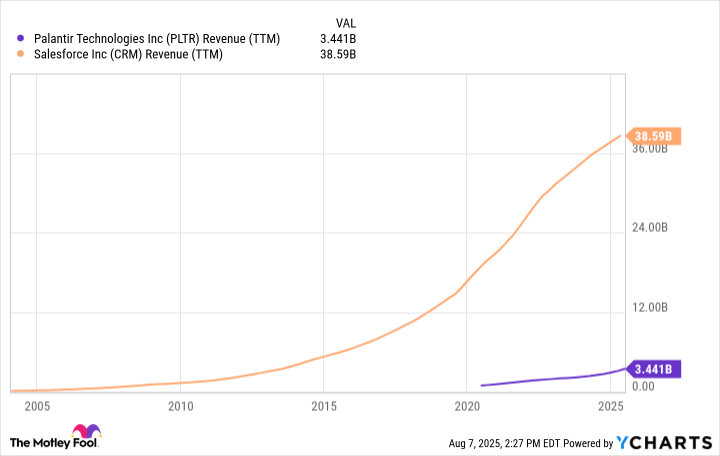

Let's use a comparable company such asto illustrate. Salesforce is a software platform for marketing departments and sales organizations, of which there are millions around the United States (not to mention globally). It generated close to $40 billion in revenue over the last 12 months and looks to steadily grow in the years to come.

Palantir is generating $4 billion in annualized revenue based on this last quarter and is valued at a market cap of $425 billion, which is close to double Salesforce. That is 10% of the revenue but double the market cap, for a price-to-sales ratio (P/S) topping 100.

Palantir has by far the most premium valuation of any software stock out there today, especially if you consider only the largest software businesses in the world.

PLTR Revenue (TTM) data by YCharts

Why you should sell Palantir stock

Being generous, a reasonable price-to-earnings ratio (P/E) for a recurring revenue software business is 30. That is a 30x multiple of the market cap to trailing earnings.

Over the last 12 months, Palantir generated $763 million in net income and is on a $4 billion revenue run rate. Staying ultra-optimistic, let's assume that Palantir can grow its revenue at a 50% annual rate for the next five years and juice its net income margin to 40% (which WOULD be best-in-class for the industry). In seven years, Palantir would be generating a staggering $30.3 billion in revenue and $12 billion in net income, or a P/E of 35 based on the current market cap.

Even making the most optimistic assumptions doesn't provide investors with positive forward returns from today's stock price. The math just simply doesn't compute for Palantir to deliver reasonable returns for shareholders going forward. Even though the stock has been a monster winner, investors would be wise to trim, sell, or avoid buying Palantir stock at today's trading prices.