Wreck League’s Cross-Chain Breakthrough: Yellow SDK Solves Fragmentation, Wins Hackathon Glory

Gaming's interoperability nightmare just met its match.

Wreck League's mech combat platform deployed Yellow SDK's cross-chain magic—slashing fragmentation barriers that have plagued blockchain gaming since its inception.

Hackathon judges spotted the potential instantly. Recognition landed not for promises, but for working infrastructure that actually connects disparate chains.

While traditional finance still debates blockchain adoption, gamers are busy building the bridges that matter. Cross-chain functionality isn't coming—it's already here, solving real problems while Wall Street analysts scratch their heads about 'crypto winter.'

The revolution won't be televised. It'll be played.

Image source: TSMC.

TSMC's results and guidance are going to be solid

TSMC's growth has been outstanding in the past couple of years thanks to the artificial intelligence (AI) chip boom. The Taiwan-based company is the world's largest contract chipmaker with an estimated market share of 70%, according to market research firm TrendForce.

TSMC manufactures chips for not just,, and, but also for the likes of(AAPL 0.97%),, and MediaTek. This diverse customer base gives TSMC the ability to benefit from the booming demand for AI chips not just in data centers, but also in smartphones and computers. It is easy to see why TSMC's growth has been ahead of its projections so far this year.

The company recently reported its revenue for September, the last month of Q3. Its top line jumped by 31% from the year-ago period during the month, bringing its total quarterly revenue to $32.5 billion. That's slightly higher than the midpoint of its guidance range, and also more than what Wall Street was looking for.

The company's total revenue in the first nine months of the year has jumped by over 36%. This puts TSMC well on course to exceed its 2025 revenue guidance of 30%. Importantly, TSMC's earnings for the third quarter are likely to grow at a solid pace as well. That's because the company has reportedly increased the price of its popular 3-nanometer (nm) process node by around 20%.

Chips manufactured using a 3nm process node are in hot demand because of their deployment in smartphones. TSMC reported that 27% of its revenue came from the smartphone segment in the second quarter of 2025, and the 3nm process node accounted for 24% of its top line. Given that Apple is manufacturing its latest iPhone processors on TSMC's 3nm node, and its latest smartphones are seeing stronger-than-expected demand, TSMC is likely to benefit from a combination of higher volumes and pricing toward the end of the year.

According to, Apple may increase its iPhone production to more than 90 million units from the earlier build forecast of 84 million to 86 million units. Apple reportedly accounts for 20% of TSMC's top line, so a potential increase in iPhone production, as well as the reported increase in prices, could help the chipmaker issue better-than-expected guidance for Q4.

The stock could sustain its rally in 2026 and beyond

TSMC is going to further improve its chip manufacturing process in 2026 by moving to a 2nm node. By shrinking the size of its chips, TSMC will be able to pack in more computing power and reduce power consumption. Apple, Nvidia, AMD, and MediaTek are reportedly going to be the first customers of the company's 2nm chip node next year.

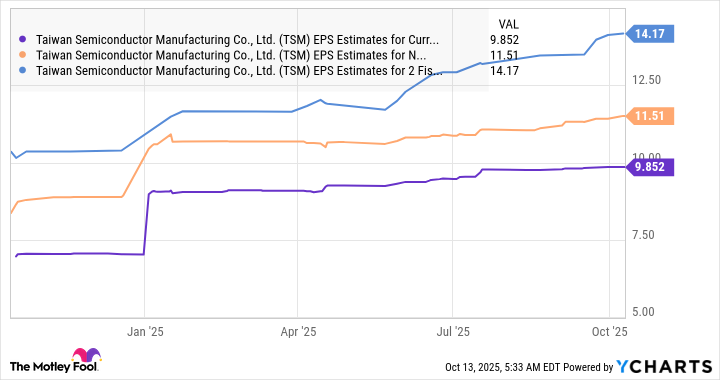

With the 2nm chips expected to carry a premium of 10% to 20% over the 3nm process node, don't be surprised to see TSMC's earnings growth to be faster than consensus estimates in 2026. The company is expected to clock a 40% increase in its bottom line this year. Analysts expect that growth rate to slow down to 17% in 2026.

However, the reported price increases of the existing 3nm process node, as well as the higher pricing of the next-generation 2nm process node, are the reasons why TSMC's earnings growth could be higher than expected. As such, its earnings expectations could likely MOVE higher.

Data by YCharts.

TSMC's ability to continue outperforming expectations and maintain a healthy pace of growth, thanks to the AI-powered secular opportunity in the semiconductor market, should be a tailwind for this growth stock. That's why it WOULD make sense to buy TSMC stock while it is trading at an attractive 25 times forward earnings.

It is currently trading at a nice discount to the tech-heavyindex's earnings multiple of 33 (using the index as a proxy for tech stocks). However, a solid set of results on Oct. 16 could send TSMC stock higher and inflate the valuation, so it may be a good idea to buy shares before that happens.