Alphabet’s $4 Trillion Ascent: The Blueprint to Becoming the World’s Second Mega-Cap Titan

Google's parent company isn't just flirting with dominance—it's rewriting the rules of corporate empire-building. Here's how Alphabet could join the $4 trillion club before Wall Street finishes its next round of avocado toast.

The AI Gold Rush: Alphabet's DeepMind and Gemini projects aren't playing catch-up—they're quietly building the infrastructure for the next decade of machine intelligence. Every ChatGPT query that bypasses Google Search? Just fuel for their long-game.

Cloud Wars Escalation: While Amazon and Microsoft bicker over Pentagon contracts, Google Cloud's Web3 division is onboarding crypto-native enterprises at a 142% YoY clip. The cloud race isn't about storage—it's about becoming the backbone of decentralized finance.

Moonshot Math: Those 'other bets' that analysts love to dismiss? They're not losses—they're $15 billion worth of lottery tickets where the jackpot is vertical monopolies in quantum computing, longevity biotech, and fusion energy.

The Regulatory Tightrope: Antitrust lawsuits might slow Alphabet down, but they won't stop it. Every fine just becomes R&D budget line items—the company spends more on coffee than some nations spend on healthcare.

Alphabet won't reach $4 trillion by being the next Apple or Microsoft. It'll get there by inventing entirely new asset classes—then quietly owning the rails underneath them. Just don't tell the fund managers still trying to value Web2 companies with 20th century multiples.

Image source: Getty Images.

Alphabet's second quarter was dominant

Alphabet is likely better known by the businesses that it owns: Google, YouTube, Waymo, and the Android operating system. It has a dominant empire in various niches, but its most important is Google Search.

In the second quarter, Google Search generated $54 billion of the company's revenue of $96 billion. That's a large chunk of its total, so it needs to continue having this division perform well to succeed as a whole.

However, there are some early warning signs that have investors concerned. The most significant technologies in generative artificial intelligence (AI) have the potential to transform how people use the internet. Currently, the vast majority of people seek information using Google Search. That could change if generative AI becomes more widely adopted by the masses. The market broadly assumes that it will replace Google, but that seems far from reality.

One area where Google has bridged the gap is with AI search overviews, which give users a generative AI-powered summary of their search results. Management discussed the popularity of this feature during its second-quarter conference call and provided a couple of key insights for investors.

First, AI overviews now have over 2 billion users in 40 different languages, showcasing its widespread appeal. Another huge revelation for investors is that it sees the same monetization as regular search results, so it's not harming Google's business at all by heavily investing in this technology.

This showed up in Alphabet's results, as Google Search revenue ROSE 12% year over year. That's an acceleration from the 10% year-over-year growth in the first quarter. This isn't a sign of a dying business; it's a sign of one that's growing.

As a result, there's no reason for Alphabet to trade at a significant discount to its big-tech peers, since it's growing just as fast (if not faster) than most of them.

Its peers fetch a much higher premium

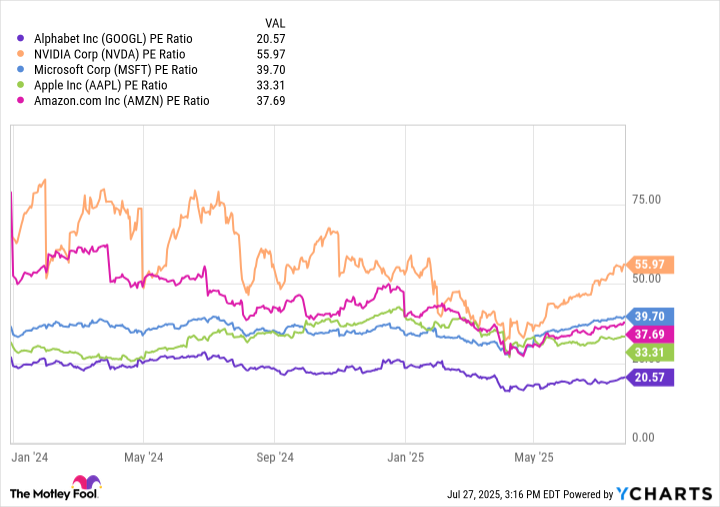

The four companies ahead of Alphabet in market cap are Nvidia, Microsoft, Apple, and. Compared to these four, Alphabet trades at a huge discount.

GOOGL PE Ratio data by YCharts; PE = price to earnings.

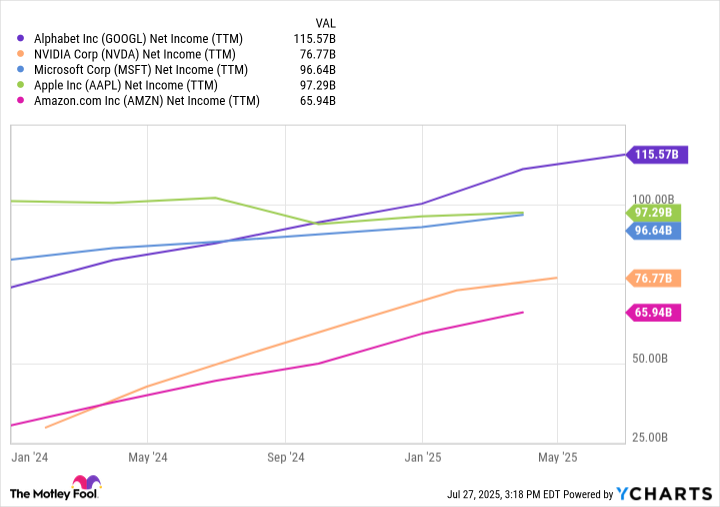

However, over the past 12 months, Alphabet has produced the most net income of any of these companies.

GOOGL Net Income (TTM) data by YCharts; TTM = trailing 12 months.

Alphabet actually produces the most profit of any company that trades on U.S. exchanges, and if it received the same multiple as its peers, it WOULD be the largest company in the world (in some cases).

| Nvidia | 56.0 | $6.47 Trillion |

| Microsoft | 39.7 | $4.59 Trillion |

| Apple | 33.3 | $3.85 Trillion |

| Amazon | 37.7 | $4.36 Trillion |

Data source: YCharts.

So, if the company were to receive the same respect as its peers, it would already be the world's largest company. Whether you think most of the big tech stocks are overvalued or if you think Alphabet is undervalued, it doesn't matter.

It has some of the best chances of beating the market over the next few years due to its low valuation and impressive growth, considering its size. I think it's a top stock to buy now, and it makes even more sense if you're concerned that the market in general is getting too expensive.