This High-Growth Stock Could Outpace Tesla in the Race for a $10 Trillion Prize

Move over, Elon—there's a new contender gunning for the $10T future.

While Tesla dominates headlines, an under-the-radar disruptor is quietly positioning itself to dominate the next era of value creation. No hype, just hard data and scalable infrastructure.

The real kicker? Wall Street hasn't fully priced this play yet—probably too busy obsessing over quarterly earnings calls.

Image source: Getty Images.

Uber's network is unrivaled

Developing the world's best autonomous vehicle isn't Tesla's biggest challenge. Building a ride-hailing network and successfully scaling it so consumers feel confident they can catch a ride anywhere, anytime is the hard part, especially since many other carmakers are likely to enter this race over the long term.

Uber has an incredible advantage in that department, because 180 million people use its platform every month for ride-hailing, food delivery, and commercial freight services. Therefore, even though Uber doesn't manufacture autonomous vehicles, it's quickly becoming the go-to destination for companies that do, because they want to access as many potential customers as possible.

CEO Dara Khosrowshahi says Uber is already equipped with the necessary infrastructure to help companies deploy their autonomous vehicles, thanks to its 15 years of experience managing utilization in so many different cities. If a company deploys too many vehicles in a given location, Khosrowshahi says up to 95% of them could sit idle during quiet periods. If they don't deploy enough vehicles, they can't provide the timely service customers expect from ride-hailing platforms like Uber.

That is a huge challenge for newcomers like Tesla. Plus, Uber has processes in place to quickly handle fare disputes, insurance claims, and lost item returns (when customers accidentally leave valuables behind), which are small but highly necessary services.

Uber's list of autonomous partnerships continues to expand

Autonomous driving could transform Uber's business from a financial perspective. During the second quarter of 2025 (ended June 30), its 8.8 million active drivers earned a combined $20.8 billion, which was the largest component of its $46.7 billion in gross bookings (the dollar amount customers spent on the platform). If Uber can eliminate that cost, a much larger chunk of its bookings will become revenue and profit.

Uber had partnerships with 20 different developers of autonomous vehicles at the end of Q2, which was up from 18 in the first quarter. One of those partners is's Waymo, which is already completing over 250,000 paid autonomous trips every week in the U.S. through a combination of its own ride-hailing platform and Uber's.

Uber also welcomed China-basedas a new partner in Q2. Its Apollo Go robotaxi service has completed over 11 million autonomous trips in total across Asia and the Middle East, which will supercharge Uber's presence in these high-growth markets.

By comparison, Tesla is way behind in the autonomous ride-hailing business. Its full self-driving software isn't approved for unsupervised use anywhere in the world right now, so the company still hasn't cleared the most basic hurdle. The autonomous ride-hailing service it launched in June uses passenger electric vehicles (EVs) like the Model Y and it requires full supervision, which means a human specialist is in the passenger seat at all times in case something goes wrong.

Uber stock looks far more attractive than Tesla stock

Uber stock might be a better investment than Tesla stock, not only because the company is in a more favorable position to capture the $10 trillion autonomous ride-hailing opportunity, but also because of its valuation.

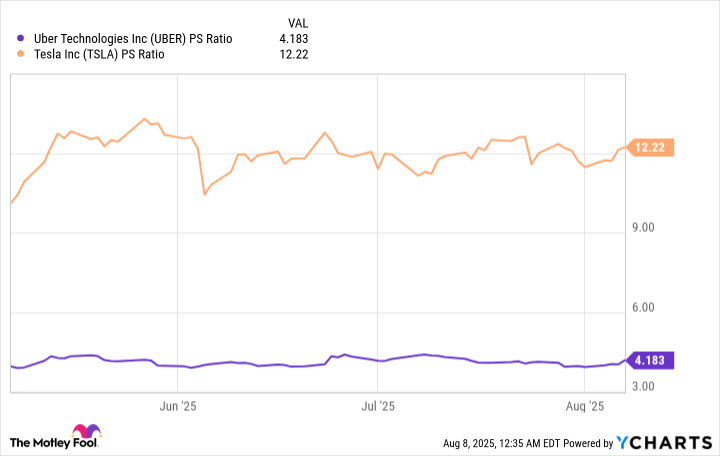

Based on Uber's trailing-12-month revenue of $47.3 billion, its stock trades at a price-to-sales (P/S) ratio of 4.2, making it far cheaper than Tesla stock, which trades at a P/S ratio of 12.4:

UBER PS Ratio data by YCharts

Uber's profits are also growing significantly, while Tesla's are currently shrinking due to several consecutive quarters of struggling EV sales. However, Uber's price-to-earnings (P/E) ratio is just 15.8, while Tesla's is an eye-popping 186.3, which could open the door to significant downside in the EV maker's stock.

As a result, I think buying Uber stock could be one of the best ways for investors to profit from the autonomous revolution.