This Super Streaming Stock Crashed 18% in July—Time to Buy, Dump, or Ride It Out for 2025?

Streaming giant's brutal July bloodbath leaves investors scrambling. Was it an overreaction—or a sign of deeper trouble?

The Drop: Panic or Prudence?

An 18% nosedive in a single month screams 'sell.' But market tantrums often create bargains for those who spot the difference between temporary turbulence and terminal decline.

Bull Case: Buffet Would’ve Bought the Dip

Subscriber growth still outpaces legacy media. Content library rivals Fort Knox. And let’s be real—every analyst downgrading this stock still binge-watches its shows on weekends.

Bear Trap: Or Just Another Broken Growth Story?

Cash burn continues despite price hikes. Competition’s eating its lunch. And that ‘super’ in the stock name? Starting to smell like last year’s hype cycle.

The Verdict: Hold (But Keep Finger Near Sell Button)

This isn’t 2021’s meme-stock casino—but if management can’t turn streaming profits into actual profits soon, even the diamond hands might bail. Bonus cynicism: If ‘long-term vision’ was a drinking game, tech investors would be permanently hospitalized.

Image source: Getty Images.

Spotify is a leader when it comes to innovation

The majority of music streaming services offer almost identical content catalogs, so they can only compete with one another by charging lower prices, developing better features, or by investing in other content formats. Spotify is heavily focused on the latter two differentiators.

On the technology side, Spotify is betting big on artificial intelligence (AI). In 2023, it introduced a feature called AI DJ, which learns what type of music each listener enjoys, and then plays them similar content while delivering commentary through a software-generated voiceover. In May of this year, the company enhanced the feature by adding voice requests, so users can steer the DJ in a different direction when their mood or their environment changes.

AI Playlist is another unique tool Spotify developed. Users can type in a simple prompt and this feature will produce a complete playlist of tracks to match. A prompt can be anything, whether it be a particular feeling, a users' favorite color, or a specific instruction. Naturally, more detail will yield better results.

On the content side, Spotify is one of the world's largest platforms for audio podcasts. It also made a huge push last year to encourage creators to make video podcasts because they drive more engagement, and they have answered the call by uploading more than 430,000 so far. Spotify says video consumption is growing 20 times faster than audio consumption this year, and the number of users who have streamed a video podcast is up 65% to 350 million compared to this time in 2024.

Spotify's revenue and operating profit fell short of expectations in Q2

Spotify had 276 million paying subscribers at the end of the second quarter, in addition to 433 million free users, which it monetizes through advertising. The premium subscriber base grew faster than the free user base, which was good news because these customers accounted for 89% of the company's revenue.

On that note, Spotify's total revenue came in at $4.8 billion for the quarter, which was up 10% compared to the year-ago period, but it was below management's forecast of $4.9 billion. Part of the shortfall was attributable to the company's advertising revenue, which shrank by 1% year over year.

CEO Daniel Ek said Spotify was moving too slowly on the execution front, so it's taking longer than expected to see improvements from some of the innovations in its ads business. However, he said there are some positive signs that could set the stage for a strong 2026.

Spotify's weaker-than-expected revenue had implications for its profitability during the quarter. It generated $464 million in operating income, which was well below management's guidance of $615 million -- however, it still represented a whopping 53% growth compared to the year-ago period, so the result wasn't a total disappointment.

Is Spotify stock a buy, sell, or hold from here?

Spotify is a great business with a stellar track record of success, so one weak quarter is unlikely to change the company's positive long-term trajectory. However, it's clearly affecting the price investors are willing to pay for its stock, given the 18% decline in July.

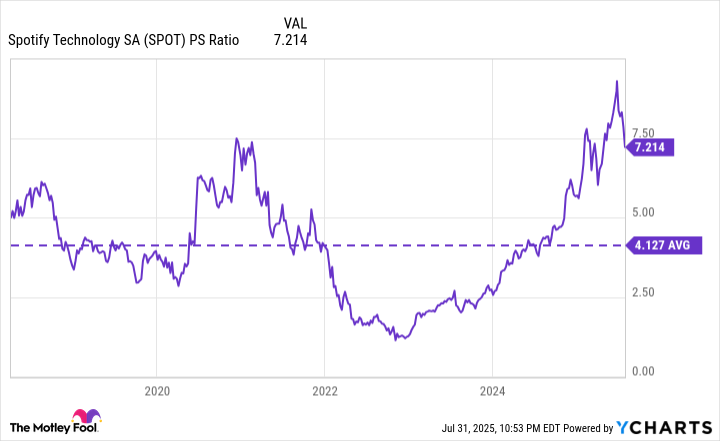

Spotify stock is still trading at an elevated price-to-sales (P/S) ratio of 7.2, a whopping 75% premium to its long-term average of 4.1 dating back to its initial public offering (IPO) in 2018. Therefore, despite last month's decline, it might still be overvalued:

SPOT PS Ratio data by YCharts

As a result, investors looking for short-term gains should probably sit this one out. But those willing to hold onto the stock for the long term could do well if they buy the recent dip, because according to a forecast issued by Daniel Ek in 2022, Spotify could reach $100 billion in annual revenue by 2032. That WOULD be a fivefold increase from where Wall Street expects Spotify's 2025 revenue to come in (according to Yahoo! Finance), which leaves plenty of room for upside in its stock over the next seven years or so.