S&P 500’s Top Dividend Stock Just Chopped Its Payout by 50%—Here’s Why It’s Still a Contrarian Buy

Wall Street’s favorite cash cow just took a chainsaw to its dividend—and somehow, it’s still mooing.

### The Guillotine Drop

No one saw this coming: The S&P 500’s highest-yielding stock just halved its dividend overnight. Cue the panic selling—except the smart money’s doing the opposite.

### The Naked Truth

Turns out, this wasn’t some desperate liquidity scramble. The move frees up capital for a aggressive expansion play that could double revenue by 2026. Funny how ‘value destruction’ sometimes builds empires.

### Yield Chasers in Shambles

Income investors are dumping shares like hot potatoes. Meanwhile, growth vultures are circling—the stock’s now trading at pre-pandemic multiples despite 20% higher EBITDA. Classic Wall Street myopia.

### The Cynic’s Bonus

Of course, this ‘strategic pivot’ conveniently lines up with executives cashing out options next quarter. But hey—at least they’re cutting the dividend instead of their own bonuses this time.

Image source: Getty Images.

An unsustainable payout

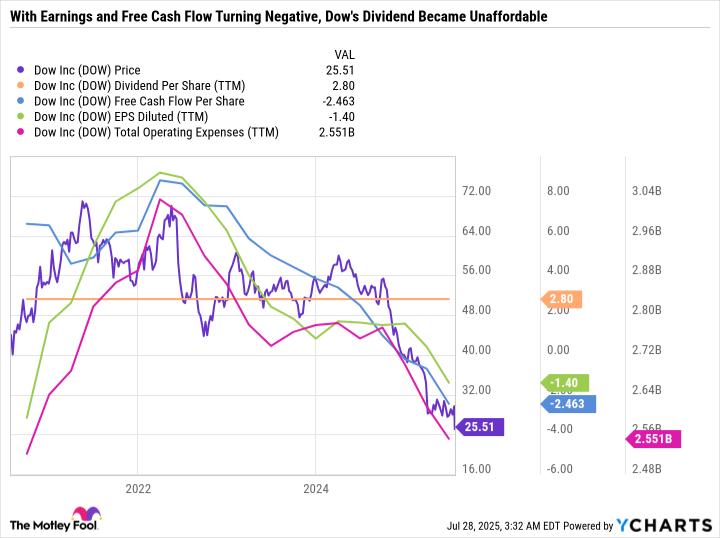

As shown in the following chart, Dow's earnings per share (EPS) and free cash FLOW (FCF) increased significantly during 2021 and 2022, as demand recovered from the pandemic and a supply-demand imbalance emerged in the commodity chemical industry.

DOW data by YCharts. EPS = earnings per share. TTM = trailing 12 months.

However, EPS and FCF have been tumbling for years now. The situation has deteriorated further as Dow's EPS and FCF have turned negative.

When a company's dividend expense is higher than its FCF, that means the money coming into the business is less than the money needed to pay investors a cash dividend. So, a company may tap into cash on its balance sheet, raise debt, dilute its stock, or sell assets. But those solutions are unsustainable over the long term.

If a company believes that its dividend shortfall may continue, even into the medium-term, it may decide to cut the dividend to avoid jeopardizing the health of its balance sheet or credit rating or having to sell assets (likely on the cheap) just to cover the cost.

Dow's dividend cut will save the company about $990 million in expenses per year -- which is a big deal relative to Dow's operating expenses of $2.55 billion over the trailing 12 months.

Referring back to the chart, you can see that Dow has been cutting its operating expenses in recent years (by shutting down plants and reducing inefficiencies). In January, it identified $1 billion in potential cost savings, and it expects to hit $400 million by the end of this year.

Taking a page out of the 3M playbook

Dividend stocks offer investors two types of return: the passive income from dividends and the potential gains from an appreciating stock price. Together, they are referred to as total return. The dividend is great when the stock price is steadily climbing or at least not going down. But if the stock price is plummeting (like in the case of Dow), even a high dividend yield won't be enough to offset those losses, resulting in a negative total return.

Industrial giant was in a similar situation. Growth was slowing, costs were mounting, and 3M's dividend had become unaffordable. 3M completed the spin-off of its healthcare business in April 2024, and then cut its quarterly dividend from $1.51 per share to $0.70. It broke a 64-year streak of increases, removing 3M's Dividend King status. But the decision was worth it.

Between the time 3M made its last full payment as a Dividend King in February 2024 to July 25, 2025, the stock price is up 95.9%, while its dividend is still 42.2% lower. The lower payout freed up precious dry powder that improved 3M's flexibility and allowed it to accelerate its turnaround. Now, 3M is delivering its best results in years, and the investment thesis is much improved.

Dow is worth scooping out of the bargain bin

A dividend is only as good as the company paying it. And right now, it's better for Dow to improve its quality as a business than pay an ultra-high yield. Yet, even after the dividend cut, Dow still yields a whopping 5.5% because the stock price is so beaten down.

Some investors may prefer to take a wait-and-see approach to Dow. However, those who believe Dow can weather this downturn may want to take a closer look at buying the stock now. Results are so terrible and sentiment so negative that even mediocre results WOULD likely be celebrated by Wall Street.

All told, the sell-off in Dow is a buying opportunity because cutting the dividend was the right MOVE and better positions the company to recover.