The Only ’Magnificent Seven’ Stock You’d Buy Today and Hold Forever (Hint: It’s Not Tesla)

Forget the hype—this isn't about chasing memecoins or betting on Elon's next tweet. We're talking about the one tech titan built to outlast market cycles, regulatory crackdowns, and even its own hype.

The AI Juggernaut Hiding in Plain Sight

While Wall Street obsesses over short-term earnings, this company's quietly locking down the infrastructure powering the next decade of automation—cloud, chips, and enterprise-grade AI tools.

Why Institutions Won't Let It Fail

With more government contracts than Bitcoin has 'institutional adoption' press releases, it's effectively become a shadow tech ETF. The ultimate 'too big to fail' play—with better margins than your local crypto exchange.

The Cynic's Take

Sure, it won't 100x overnight like some degen's shitcoin portfolio. But unlike 99% of 'Web3' projects, it actually generates revenue—billions worth—while your NFT collection gathers digital dust.

Microsoft is the tech world's one-stop shop

When you've been in business for 50 years, you tend to expand your business beyond its initial focus. In Microsoft's case, what began as a company solely focused on operating systems evolved into a comprehensive tech conglomerate spanning multiple industries. Below are some notable categories and what Microsoft offers in each:

- Software: Windows operating system, Office (Excel, PowerPoint, Teams, Outlook, OneDrive)

- Hardware: Laptops, tablets, and various accessories

- Cloud computing: Microsoft Azure

- Gaming: Xbox (and a recent $68 billion Activision Blizzard acquisition, making it one of the largest gaming companies in the world)

- Social media: LinkedIn (over 300 million active monthly users)

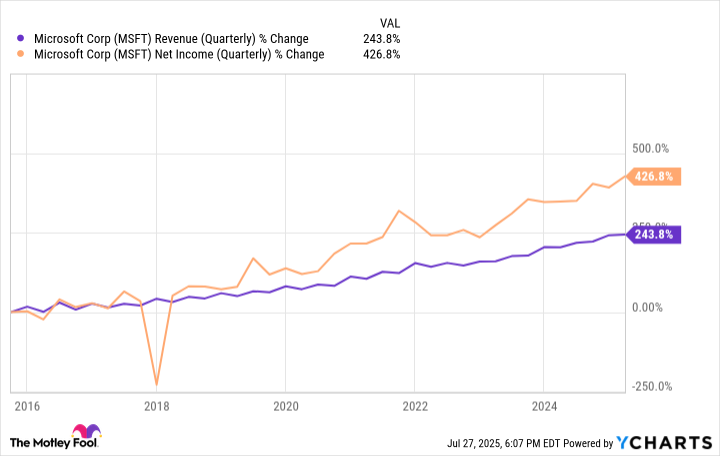

Microsoft's diversified business positions it well for the long term by reducing its reliance on a single segment. That is a large part of why its revenue and profit growth have been steady despite broader economic challenges.

MSFT Revenue (Quarterly) data by YCharts

All eyes on Microsoft's cloud business

Like other big tech companies, such as Amazon, Alphabet, and, Microsoft's most important growth engine is its cloud business, Azure. Azure is the second-leading cloud services provider in the world (21% market share), trailing only Amazon Web Services (AWS) (30% market share).

It WOULD be an uphill battle for Azure to catch up to AWS in the near future, but it grew its market share by nearly 10% since 2017. In its fiscal third quarter, ended March 31, Microsoft's Azure and "other cloud services" segment grew revenue 33% year over year, far outpacing any other segment.

One key advantage Azure has is Microsoft's partnership with ChatGPT creator OpenAI. The partnership makes Azure the sole cloud provider powering OpenAI's workloads and artificial intelligence (AI) models, enabling Microsoft to integrate OpenAI's AI capabilities more seamlessly into its products and services.

Microsoft is already the leader in enterprise software. Adding AI capabilities -- especially ones that don't require tons of resources to develop in-house -- further strengthens Microsoft's ecosystem.

A premium price for a premium company

Microsoft's stock is far from cheap by most standards, but that shouldn't come as a surprise, given its popularity and dominance. It's currently trading at nearly 34 times its forward earnings, which puts it in the middle of the Magnificent Seven companies, trailing only Tesla, Nvidia, and Amazon.

TSLA PE Ratio (Forward) data by YCharts

Typically, when you're paying a premium for a stock like Microsoft, you need to be prepared for short-term volatility as investors react to both good and bad news. However, in my case, it's a stock that I don't plan on selling, so the current valuation isn't as important to me as it would be for someone who has a shorter time frame.

My strategy with Microsoft for a while has been to dollar-cost average and trust its long-term potential.