Is Palantir Stock the $10,000 Bet Worth Making in 2025?

Palantir’s stock keeps buzzing—but does it deserve a spot in your portfolio? The data-mining giant’s shares swing between hype and skepticism, leaving investors torn.

Bull Case: Government contracts and AI-driven analytics fuel growth. Bears counter with valuation concerns and opaque revenue streams.

Bottom line: If you’ve got $10K burning a hole in your pocket, ask yourself—do you trust Peter Thiel more than your gut? (And remember: Wall Street’s ‘sure things’ have a habit of cratering.)

Image source: Getty Images.

Palantir's platform is rising in popularity

Palantir provides AI-powered data analyst software to its clients. Its client base is highly diverse, as it got its start selling software to government entities. Eventually, the company expanded beyond government clients to the commercial side and has built a well-balanced business between these two sectors.

One of the driving factors behind Palantir's growth is AIP (artificial intelligence platform). AIP enables users to easily integrate AI into workflows, increasing the speed at which employees can perform tasks. Additionally, it also allows clients to deploy AI agents to automate manual processes. This platform is rapidly growing in popularity, attracting many new clients to the Palantir platform.

During Q1, the company's commercial customer count rose 46% year over year to 622, with the U.S. seeing particular strength, rising 65% year over year to 432. This underscores a key aspect of the Palantir investing thesis: Not many companies have adopted its products. As a result, investors are incredibly bullish on its future as the potential client list for its products is massive.

However, one item investors must know is how expensive the company's product is. If we calculate the revenue generated by the 432 U.S. customers for Palantir and annualize it, we obtain an average annual cost of $2.36 million. The number of clients that can afford to spend more than $2 million per year on a software product is fairly limited, so don't expect Palantir to be used by every company worldwide.

Still, that's what the market is pricing into its stock.

Palantir has more than four years' worth of growth priced into its stock

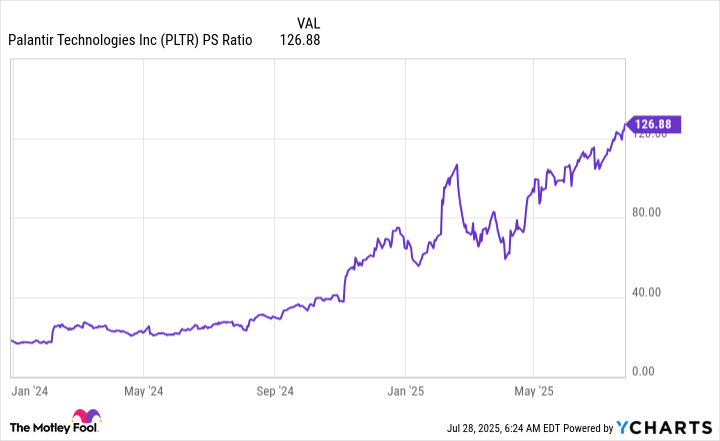

After Palantir's massive run-up, there's no secret surrounding how expensive its stock is. Most software companies trade between 10 and 20 times their sales, with the most expensive companies trading at 30 times sales. Palantir completely blows those historical figures out of the water, with a valuation of around 125 times sales.

PLTR PS Ratio data by YCharts

That's an incredibly expensive stock, conveying massive growth that is already priced into the stock. For its stock to trade at a far more reasonable, but still very expensive, 30 times sales, its revenue WOULD need to total $12.5 billion. Over the past 12 months, Palantir produced $3.1 billion in revenue.

At Palantir's current 39% revenue growth rate, it would take over four years to return to a historically high valuation for software stocks. Investors need to ask themselves if four years' worth of growth priced into a stock is a reasonable price tag to pay. In my eyes, it isn't, so investing in Palantir's stock right now isn't a smart move. Palantir's business is thriving and is likely to continue growing at a rapid pace. However, the stock has priced in a far greater growth rate than it is currently delivering, and this could cause the stock to underperform the market over the next five years.