Japan’s Crypto Insider Trading Crackdown Forces Global Regulators to Play Catch-Up

Tokyo draws a hard line in the digital sand—while Wall Street regulators scramble to keep pace.

The New Enforcement Standard

Japan's Financial Services Agency just dropped the regulatory equivalent of a nuclear warhead on crypto insider trading. Their sweeping ban doesn't just target traditional securities—it covers digital assets with teeth that make SEC enforcement look like a gentle suggestion.

Global Domino Effect

Watch as financial watchdogs from London to Singapore suddenly find themselves playing regulatory catch-up. The Land of the Rising Sun just became the global standard-bearer for crypto market integrity—leaving other nations scrambling to justify their slower-moving approaches.

Market Impact

Traders are noticing the shift. Compliance departments worldwide are burning midnight oil rewriting rulebooks that suddenly seem dangerously outdated. Meanwhile, crypto exchanges operating in Japanese waters are implementing surveillance systems that would make Big Blink twice.

The irony? Traditional finance spent decades building insider trading frameworks, while crypto gets the polished version in one regulatory sweep—proving sometimes the student becomes the master while the old guard is still figuring out blockchain basics.

Image source: The Motley Fool.

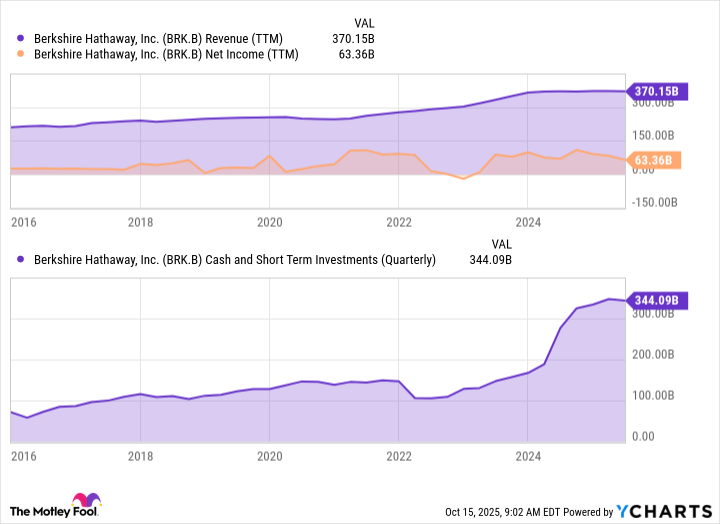

Berkshire Hathaway is a cash-generating machine

Berkshire Hathaway operates a diversified group of businesses, spanning major sectors such as insurance, freight rail transportation, and utilities and energy.

Some of its Core businesses include GEICO, the Berkshire Hathaway Reinsurance Group, the Burlington Northern Santa Fe railroad, and Berkshire Hathaway Energy. These are supplemented by numerous manufacturing, service, and retailing operations, including Precision Castparts, Clayton Homes, McLane Distribution, and Pilot Travel Centers.

One significant component of Berkshire's CORE operations is its numerous insurance businesses. Buffett loves insurance because it generates something called float. Float, which is the pool of premiums collected up front that can be invested before claims are paid, acts as a low-cost source of capital that fuels Berkshire Hathaway's other investments. This float has grown substantially, reaching about $171 billion at the end of 2024.

Berkshire can invest this float in short-term instruments, such as U.S. Treasury bills, which generate interest income for the company. As policies lapse over time, Berkshire retains the remaining amount after paying claims, which gives it a substantial cash reserve for investment purposes.

BRK.B Revenue (TTM) data by YCharts

Looking toward the future of a Berkshire Hathaway post-Warren Buffett

Investors may be concerned about Berkshire's future after Buffett steps down at the end of this year. After all, Buffett, alongside his right-hand man, the late Charles Munger, has displayed stellar investing acumen and patience over the years.

Investors will want to get familiar with Todd Combs and Ted Weschler. Buffett and Munger handpicked the two in the early 2010s to help manage Berkshire Hathaway's vast investment portfolio and prepare for the company's long-term succession.

Both brought strong track records from their hedge fund backgrounds: Combs from Castle Point Capital, where he specialized in financials, and Weschler from Peninsula Capital Advisors, where his returns exceeded 23% annually from 1999 to 2011.

Since joining, they've gradually taken over billions in Berkshire's equity portfolio and helped modernize its holdings. One of their most influential moves was encouraging Berkshire's position in, a company Buffett once avoided for being too tech-oriented. The investment has since become Berkshire's single most valuable stock holding, contributing tens of billions in gains.

Berkshire Hathaway is an enormous conglomerate with a huge cash stockpile of nearly $340 billion. The company looks well positioned to continue generating steady cash flows from its core businesses, and under its new investing lieutenants, could grow its public stock portfolio, too.

Could buying Berkshire Hathaway set you up for life?

If Berkshire delivers average annual returns of 11% (which it has since 2000), a $10,000 investment would be worth $80,623 after 20 years and $228,923 after 30 years. This demonstrates the power of compound returns over time and how single stocks can significantly contribute to your investment journey.

Berkshire owns numerous businesses, so investors could feel comfortable allocating a larger proportion of their portfolios to this stock. However, it remains essential to maintain a diversified portfolio of stocks that you contribute to over time.

Berkshire is an excellent company that is diversified across the economy. I think Buffett's hand-picked investing lieutenants could breathe life into its investment portfolio. If Buffett and Munger were as adept at selecting successors as they are with stocks, then Berkshire investors should be in good hands for years to come.