BigBear.ai Stock Skyrockets 68% in One Month - Time to Buy the AI Hype?

AI stock explodes as investors chase the next big thing in artificial intelligence

The Numbers Don't Lie

Sixty-eight percent gains in thirty days - that's the kind of performance that turns heads on Wall Street and Main Street alike. BigBear.ai's sudden surge has traders wondering if this is the beginning of a major AI revolution or just another bubble waiting to pop.

Market Psychology at Play

When a stock moves this fast this quickly, it triggers every investor's FOMO instinct. The fear of missing out on the next NVIDIA or Tesla drives rational people to make irrational decisions. Meanwhile, hedge funds are probably already taking profits while retail investors pile in.

Timing the Unpredictable

Buying at the peak feels brilliant until it doesn't. The same momentum that drives prices up can reverse just as violently. Remember - what goes up 68% in a month can easily give back half those gains in a week when the algorithms turn.

Wall Street's favorite game: convincing you to buy what they're selling while quietly positioning for the inevitable correction. The house always wins, even when it's dressed in AI clothing.

Image source: Getty Images.

BigBear.ai stock may have rallied thanks to these developments

When BigBear.ai released its Q2 results a couple of months ago, it reported an 18% decline in its revenue from the prior-year period. The company's losses increased as well. It reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of negative $8.5 million, as compared to a negative reading of $3.7 million in the year-ago period.

BigBear.ai attributed its poor performance to lower-than-expected revenue from certain U.S. Army contracts. But the fact that the company reduced its full-year guidance indicates that there is more to the situation than meets the eye. BigBear.ai was originally forecasting a 7% increase in revenue in 2025 to $170 million at the midpoint of its guidance range.

However, its updated guidance range of $125 million to $140 million points toward a drop of almost 18% in its revenue from 2024 levels. That's why the stunning rally in BigBear.ai stock of late seems pretty surprising. Apparently, the company managed to win back investor confidence by highlighting some recent contract wins.

In September, the company announced that its passenger processing solution was approved for deployment by Nashville International Airport to enable faster identity checks with the help of BigBear.ai's AI-powered facial recognition solution. The company followed up this development with another announcement in September, pointing out that its AI solutions will be used by the U.S. Navy in a maritime exercise.

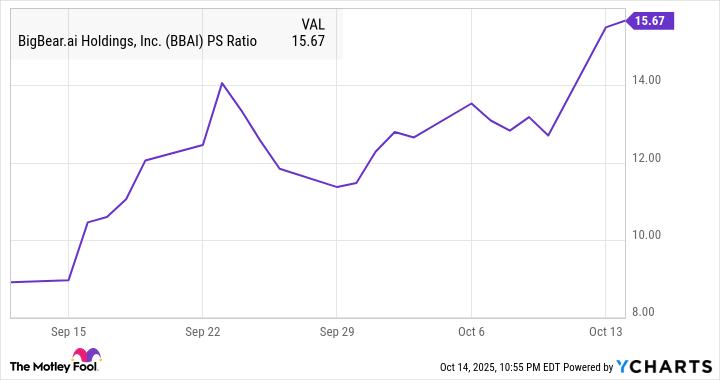

And just recently, BigBear.ai said it is partnering with another company to help security organizations deploy AI tools at the edge while conducting ground operations on the battlefield. These announcements seem to have boosted investor confidence in BigBear.ai stock. However, the massive rally means that the stock now trades at an expensive 15.5 times sales. That's well above its price-to-sales ratio just a month ago.

Data by YCharts.

Can the stock sustain its rally?

BigBear.ai's valuation makes it clear that the stock is priced beyond perfection. This means that the company will have to continue exceeding the market's expectations and deliver a solid set of results and guidance that point toward a turnaround in its fortunes.

However, BigBear.ai hasn't put a dollar value on these recent partnerships. So, it is difficult to gauge how much added revenue it expects. Not surprisingly, the recent developments advertised by BigBear.ai haven't led to any improvement in analysts' sentiments.

Data by YCharts.

Moreover, BigBear.ai's reliance on federal contracts for a significant chunk of its revenue means that its business is dependent on government budgets and the timing of contracts. So, it seems difficult to count on the company to post a quick turnaround based on the recent announcements. Moreover, the big jump in BigBear.ai stock in the past month means that the stock got ahead of itself when its valuation and financial performance are taken into account.

As a result, the stock's 12-month median price target points toward a potential drop of 33% from current levels. That's why it WOULD be a good idea for investors to stay away from this AI stock and look at other options that are clocking healthy growth levels and have the potential to jump higher.