Forget Intuitive Surgical? This Magnificent Medical Device Stock Could Be Your Next Big Win

Medical robotics giant faces unexpected challenger in high-stakes surgical arena.

The Robotic Revolution Hits a Crossroads

Surgical suites worldwide are witnessing a quiet takeover—automated systems now outperform human hands in precision procedures. While one company dominated early adoption, fresh competition emerges with groundbreaking technology.

Innovation That Cuts Through Conventional Limits

Newer systems bypass traditional surgical constraints with adaptive AI integration and modular design. Reduced setup times and lower per-procedure costs create compelling value propositions for hospital administrators watching their budgets—because nothing makes a CFO happier than cutting costs while maintaining quality metrics.

Market Dynamics Shift Beneath the Surface

Established players face margin pressure as next-generation devices hit commercialization phase. Early adoption rates suggest potential for rapid market share capture in key surgical specialties. The medical device sector's constant innovation cycle continues—where today's breakthrough becomes tomorrow's commodity.

Investment thesis meets operating table reality: sometimes the best returns come from knowing when to abandon a former champion for the rising contender. After all, in healthcare investing, yesterday's innovative solution is just today's expensive legacy system waiting to be disrupted.

What's wrong with Intuitive Surgical?

Intuitive Surgical was one of the first companies to introduce a surgical robot. Its da Vinci robot is an industry-leading medical device. There are a lot of reasons to like the business, including the huge opportunity that surgical robots offer with regard to health outcomes for patients. Notably, in the long term, a robot could be controlled by a doctor thousands of miles away. That WOULD allow top-tier medicine to be delivered anywhere there is a da Vinci system in place.

Image source: Getty Images.

Demand is still robust for da Vinci systems. In the second quarter of 2025 the company had 10,488 robots in place globally, up 14% year over year. The company's robots performed 17% more surgeries year over year. Clearly, healthcare professionals want to use da Vinci systems and patients want their doctors to use them. But there's one small problem: Intuitive Surgical only makes surgical robots. That can leave the stock exposed to material volatility based on the often-fickle mood of investors.

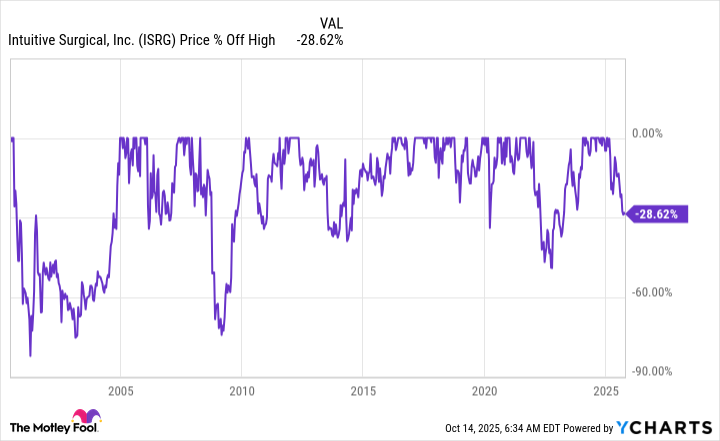

The stock has fallen around 25% from its recent highs. A drawdown of that size is, actually, a fairly common occurrence for this growth stock. More aggressive investors might see that as a buying opportunity, but more conservative investors might see that as a sign that the stock isn't going to be a good fit for their portfolios.

There's another option.

Data by YCharts.

Medtronic makes surgical robots and much, much more

If you like the idea of having exposure to surgical robots but don't want to go all-in on the one medical device, you'll want to consider buying(MDT -1.29%). Medtronic is one of the largest medical device makers on the planet, and it is in the process of commercializing its own surgical robot. But that's just one part of its business, which spans across the medical surgical, cardiovascular, neuroscience, and diabetes arenas.

To be fair, Medtronic is coming out of a weak patch in which new product launches were scarce and operating costs were rising. It has been a bit of a turnaround story, noting that the company's efforts to focus on its most profitable operations will lead to the spinoff of its diabetes business in 2026. But the company is starting to get back on track. In the fiscal first quarter of 2026, ended July 25, the company's top line grew 8.4% with organic sales growth of 4.8%. Both are solid numbers for a diversified industry giant like Medtronic.

But what's most likely to interest more conservative investors is the dividend. For starters, Medtronic has one, and Intuitive Surgical does not. Further, Medtronic has increased its dividend annually for 48 consecutive years, which is just two shy of Dividend King status. And the nearly 3% dividend yield on offer right now is well above the 1.2% you'd get from theindex and the average 1.7% for the healthcare sector.

All in, you get exposure to surgical robots, a diversified medical device business, a company that's starting to grow more quickly, a reliable dividend payer, and a lofty dividend yield. That's a pretty compelling alternative to Intuitive Surgical if you are a more conservative investor or even just a dividend lover.

There's nothing wrong with Intuitive Surgical

Intuitive Surgical is a well-run business and likely has a bright long-term outlook as a company. But that doesn't mean it will be a good investment choice for everyone. If you like the idea of surgical robots but can't stomach buying volatile Intuitive Surgical stock, you should take a look at Medtronic today.