8 Quantum Computing Stocks AI Investors Can’t Afford to Miss in 2025 – Here’s the Top Pick

Quantum meets AI: The trillion-dollar collision Wall Street isn’t ready for.

Forget CPU vs GPU—the real hardware arms race is happening in subzero labs where qubits replace bits. These eight companies are building the unholy alliance of quantum and artificial intelligence.

The quantum-AI nexus: Why it matters now

When machine learning models start leveraging quantum superposition, your portfolio either rides the wave or gets decimated by algorithmic tsunamis. Early movers are already pricing in 2030 revenue streams.

The contenders (and one pretender)

From established semiconductor giants pivoting to photonic qubits to stealth startups manipulating anyons in 2D materials—we’ve got the breakdown. One ‘pure play’ trades at 30x sales because, well, quantum hype bypasses valuation models.

The verdict

There’s always that one stock that makes hedge fund managers whisper ‘Schrödinger’s valuation’—simultaneously overpriced and undervalued until the quantum winter comes. We’ll tell you which one actually has working hardware (and which just filed their third ‘quantum’ trademark this year).

Bonus cynicism: If you think ICOs were speculative, wait until you see quantum computing SPACs with PowerPoints about ‘post-quantum blockchain’.

Everyone is talking about these four quantum computing stocks, but...

Whenever a new theme begins to emerge within a broader megatrend, investors often try to identify the "next big opportunity." What I mean by that is throughout the AI revolution, investors have been repeatedly reminded of how great the "Magnificent Seven" stocks are.

But now that quantum computing is becoming an increasingly popular topic within the broader AI discussion, more speculative investors are seeking to find new opportunities that could potentially mimic returns similar to those of the Magnificent Seven.

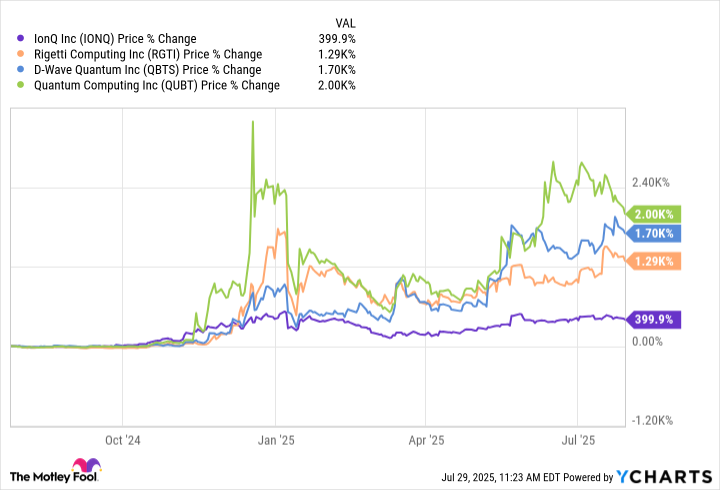

At the moment, four of the most popular quantum computing stocks are,,, and the appropriately named. While it's tempting to follow outsize momentum, all four of these quantum computing stocks deserve a closer look before investors begin to pour in.

IONQ data by YCharts

First, all of these businesses are investing heavily in research and development (R&D) and capital-intensive projects as they explore quantum technology. This is an important nuance for investors to understand. None of these companies is generating significant or consistent revenue yet. This could be considered a risk, as these businesses are not yet offering various product lines that are commercially scaled.

Given the lack of sales coming through the door, it shouldn't be surprising to learn that these small companies are burning through quite a bit of cash -- making long-run liquidity a major concern. For now, each of these quantum computing hopefuls has relied on stock issuances in order to raise funds. Not only is that dilutive to shareholders, but it's not a sustainable method of capital raising in the long run.

All of these quantum computing stocks are trading for valuations far beyond what investors witnessed during prior stock market bubbles. Management may understand this and are taking advantage of frothy conditions to raise as much capital as possible before valuations protract and become more appropriately aligned with the fundamentals of their respective underlying businesses.

Image source: Getty Images.

...I like these four magnificent stocks even better

While it may seem a little anticlimactic, I think the most prudent way to invest in quantum computing is through the usual suspects: the Magnificent Seven. Cloud hyperscalers,, andhave largely been tied to hefty investments in data centers, servers, and chips over the last few years. However, each of these companies has quietly been exploring quantum computing, too.

All three of these Magnificent Seven members have developed their own custom quantum computing chips, called Majorana, Ocelot, and Willow. On top of that,(NASDAQ: NVDA) is exploring quantum applications by offering new, extended features of its existing CUDA software system.

The reason that I like big tech over the speculative players above is that each also has a multibillion-dollar business spanning various pockets of the AI realm. In other words, quantum computing represents an extension of an already established footprint.

By contrast, companies such as IonQ, Rigetti, D-Wave, and Quantum Computing are essentially singularly focused businesses whose long-run viability hinge on successful business execution and penetration of the quantum computing industry. If they fail to achieve a critical mass in terms of enterprise-level customers, these companies could quickly run through their remaining capital and be headed toward a path of insolvency.

Which quantum computing stock is the best of the bunch?

At a high level, I think there are merits to owning any of the big tech stocks referenced above. But if I had to choose just one, I'd pick Nvidia as my best quantum computing idea.

I see Nvidia as the most ubiquitous business among megacap technology AI stocks. The company already dominates the data center and chip landscapes, and with more sophisticated use cases across autonomous vehicles, robotics, and now quantum computing starting to emerge, I'm hard-pressed to think of how or why Nvidia won't continue to be a major source powering these applications.

In my eyes, Nvidia has much more room for growth beyond the Core chip business in the long run. For this reason, I think Nvidia stock is a no-brainer right now.