2 Top Stocks to Buy in August 2025 for Lifetime Passive Income (Wall Street Hates These)

Forget meme stocks—these cash-printing machines actually deliver.

The 'Boring Money Printer' Stocks Wall Street Ignores

While hedge funds chase AI vaporware, two old-school giants keep minting dividends like clockwork. No hype, no drama—just cold hard cash landing in accounts every quarter.

Why Your Broker Won't Recommend These

No 10,000% moonshots here—just steady 6-8% annual returns that compound into generational wealth. The kind of 'slow wealth' that won't earn your financial advisor a yacht bonus.

The Cynical Kicker

Bonus: Both stocks are in sectors so unsexy, CNBC won't even put their tickers on the chyron. Perfect for building real wealth while the suckers chase 'the next big thing'.

1. Visa

Visa is a leading payment network company that processes credit card payments and earns a fee for each transaction. It is not an issuing bank, which means it misses out on the interest customers pay on their credit card balance. However, Visa's business model also allows it to avoid credit risk, which can be a significant headwind for banks, especially during economic downturns.

Image source: Getty Images.

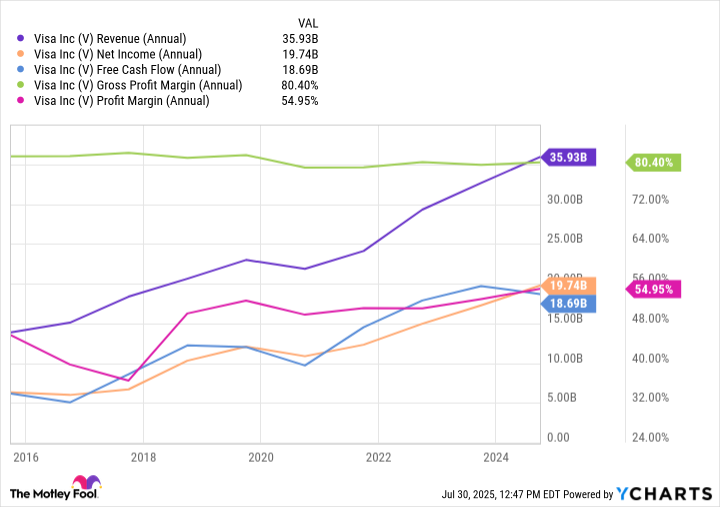

Visa does have its own risks. Transaction volume tends to decline during a slowdown, resulting in lower sales than the company WOULD otherwise expect. However, Visa has a resilient business and can navigate these challenges. The company generates consistent revenue, earnings, and cash flow, while also recording gross and net profit margins of about 80% and 50%, respectively. That's outstanding for a company of this size.

V Revenue (Annual) data by YCharts

What's more, Visa still has significant growth prospects. First, general economic growth benefits Visa as it leads to higher discretionary spending, some of which the company will handle over its network. Second, the increased displacement of cash and checks represents another significant long-term growth opportunity for Visa. Despite appearances, there are still trillions of dollars' worth of cash and check transactions.

Visa's effort to displace cash and check transactions by bringing them into its ecosystem is a trend that is likely to continue in the long run. Third, the increased reliance on e-commerce will also be a tailwind for the company. Cash and checks aren't options for many retail transactions, but credit cards are. So, Visa is looking at lucrative long-term trends. Given the company's leading position in its industry and its network effect, Visa can capitalize on its opportunities.

Lastly, Visa has been hiking its payouts at a terrific rate in recent years. The company's dividends have increased by 392% during the past decade. Although Visa's forward dividend yield of 0.7% looks subpar compared to theindex's average of 1.3% (which isn't great, either), Visa's strong business, excellent prospects, and attractive dividend growth track record make it a top stock for income seekers to hold on to.

2. Abbott Laboratories

Abbott Laboratories is a healthcare leader with a diversified business across medical devices, diagnostics, nutrition, and pharmaceuticals. The company routinely develops and markets newer and better products within its Core areas, holds plenty of patents that protect its inventions against competition and grant it some pricing power, and generates consistent financial results. Abbott Laboratories' diversification has also proven to be a strength.

When one of its units is struggling, the others tend to pick up the slack. That's another reason Abbott Laboratories has remained successful for as long as it has, besides its innovative abilities. The great news is that there is more where that came from. Several of Abbott's segments are expected to be important long-term tailwinds.

Perhaps the most important will be diabetes care. Abbott markets a franchise of continuous glucose monitoring (CGM) systems called the FreeStyle Libre. Sales from these devices have been Abbott Laboratories' most important growth driver for years. The FreeStyle Libre has become the most successful medical device of all time in terms of dollar sales, a remarkable achievement.

Yet only a small fraction of people with diabetes worldwide use CGM technology, which has been proven superior to blood glucose meters. There is a long runway for growth here, as well as within some of Abbott Laboratories' other segments. Lastly, the healthcare leader is a Dividend King currently on a streak of 53 consecutive payout increases. Abbott's forward dividend yield of 1.8% is slightly above the S&P 500's average -- although it still isn't a particularly juicy one.

Regardless, the company should continue returning increasing dividends to shareholders for a long time.