Still Thirsty for Passive Income? PepsiCo’s Dividend Yield Keeps Fizzing in 2025

Dividend hunters, take note—PepsiCo’s cash faucet hasn’t run dry.

While crypto bros chase the next memecoin pump, this snack-and-sip giant keeps doling out reliable yields. No flashy ATHs here—just steady drips of shareholder payouts.

The Boring (But Beautiful) Math

Pepsi’s dividend track record outlasts most crypto projects’ lifespans. Fifty years of increases? That’s more predictable than a Bitcoin halving cycle.

Why TradFi Still Quenches

Unlike DeFi yields that vanish faster than a shitcoin’s liquidity, Pepsi’s 3%+ yield comes with actual revenue—$86 billion last year. Those soda sales? They’re somebody’s mortgage payment now.

The Cynic’s Corner

Sure, it won’t make you a ‘crypto overnight millionaire’—just comfortably retired. How terribly dull.

Image source: Getty Images.

PepsiCo is a very well-run business

PepsiCo is one of the largest beverage makers on the planet, with its namesake brand leading the way. It is also the most important salty snack company, thanks to its Frito-Lay business. And it has a strong position in the packed food space with Quaker Oats. It is one of the most diversified food companies you can buy.

It also easily competes with its peers. PepsiCo has a well-honed distribution system and a strong research and development (R&D) team. Its advertising might is on par with any of its competitors. And it is large enough to act as an industry consolidator, buying up-and-coming companies to quickly expand its brand portfolio.

However, even well-run companies end up struggling once in a while. And today, PepsiCo is in a funk, lagging behind its closest peers on key financial metrics. For example, the 2.1% organic sales growth PepsiCo achieved in the second quarter of 2025 was less than half of the 5% achieved by its beverage-focused archrival.

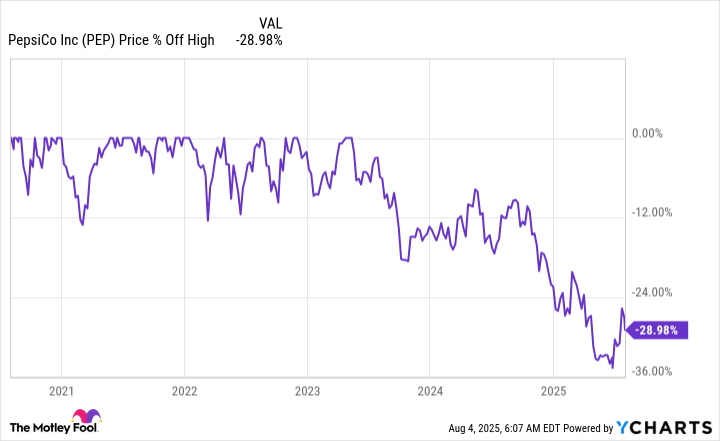

Given the often myopic vision of Wall Street, PepsiCo's stock has fallen -- a lot. Even after a recent rally, PepsiCo's shares are down more than 25% from their 2023 highs. That's pushed the dividend yield up to a historically high 4% or so.

PEP data by YCharts.

Is PepsiCo's nosedive a sign of risk or an opportunity?

So, when a stock price falls as far as PepsiCo's stock price has fallen, investors need to stop and take notice. Yes, PepsiCo is an industry laggard right now. But for investors who think in decades and not days, PepsiCo's stock looks incredibly cheap. The historically high yield hints at this, but the view is backed up by price-to-sales, price-to-earnings, and price-to-book value ratios that are all below their five-year averages.

This is a big opportunity because PepsiCo has proven over time that it knows how to muddle through the rough periods so that it can excel over the long term. The biggest indication of this is the company's status as a Dividend King with over five decades of annual dividend increases under its belt. You can't build a track record like that by accident. It requires discipline, consistency, and a good business plan.

What's interesting is that, despite the current headwinds the company is dealing with, the board of directors voted to increase the dividend in June 2025. The 5% increase is well above the historical growth rate of inflation and fairly impressive when you consider how negative investors are on the stock.

Clearly, management and the board believe there are good things ahead for PepsiCo.

High-yield PepsiCo is still delivering the goods

For long-term dividend investors, the best time to buy stocks is often when they are facing problems that are likely to be short term in nature. That appears to be the case today with PepsiCo, noting that it recently bought a Mexican-American food Maker and a probiotic beverage company to help modernize its brand portfolio.

Given enough time, this Dividend King is likely to muddle through again, just like it has many times before. It may be hard to buy when everyone else is selling, but PepsiCo is continuing to deliver what long-term dividend investors want to see.