Apple Bets $600 Billion on U.S. Expansion—Here’s Why It’s a Game-Changer

Apple just dropped a $600 billion bomb on the U.S. economy—and it’s not just another shiny campus. This move reeks of geopolitical chess, tax maneuvering, and maybe even a dash of desperation. Let’s break it down.

Why Now? The Tech Giant’s Power Play

Tim Cook didn’t wake up feeling charitable. That $600 billion isn’t philanthropy—it’s a shield against supply chain chaos, regulatory heat, and the looming specter of ‘peak iPhone.’

The Fine Print: Factories, Jobs, and Empty Promises?

Sure, they’ll tout ‘American jobs’ and ‘manufacturing revival.’ But watch where the money actually flows—robots don’t vote, but they do slash labor costs. Wall Street will clap while Main Street gets crumbs.

The Cynic’s Take: A $600 Billion Tax Dodge?

Funny how these ‘investments’ always align with juicy subsidies and friendly lawmakers. Apple’s accountants probably high-fived over this one. Meanwhile, crypto degens shrug—$600B could’ve bought a lot of Bitcoin.

Bottom line: Apple’s playing 4D chess with taxpayer money. Checkmate—or just another corporate gambit? You decide.

Image source: Getty Images.

A turnaround for Apple stock?

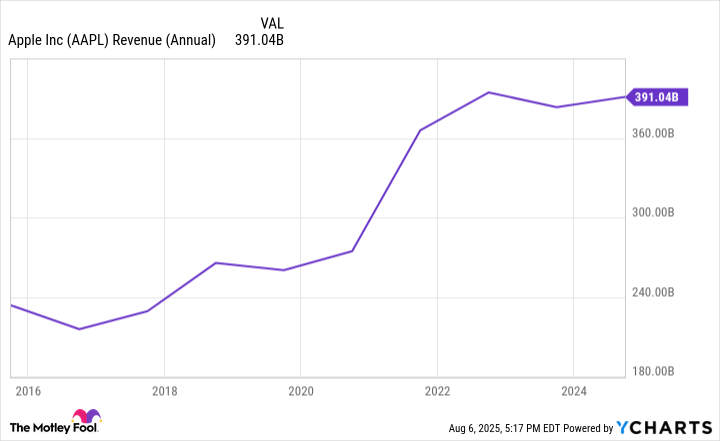

Investors are obviously hoping that this, coupled with Apple's most recent earnings report, will spark a fire under Apple stock and finally get it moving higher. While other tech stocks are booming, Apple has been relatively flat, rising less than 2% in the last 12 months. Its annual revenue, which helped make Apple the biggest publicly traded company in the world for nearly two decades, flattened in the last three years.

AAPL Revenue (Annual) data by YCharts.

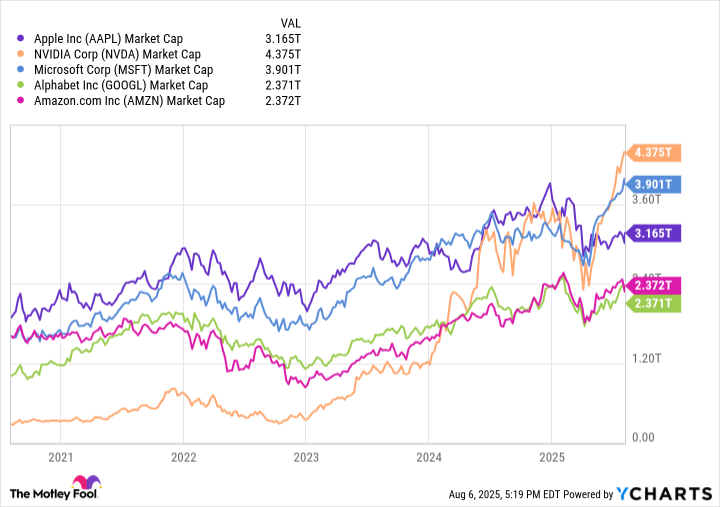

Now bothandtop Apple in the rankings of largest companies, withandrapidly closing the gap.

AAPL Market Cap data by YCharts.

However, investors finally got some good news on July 31, when Apple reported its fiscal third-quarter earnings (ended June 28). Revenue jumped 10% to $94 billion, and earnings per share were up 12% to $1.57. Product sales were up 8.2%, which was a vast improvement from the 2.7% increase that Apple saw in the fiscal second quarter.

Regarding Wednesday's announcement, Apple isn't the first tech company to promote U.S. manufacturing to avoid tariff issues. TSMC, which is the world's largest fabricator for high-level semiconductors that power generative artificial intelligence platforms, is investing $165 billion in Arizona to create a research and development center, two advanced packaging facilities, and three fabricators. The work is widely viewed as a hedge to avoid being penalized by future tariffs.

It's unclear so far how Apple's announcement will affect the cost of products. While Apple's Services division continues to grow and has a far higher profit margin, Apple continues to get the lion's share of its revenue from its products, including smartphones, Macbooks, iPads, and wearable devices.

Should you invest in Apple stock?

Apple has been a disappointment of late, but there's real momentum here that the company can use to make a change. The company is also fairly valued, with a recent price-to-earnings ratio of 32, which is reasonable for tech stocks.

Apple's announcement should be enough to keep it out of the WHITE House's disapproval. Whether it's enough to keep Apple customers buying its products and help Apple continue to grow its quarterly revenue is another question.