Apple Stock in 2025: Time to Buy or Just Hype?

Tech giant's shares flirt with all-time highs—but can they defy gravity forever?

Bulls vs. bears: The $3T question

Supply chain whispers and iPhone 17 leaks fuel volatility. Meanwhile, Vision Pro sales either 'revolutionary' or 'overpriced ski goggles'—depending which analyst you ask.

Services revenue now 25% of pie. Tim Cook's 'subscription everything' play hits different when macro headwinds blow.

Cash reserves could buy El Salvador's Bitcoin stash 12 times over. Yet still no dividend bump for retail investors—classic.

Bottom line: In a world where 'AI' gets slapped on every earnings call, Apple's actual innovation pipeline matters more than ever.

Image source: Getty Images.

Apple is behind in AI

Apple is the leading consumer tech brand in the U.S., and it is also popular around the world. It ROSE to this position through continuous innovation and always having some of the best products available. However, it has fallen behind in a key area: Artificial intelligence (AI).

It's no secret that Apple Intelligence (Apple's take on AI) hasn't lived up to the hype, and has failed to launch several key features that it promised WOULD be launched last year. Whether these features will make a difference in selling more phones is up for debate, but this is just one area where Apple has fallen behind recently.

CEO Tim Cook hinted at one way Apple may be open to catching up in the AI race: Acquisitions. On Apple's third-quarter fiscal year 2025 conference call (ending June 28), Cook mentioned that management is open to making an AI acquisition, and is not concerned about the size of the company. Depending on which company Apple scoops up, this could propel Apple from an AI laggard to an AI leader, and could be the next technological innovation it needs to get back on top.

Apple's revenue growth lags compared to its peers

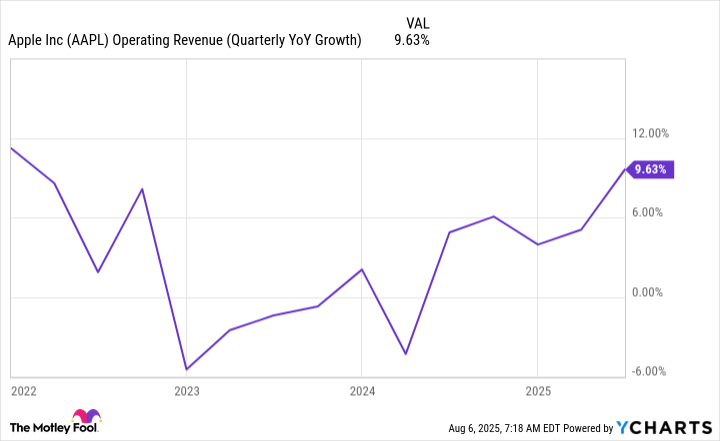

Even without AI, Apple's growth has finally returned. In Q3, Apple's revenue was up 10% year over year. While that's not rapid growth by any means, it's at least market-matching and is a big improvement from where it has been.

AAPL Operating Revenue (Quarterly YoY Growth) data by YCharts.

If Apple can continue this trend and return to mid-teens growth, Apple could finally start to justify its valuation.

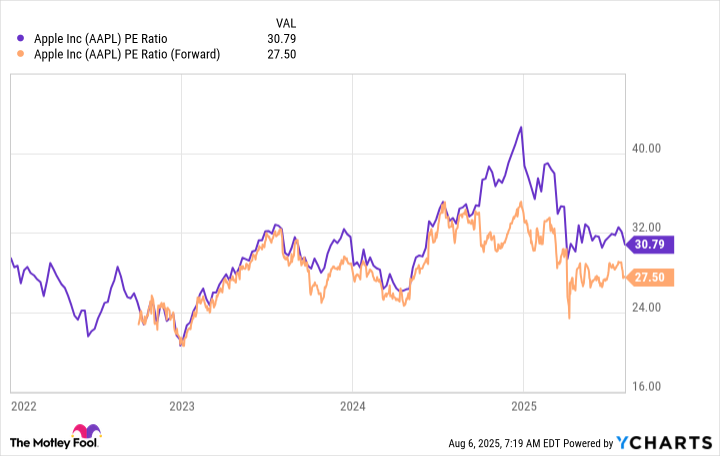

Even though Apple's growth has been lackluster over the past few years, it still maintains a premium valuation in the market. The argument was that Apple is Apple, and it will eventually return to growth mode. Still, despite Apple's successful quarter, it remains a pricey stock.

AAPL PE Ratio data by YCharts. PE = price-to-earnings.

At 31 times trailing earnings and 28 times forward earnings, Apple's stock still trades at the high end of its range over the past four years. Furthermore, Apple is more expensive than the(SNPINDEX: ^GSPC), which trades for 25 times trailing earnings and 24 times forward earnings.

Additionally, if you compare Apple to its "Magnificent Seven" peers, it also looks rather expensive for its growth.

| Apple | 9.6% | 27.5 |

| Nvidia | 69.2% | 41.4 |

| Microsoft | 18.1% | 34.0 |

| Amazon | 13.3% | 32.5 |

| Alphabet | 13.8% | 19.7 |

| Meta Platforms | 21.3% | 27.6 |

| Tesla | (11.8%) | 183.0 |

Data source: YCharts.

Companies like(NASDAQ: GOOG) (NASDAQ: GOOGL) and(NASDAQ: META) provide better growth at a cheaper or similar price tag. But if Apple can improve its growth into the low double-digit range, it will start to look like an attractive pick compared to(NASDAQ: MSFT) or(NASDAQ: AMZN).

I don't think Apple is a buy just yet, although it's getting close. I want to see what happens to Apple once its supply of iPhones -- its most important product -- runs out in the U.S., and it has to deal with tariffs.

Apple is an improving story, but I'm not quite ready to invest in it yet. There are some better big tech options out there.