5 Reasons Alphabet (GOOGL) Is the Smartest AI-Powered Stock Play for 2025

Alphabet's stock isn't just climbing—it's rewriting the rules of tech investing. Here's why Wall Street's sleeping giant just woke up.

1. AI arms race? They're winning quietly

While rivals burn cash on flashy LLMs, Google's deploying AI where it matters—search margins up 18% last quarter.

2. Cloud division printing money

Google Cloud now generates more profit than 90% of Fortune 500 companies. No big deal.

3. YouTube's ad machine

Short-form video revenue up 35% YoY. TikTok who?

4. The self-driving dark horse

Waymo's robotaxis are actually functional—unlike certain 'full self-driving' promises from *cough* other CEOs.

5. Cash position like a crypto whale

$120B in reserves makes even Bitcoin maximalists blush. Perfect for snapping up AI startups during the coming 'correction.'

*Bonus jab: Meanwhile, Meta's still trying to monetize legless VR avatars.*

Image source: Getty Images.

1. Google Search revenue is rising

The biggest reason why shares of Alphabet trade at a discount to its peers is that the market is worried about its base business collapsing. While there are several brands underneath its umbrella, the biggest is Google Search.

The theory is that Google Search won't be able to compete against various generative AI services. If more people use generative AI than Search, Alphabet's revenue will tumble and drag its profits down with it.

While several people seem to hold that opinion, and there is some evidence Google is very slowly losing some users to generative AI, it hasn't affected its results. In the second quarter, Search's revenue ROSE 12% year over year. That's an acceleration from the previous quarter's 10% growth.

Clearly, Google Search is doing quite well, and the central argument to the bear case isn't supported by the financial results.

2. AI Search Overviews bridge the gap

Just because generative AI challenges Google doesn't mean that it's ignoring it. Instead, it has embraced generative AI and offers AI Search Overviews at the top of its results. Management says that this has become a very popular feature and has been used by over 2 billion people in 40 languages.

While Alphabet may see some defectors to generative AI platforms, its AI Search Overviews could provide enough of a generative AI experience to maintain the vast majority of its user base.

Furthermore, management has stated that Overviews has around the same monetization as a regular Google Search, so it isn't losing out on a TON of revenue, either, with this integration.

3. Google Cloud is gaining momentum

Another key part of the Alphabet investment thesis is the growth of Google Cloud, its cloud computing wing that allows its clients to rent high-powered computing devices over the internet to run workloads. Google Cloud has been gaining momentum recently, and even captured one of the most important clients in the world: OpenAI, the Maker of ChatGPT, one of the leading generative AI models.

Although Google has a competing model, Gemini, it remains neutral in the cloud computing market and allows other models to be used. This neutrality was attractive to OpenAI, and it trusts Google enough to run its workloads on its servers. This is a huge client win for Google Cloud and showcases its overall strength

4. Google Cloud's finances are improving

Google Cloud had an excellent first quarter, with revenue rising 32% year over year. Furthermore, the segment's operating margins are rapidly improving, with a 21% margin in the second quarter, up from 11% year over year.

As Google Cloud continues to grow faster than the rest of the company and operating margins improve, this segment will become a much larger part of the Alphabet investment thesis. Cloud computing has powerful tailwinds, including traditional workload migration and AI workload growth.

This segment will continue growing rapidly, and over the next decade, will become a key part of the overall company's finances.

5. The stock is dirt cheap

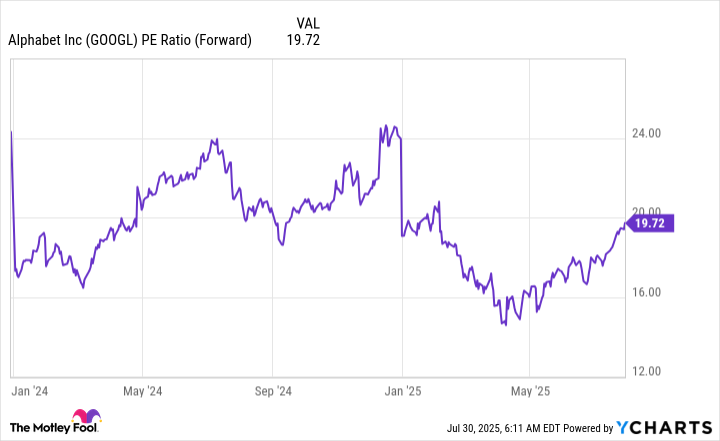

Circling back to the top, Alphabet's stock is unbelievably cheap right now. It trades at less than 20 times forward earnings, which is significantly cheaper than the broader market, as measured by the, which trades for 24 times forward earnings.

GOOGL PE Ratio (Forward) data by YCharts; PE = price to earnings.

Most of the big tech stocks trade in the high 20s range of forward price-to-earnings (P/E), all the way up to the high 30s. This either makes Alphabet undervalued or the other group overvalued. Regardless, it's an excellent buy now and is a great way to ensure that you're not overpaying for a big tech stock.