Why Crypto Investors Are Flocking to MUTM Alongside XRP in 2025

Portfolios are getting a major reshuffle as savvy crypto investors double down on MUTM while maintaining XRP positions.

The New Power Pair Emerges

XRP continues its steady climb, but MUTM's explosive potential is turning heads across trading desks. Investors aren't abandoning established players—they're building strategic positions in both.

Diversification Meets Opportunity

While XRP handles regulatory hurdles with institutional grace, MUTM represents the high-growth frontier that still defines crypto's wild west. Smart money knows you need both horses in the race.

Timing the Market Waves

2025's regulatory clarity created windows of opportunity that weren't available during last cycle's uncertainty. Investors aren't just buying tokens—they're buying into specific timelines and use cases.

Because nothing says 'calculated risk' like betting on two unproven assets instead of one—welcome to modern portfolio theory, crypto-style.

Image source: Getty Images.

Gold is the ultimate hedge against a growing money supply

Gold is a scarce precious metal, and it's quite difficult to mine, which means very little new supply hits the market each year. In fact, just 216,000 tons have been extracted from the ground throughout history, compared to billions of tons of other commodities like coal and iron ore.

Gold also can't be controlled by any one country. It's stored as a reserve in most central banks throughout the world, so there is a clear consensus about its legitimacy as a store of value. In fact, many governments used to peg their domestic currencies to the value of gold, including the U.S. until 1971.

Under the gold standard, a country needed to have enough physical gold to match its currency reserves, which limited the amount of new money its government could print, thus keeping inflation under control. Since the U.S. abandoned the gold standard five decades ago, money supply has exploded, resulting in a decline in the U.S. dollar's purchasing power of over 90%.

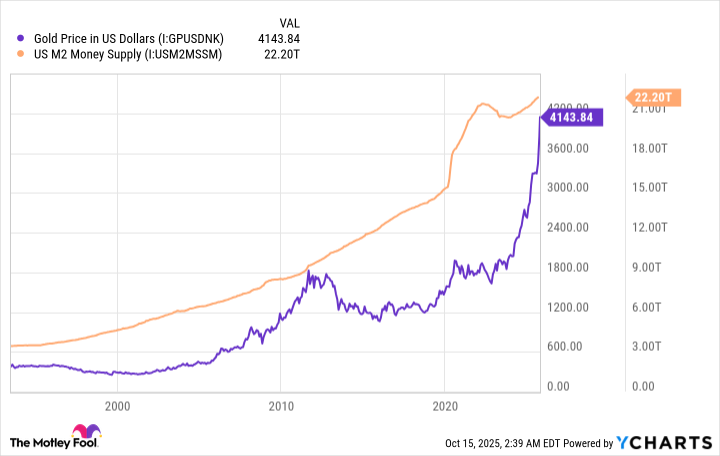

The below chart shows how closely the value of gold (relative to the U.S. dollar) has tracked the enormous increase in money supply:

Gold Price in US Dollars data by YCharts

The U.S. national debt is currently $37.6 trillion (and climbing), and the budget deficit in fiscal 2025 alone (which ended on Sept. 30) was an eye-popping $2 trillion. Investors are betting the dire fiscal situation can only be resolved by devaluing the U.S. dollar even further through the expansion of money supply, so they are aggressively hedging with gold.

Ray Dalio's unusual gold recommendation

Ray Dalio is a student of history, which is a key reason for his success as a hedge fund manager. He regularly warns about the consequences of reckless government spending, and he likens the current situation to the early 1970s when soaring inflation, spending, and debt destroyed confidence in paper currency.

Financial advisors have wide-ranging opinions when it comes to buying gold. Some believe it should make up no more than 5% of an investors' portfolio, because it typically underperforms earnings-producing assets like stocks. However, in light of the present fiscal situation in the U.S., Dalio recommends investors park a sizable 15% of their portfolios in the yellow metal.

I'm not sure I agree. While it might be tempting to chase gold's eye-popping 58% return this year, it's worth noting certainly the yellow metal has averaged a more conservative annual gain of around 8% for the last 30 years, underperforming the benchmark(^GSPC 0.40%) stock market index.

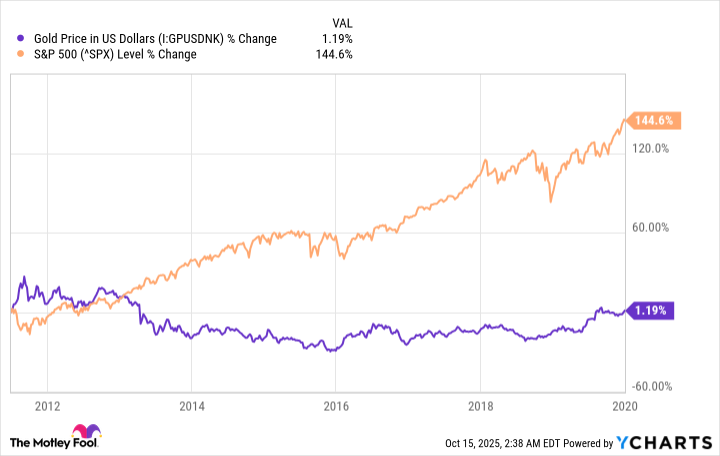

Gold also has a tendency to deliver flat returns for lengthy periods of time -- had you bought it in June 2011, for example, you'd have earned nothing for almost an entire decade. The stock market was up 144% over the same period:

Gold Price in US Dollars data by YCharts

In other words, gold might be borrowing some returns from the future right now, which could lead to another long period of poor performance in the years ahead. But that doesn't mean investors should avoid it completely.

Buying gold has never been simpler

Before investors go out and buy gold bars, they might want to consider a much simpler alternative. Physical gold requires secure storage and insurance, and it's difficult to sell quickly in a pinch. But an exchange-traded fund (ETF) like the(GLD 1.75%) can solve those problems, because it can be bought and sold instantly through a regular investment account just like any stock.

The SPDR Gold Trust is fully backed by real gold reserves, but owning shares won't entitle investors to any physical metal. They can still capture all of gold's upside through the ETF, but they won't receive delivery of any gold bars in the event of an apocalypse.

Plus, the ETF has an expense ratio of 0.4%, meaning an investment of $50,000 will incur an annual fee of $200. For most people, that's probably still cheaper than storing physical gold.

In summary, despite the minor drawbacks I outlined above, buying an ETF like the SPDR Gold Trust is probably the simplest and most convenient way for most investors to add gold to their portfolios.

Personally, I think a smaller portfolio allocation than Dalio's recommended 15% might be the way to go, considering there are so many other high-growth investment opportunities up for grabs right now, particularly in the artificial intelligence space.