Square Launches Zero-Fee Bitcoin Payment Program - Crypto Adoption Accelerates

Square just flipped the script on traditional payment processors with its revolutionary zero-fee Bitcoin payment initiative.

The Game Changer

No more hidden fees eating into merchant profits. No more complex payment structures confusing both businesses and customers. Square's bold move cuts through the financial industry's favorite revenue stream - those pesky transaction fees that somehow always manage to surprise everyone except the banks collecting them.

Adoption Catalyst

This program bypasses traditional payment gateways entirely, creating direct Bitcoin-to-cash settlements that leave legacy systems scrambling. Merchants receive immediate liquidity while customers enjoy seamless crypto transactions.

Market Implications

The timing couldn't be more strategic. As traditional finance institutions continue debating whether crypto deserves a seat at their polished oak tables, Square just pulled up with its own chair - and it's accepting Bitcoin. Because nothing says financial revolution like watching established players realize they're charging for services that technology just made free.

Image source: Getty Images.

One market indicator has a warning for investors

To be clear, nobody -- even the experts -- can predict with 100% accuracy where stocks will be in a few months or when the next downturn will begin. The market can be incredibly unpredictable in the short term, and even the most knowledgeable investors often get it wrong.

That said, it can still be helpful to look at historical context to see what has happened with similar market cycles.

One stock market metric that can be beneficial in seeing whether the market is overvalued is the Buffett Indicator. This indicator measures the ratio between the total value of U.S stocks to GDP, and it gained its nickname after Warren Buffett famously used the metric to predict the dot-com bubble burst of the late 1990s.

In a 2001 interview with Fortune Magazine, Buffett noted that it's generally safest to invest when the ratio is between 70% and 80%. However, he noted that "if the ratio reaches 200% -- as it did in 1999 and a part of 2000 -- you are playing with fire."

So where does the Buffett Indicator stand right now? As of October 2025, it's close to 221%. That's the highest it's ever been, and it could suggest that the stock market is in uncharted territory.

Should you be worried about investing right now?

It's important to note that no stock market indicator is accurate all of the time, and some experts criticize the Buffett Indicator for not being as accurate as it once was.

Because this indicator compares total market value to GDP, higher company valuations will drive up the ratio. The tech industry has grown at breakneck speed over the last couple of decades, and these companies have far higher valuations than even the largest organizations 30 years ago. That doesn't necessarily mean these stocks have all been overvalued for years; rather, valuations have simply increased over time.

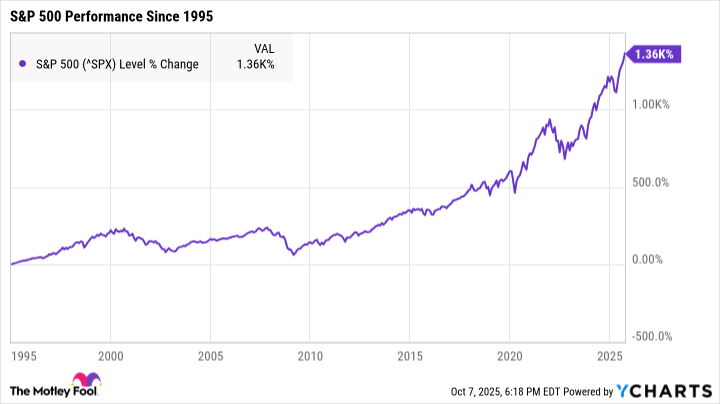

^SPX data by YCharts

It may not be fair, then, to use the same metrics to compare today's companies to those from decades ago. In fact, the last time the Buffett Indicator ratio dipped below 80% was in 2012. If you'd held off on investing after that for fear that the market was close to becoming overvalued, you'd have missed out on life-changing wealth.

In other words, stock market metrics -- like the Buffett Indicator or the S&P 500's potential three-peat -- can be helpful in some cases to gain context. However, they're not always an accurate prediction of what's to come.

We will see a stock market downturn at some point, as prices can't keep soaring forever. But rather than getting hung up on precisely when it might happen, it's often better to keep investing as usual, stay focused on the long term, and double-check that your portfolio is prepared to weather any potential stock market storms just in case.