Apple’s AI Surge Is Accelerating – Why Investors Can’t Afford to Ignore It

Apple's AI ambitions are shifting into high gear—and Wall Street's starting to sweat. Forget incremental updates; Cupertino's machine-learning push is reshaping its ecosystem from chips to Siri. Here's how it impacts your portfolio.

The AI Stack Gets a Silent Overhaul

Beneath iOS 18's glossy interface, Apple's deploying neural engines that chew through 18 trillion operations per second. Their acquisition spree—snapping up 12 AI startups since 2023—is finally bearing fruit. Developers whisper about on-device models that bypass cloud costs entirely.

Investor Playbook: Beyond the Hype Cycle

While analysts hyperventilate over AI revenue projections (always conveniently 3 years out), the real money's in the supply chain. TSMC's 3nm wafer orders tell the truth Apple's PR won't: this isn't another Siri-grade disappointment. Short the doubters—the M4 chip's 40% NPU boost doesn't lie.

The Cynical Take

Let's be real—Apple's 'AI revolution' mainly automates upselling you iCloud storage. But when the market's this desperate for growth narratives? Even Tim Cook's grocery list could moon a microcap stock.

A much-needed rebound for the iPhone and Mac products

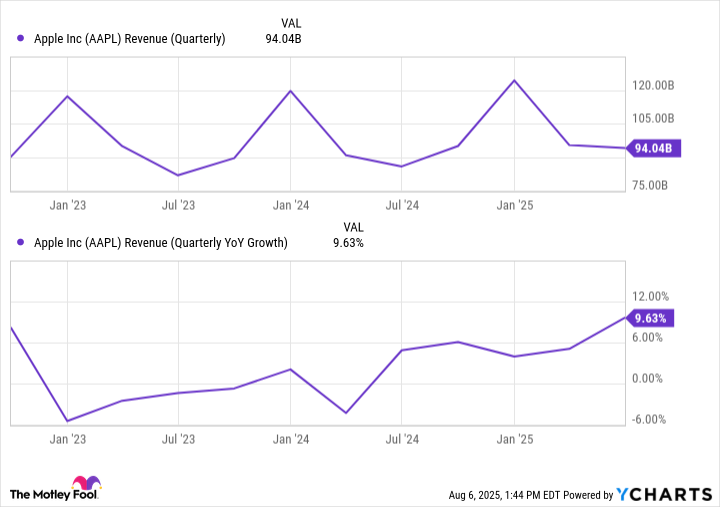

Apple's fiscal third-quarter earnings, for the period ended June 28, were a pleasant surprise for many people. Its revenue grew nearly 10% year over year to $94 billion, which is a June quarter record for the iPhone maker. And speaking of iPhone, the smartphone's revenue grew 13% year over year to $44.6 billion, which Apple noted was driven by the popularity of the iPhone 16 family.

Mac (which includes products like MacBook Pro, MacBook Air, iMac, and Mac Studio) revenue grew 15% year over year to $8 billion, but iPad and wearables, home, and accessories sales were noticeably down -- 8% and 9% year over year, respectively.

Still, Apple's hardware revenue grew by 8% year over year and accounted for nearly 71% of its total revenue for the quarter. Apple's services segment reached an all-time high, bringing in $27.4 billion, but hardware remains -- and will likely remain -- king for the company.

AAPL Revenue (Quarterly) data by YCharts

Apple's year-over-year revenue growth was its highest in the past three years.

Is Apple finally getting serious about AI?

The big cloud hanging over Apple's business has been AI (what it calls "Apple Intelligence"), and the lack of urgency in the space compared to rivals likeand. It seems Apple is beginning to take it more seriously and address this issue.

A major advantage on Apple's side is the number of devices it has in people's pockets, homes, and offices. Ideally, Apple can integrate AI into its various hardware, giving people even more of a reason to choose it over competitors. This has been the plan for a while, but it hasn't gone as smoothly or as quickly as most people thought or hoped.

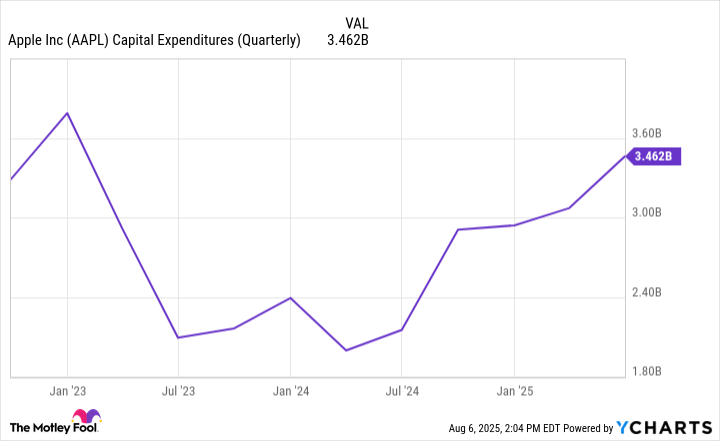

That should change soon, with Apple's management noting on its latest earnings call that Apple is "increasing [its] investment significantly in AI," both in infrastructure and company personnel. In its latest quarter, Apple spent nearly $3.5 billion on capital expenditures, its most since its fiscal quarter that ended in January 2023.

AAPL Capital Expenditures (Quarterly) data by YCharts

Apple has always moved cautiously and with intention. These new AI investment developments don't strike me as the company just now coming to its senses, but more so Apple feeling like now is the right time (a lagging stock price sure helps it come to that realization).

Image source: Getty Images.

Apple's stock looks like a good entry point for investors

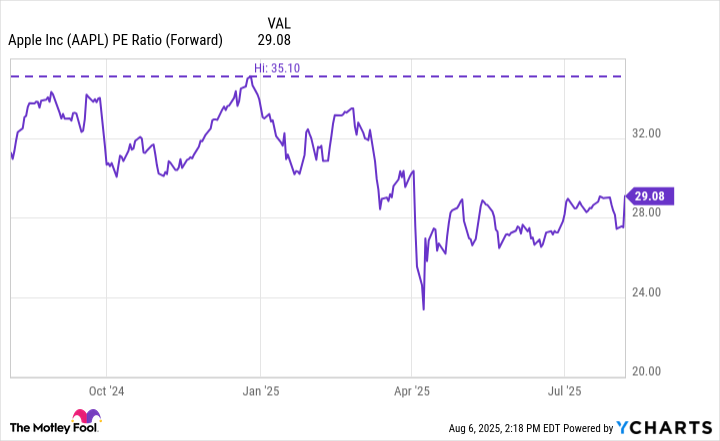

At the time of this writing, Apple is trading at 29 times its projected earnings for the next year. That's the second-lowest out of the "Magnificent Seven" stocks and below the 35 it was at to start this year.

AAPL PE Ratio (Forward) data by YCharts

That alone doesn't make Apple a buy right now, but it does give it a lot more upside now than before. This is especially true if its new AI prioritization plays out as management envisions. With $133 billion in cash and marketable securities to its name, Apple has all the resources it needs to ensure it keeps pace in the AI race.