Cathie Wood’s Bold AI Bet: The Undervalued Stock She’s Loading Up On for 10X Gains

Cathie Wood just doubled down on an AI dark horse—while Wall Street slept.

Here's why this overlooked play could mint her next ARK moonshot.

The Contrarian AI Play

While mega-caps hog the AI spotlight, Wood's scooping up shares of a battered growth stock trading at fire-sale multiples. No shiny Nvidia competitor—this is a picks-and-shovels provider quietly powering the AI revolution.

Numbers Don't Lie

The stock cratered 60% from highs before ARK pounced. Now trading at 1.8x sales versus the sector's 12x average? Even hedge fund bros might call that 'asymmetric upside.'

The Cynic's Corner

Sure, Wood's 2023 crypto calls aged like milk—but when she nails it (hello, Tesla), the gains cover a decade of misses. This time, she's betting the AI gold rush needs more than just flashy GPUs.

The bottom line? When ARK zig-zags into 'uninvestable' territory, smart money watches closely. The stock's still cheap—for now.

Alphabet's business is in great shape

Alphabet recently reported operating results for its second quarter, which ended June 30.

The company's largest source of revenue -- advertising -- generated $71.3 billion in revenue, growing by 10% year over year. Advertising growth from Google Search and YouTube was even more robust, coming in at 12% and 13%, respectively.

Over the last few years, skeptics on Wall Street have been parroting a bearish narrative that the rise of ChatGPT and other competing large language models (LLMs) will diminish Google's dominance in search. Accelerating growth between Google Search and YouTube suggests that advertisers still see a high return on investment (ROI) from these platforms, despite some shifts in how people are consuming content on the internet.

Where investors may be getting nitpicky is around Alphabet's profit margin profile. The advertising segment sits under a larger category of Alphabet's business, called Google Services. During the second quarter, Google Services grew its revenue 12% year over year to $82.5 billion. However, the operating margin for the Services business remained flat year over year -- coming in at 40%.

When expenses grow in line with revenue, profit margins become capped. On the surface, this may look like Alphabet is not running an efficient business despite an accelerating top line. I wouldn't rush to such a conclusion, though.

Over the last few years, Alphabet has made a number of strategic investments to bolster its AI position. For starters, the company augmented its cloud infrastructure business by acquiring cybersecurity start-up, Wiz, for a reported $32 billion.

On top of that, Alphabet's multibillion-dollar investments in AI data centers are often underappreciated -- and yet it's this infrastructure that attracted OpenAI, a perceived rival, as one of Google Cloud's new major partners.

Lastly, Alphabet is also quietly building its own quantum computing operation through the development of its own custom chipsets, called Willow. Although monetizing quantum computing applications is still likely many years away, I find it encouraging that Alphabet is allocating capital across several pockets of the AI realm in an effort to build a diversified ecosystem that strengthens Core businesses while opening the door to new opportunities as well.

Image source: Getty Images.

Is Alphabet stock a buy right now?

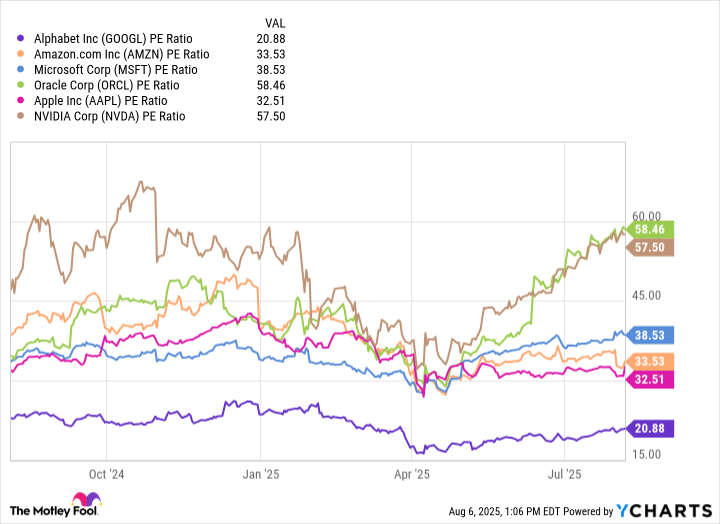

The chart below benchmarks Alphabet against many of its big tech peers on a price-to-earnings (P/E) basis. Ultimately, I think Alphabet stock is being punished by investors because the company isn't posting growth as robust as some of its peers.

GOOGL PE Ratio data by YCharts

In my eyes, the fact that the company continues to grow revenue from its CORE businesses while striking lucrative deals with rivals and maintaining its profit margin profile in the face of aggressive investments shows a high degree of resiliency from Alphabet. Given the disparity in valuation multiples illustrated above, I think that the bearish narrative appears to be fully baked into Alphabet stock at this point.

To me, Alphabet is positioned for significant valuation expansion in the coming years as its infrastructure investments continue to bear fruit. I think Wood identified a rare opportunity among major AI players by identifying such a cheap stock floating around in a sea of frothy valuations. I see Alphabet stock as a no-brainer buying opportunity at its current price point for long-term investors.