Cathie Wood’s Robotaxi Obsession: The One Stock She’s Betting Big On—Does Wall Street Miss the Signal?

Cathie Wood’s ARK Invest is doubling down on a controversial robotaxi play—again. While Wall Street analysts obsess over short-term earnings, Wood’s team keeps loading up on what they see as the future of mobility. Here’s why.

### The Unstoppable Bet

ARK’s latest trade filings reveal another massive buy order for this autonomous vehicle stock. No dips, no cold feet—just relentless accumulation. Meanwhile, traditional funds keep chasing ‘safe’ dividends like it’s 1995.

### Disrupt or Die

Robotaxis aren’t just about replacing Uber drivers. They’re a Trojan horse for AI, IoT, and decentralized transport networks. Wood’s betting legacy automakers—stuck in combustion-engine mindset—will bleed market share by 2030.

### The Cynic’s Corner

Sure, Tesla’s FSD still hits curbs, and Waymo’s geofenced to three cities. But while Wall Street demands quarterly perfection, Wood’s playing 5D chess with regulation, infrastructure, and yes—speculation. Sometimes the ‘crazy’ thesis wins. (Looking at you, Bitcoin.)

Taking a look at Wood's recent buying activity

Unlike many of her peers in the wealth management space, Wood distributes summaries at the end of each trading session which itemize all of the stocks that Ark bought and sold on that day.

In the table below, I've summarized Ark's recent activity around Tesla stock.

| July 11 | 59,705 |

| July 15 | 115,380 |

| July 24 | 143,190 |

Data source: Ark Invest.

Over the last few weeks, Wood added 318,275 shares of Tesla which were spread across the,, andexchange-traded funds (ETFs).

Image source: Getty Images.

Why might Wood like Tesla stock right now?

Tesla is primarily known for its electric vehicles and energy storage solutions. But over the last few years, CEO Elon Musk has been making grand promises that Tesla is going to disrupt the AI realm in epic fashion.

One of the ways Tesla plans to make a splash in the AI landscape is through its innovations in autonomous driving. The company is introducing self-driving vehicles to the Tesla ecosystem by offering the technology as a service -- primarily within Tesla vehicles purchased by consumers, as well as through the creation of a robotaxi fleet.

Wood has been bullish on Tesla's AI pursuits for years, especially the robotaxi business. In fact, Ark's long-run price target of $2,600 per Tesla share relies heavily on optimistic assumptions surrounding the company's ability to scale the robotaxi operation.

While Tesla's robotaxi business is still comparatively smaller than's Waymo and faces increased competition from the likes ofand its various partnerships, Musk appears undeterred.

During Tesla's second-quarter earnings call, Musk proclaimed, "I think we will probably have autonomous ride-hailing in probably half the population of the U.S. by the end of the year."

Musk's statement is equal parts bold and speculative -- attributes that are congruent with Wood's growth investing strategy. At the end of the day, I don't think Wood is privy to anything meaningful that the rest of Wall Street isn't, though.

Investors like Wood tend to view Tesla through a long-run lens. In other words, some growth investors are not pricing Tesla for what the company is today, but rather they are assessing what the price could become if Musk pulls off his AI vision. While I understand how tempting it can be to follow HYPE and momentum, valuing narratives is essentially impossible.

I think that Wood is optimistic that the robotaxi business will scale meaningfully during the second half of 2025, finally bearing fruit for Tesla as the company shifts from a traditional automaker to a technology business.

Is Tesla stock a buy right now?

Valuing Tesla stock is an arduous exercise. On the one hand, the company does not fit neatly into the traditional automaker category alongside companies such asand. But on the other hand, Tesla is not purely a technology business much like, Alphabet,,, or. Rather, Tesla sits at the intersection of car manufacturing, energy storage, AI, robotics, and software.

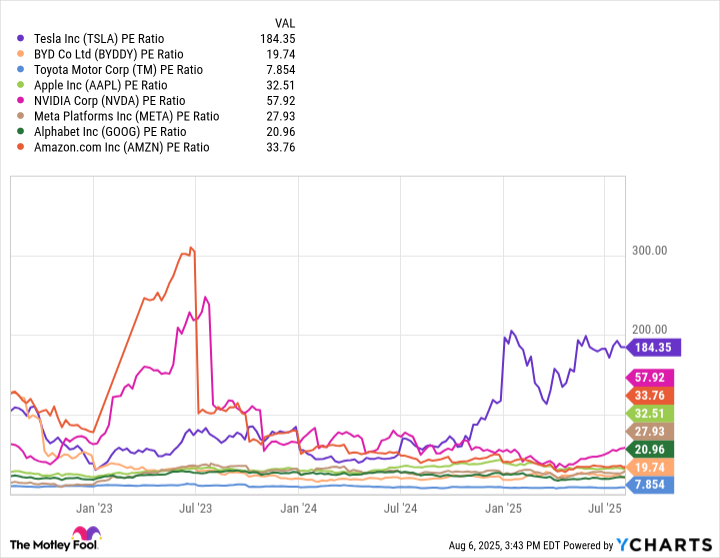

TSLA PE Ratio data by YCharts

In the chart above, investors can see how Tesla stock tends to trade on narratives well beyond traditional valuation fundamentals. These dynamics can be seen clearly by the company's expanding price-to-earnings (P/E) multiple despite decelerating profitability across the business.

While I'm optimistic about Tesla's robotaxi business in the long run, I do question Musk's aggressive timeline of serving half the U.S. population by year end. Beyond variables such as regulatory approvals needed across the country, Musk does have a reputation for missing deadlines. Candidly, I don't think the robotaxi rollout will be any different.

For now, I'd monitor Tesla as it scales the robotaxi business. It will take time before AI begins to MOVE the needle for the company from a financial perspective, anyway. For these reasons, I think investors will have ample opportunity -- and probably more reasonable valuation levels -- to buy Tesla stock in the long run.