Why Visa Could Be the Safest Stock in Your Portfolio

Digital Payments Giant Defies Market Volatility

While Wall Street obsesses over the next shiny tech stock, Visa quietly processes billions in global transactions—rain or shine. The payment processor's network effects create an impregnable moat that even the most bearish economists can't ignore.

Steady Growth in Cashless Revolution

Visa's infrastructure handles over 200 billion transactions annually across 200+ countries. As digital payments surge, the company collects fees on every swipe, tap, and click—whether it's coffee in Tokyo or groceries in London.

Regulatory Protection and Recurring Revenue

Unlike speculative tech plays, Visa operates within established financial frameworks while benefiting from the global shift away from physical currency. Their subscription-like revenue model makes quarterly earnings predictable—something rare in today's meme-stock casino.

While crypto bros chase 1000x returns, Visa shareholders sleep soundly knowing the company gets paid when both traditional and digital assets change hands. Sometimes the safest bet is the house taking a cut of every transaction—financial innovation's oldest trick.

Image source: Visa.

Visa's incredible growth story

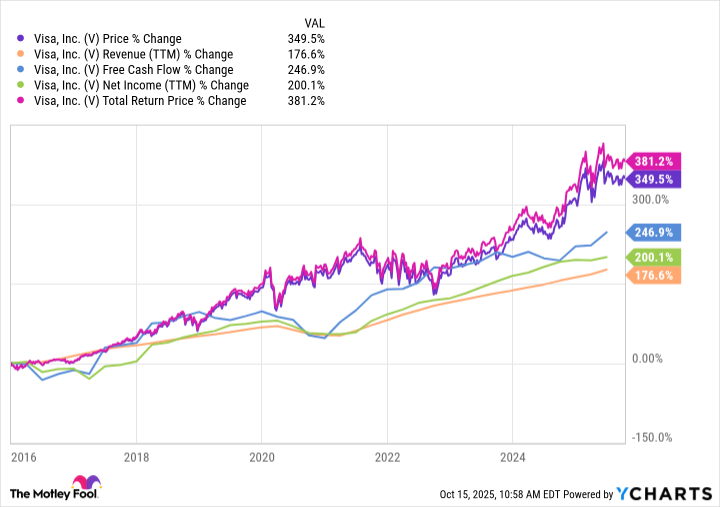

Visa has delivered stupendous revenue, earnings, and cash-flow growth over the years, and that's been reflected in its share price. A regular dividend further adds to Visa stock's value.

Here's a chart showing Visa's growth over the past 10 years and the returns its stock has generated during the period, including total returns with reinvested dividends.

V data by YCharts.

Visa is one of the largest payment-processing companies in the world with over 4.7 billion credentials, which are the total number of its payment instruments in circulation, such as co-branded credit and debit cards, prepaid cards, and digital wallets. Each time someone swipes a card to transact anywhere in the world, Visa earns a fee for authorizing, clearing, authenticating, securing, and settling transactions. It also earns income from cross-border payments and value-added services, such as advisory and risk management.

An asset-light business model and a vast global presence creates powerful network effects for Visa, leading to higher margins and profits. The company processed over 300 billion transactions totaling a staggering $16 trillion in volume last fiscal year.

Those numbers should only grow higher for two reasons. First, Visa's consumer card payments business has a lot of potential as e-commerce grows and more economies go cashless. Second, Visa's innovative technologies and expansion into commercial payments, money transfers, and more value-added services should drive growth. Add it all up, and Visa could be the safest stock you'll ever own.