Bloom Energy Stock Surges: The Clean Energy Rally No One Saw Coming

Wall Street's latest darling? Bloom Energy stock is skyrocketing this week—leaving fossil fuel dinosaurs scrambling.

The hydrogen hype train rolls on

Clean energy plays are back in vogue as institutional money floods the sector. Bloom's solid oxide fuel cells suddenly look like the iPhone of energy infrastructure—if iPhones ran on electrochemical reactions and government subsidies.

Short sellers get burned (again)

The bears didn't see this rally coming. Then again, neither did the analysts who were busy upgrading oil stocks last quarter. Classic Wall Street—always fighting the last war.

One thing's clear: in the race to decarbonize, Bloom just lapped the competition. Whether this is the start of a clean energy revolution or just another bubble waiting to pop... well, that's why they call it speculation.

Image source: Getty Images.

Bloom is blossoming in investors' eyes thanks to this opportunity

Investors leaped at the opportunity to power their portfolios with the stock last week after the company announced a deal withfor the deployment of fuel cells to power data centers, and the enthusiasm is continuing into this week as well.

Nuclear energy stocks have emerged as one of the most appealing alternative energy options for companies operating data centers, but the deal with Oracle suggests that Bloom Energy might have a robust new opportunity considering the massive amounts of capital that artificial intelligence (AI) companies are investing in data centers.

Another source of the market's ebullience is an analyst's auspicious outlook. Last Friday,analyst Manav Gupta boosted the price target on Bloom to $51 from $29 due to the company's deal with Oracle.

Is Bloom ready to wilt, or is there still room to run?

While the Oracle deal and the analyst's revised price target are understandable reasons for shares to rise, it's important to acknowledge that there are more tangible reasons for buying the stock.

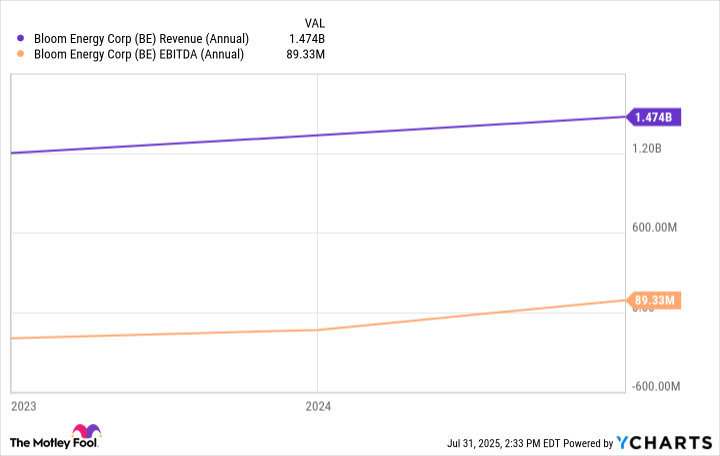

BE Revenue (Annual) data by YCharts.

Bloom Energy is growing both revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) -- a hopeful sign that the company will succeed in a way that its peers have not. This makes Bloom Energy worth further investigation for fuel cell exposure.