Wendy’s Dividend Slash: Still a Tasty Investment or a Value Meal Gone Stale?

Wendy's just trimmed its dividend—but is the burger chain still serving up shareholder value?

Here's the beef: The fast-food giant cut payouts this year, leaving income investors hungry for returns. While dividend stocks often anchor portfolios, Wendy's move raises questions about its financial seasoning.

Behind the counter: Slower foot traffic and inflation-battered margins forced management's hand. Now the stock trades like a discounted combo meal—but is it a bargain or yesterday's fries?

Wall Street's still chewing on the numbers. Some analysts see a turnaround play; others smell a value trap. (Then again, these are the same geniuses who thought 'dynamic pricing' was a good idea for burgers.)

Bottom line: Dividend cuts always sting, but Wendy's might still sizzle long-term—if you can stomach the volatility. Just don't expect a happy meal for your portfolio.

Image source: Getty Images.

Is Wendy's new dividend safe?

Earlier this year, Wendy's reduced its quarterly dividend from $0.25 to just $0.14. It was a stock that I mentioned might be due for a cut this year given how low its earnings numbers were; they simply weren't strong enough to suggest the payout was safe. Now, the stock is paying $0.56 per share to investors over the course of an entire year.

During the first three months of 2025, the company reported diluted earnings per share of $0.19, which was down by $0.01 year over year. If it were to maintain that level of profitability consistently in future quarters, then its payout ratio WOULD be approximately 74% of earnings. That would certainly appear to be sustainable.

Are investors overreacting?

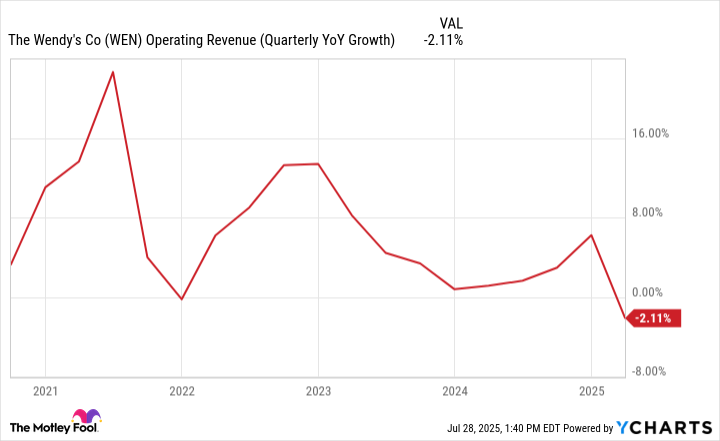

Entering trading this week, Wendy's stock has declined by 35% since the start of the year. Not only has the dividend cut dissuaded investors, but underwhelming results have also been a cause for concern. The company's sales were down during the March quarter and Wendy's guidance calls for systemwide sales growth of between -2% and 0% for the full year.

WEN Operating Revenue (Quarterly YoY Growth) data by YCharts

As a result of the sell-off, the restaurant stock now trades at just 11 times its trailing earnings and it's NEAR its 52-week low. It's a dirt cheap valuation when you consider the average stock in the S&P 500 trades at a multiple of 25.

Should you buy Wendy's stock today?

There's been a lot of bad news around Wendy's stock lately but I'm going to take the unpopular opinion of saying that it's a good buy. It's still a top fast-food chain in the country, and rival chains have also struggled with growth recently.

And by addressing concerns about its dividend and decreasing the payout to a manageable level, it can reduce some of the worry income investors may have about the stock today. Unless the company's financials drastically deteriorate, I don't expect that another dividend cut will happen.

Meanwhile, if the yield -- now standing at 5.2% -- proves to be sustainable, this could be one of the better dividend stocks to own right now. Combine that with a low valuation, which gives the stock a good margin of safety, and I believe you could have yourself a good contrarian investment in Wendy's with plenty of room to rise higher and the possibility to provide you with a lot of dividend income.

I do believe investors have overreacted and have been overly punitive on Wendy's stock this year. But if you're willing to be patient, I think this can make for a good investment to hang on to for the long haul. While the business may be struggling, it's by no means broken.