Palantir Plunges 7%: Crypto-Style Opportunity or Value Trap?

Palantir's sudden 7% nosedive has traders buzzing—is this the dip worth buying or another tech stock illusion?

DATA DIVE OR DATA DISASTER?

That 7% haircut looks suspiciously familiar to crypto veterans who've seen this movie before. Palantir's government contracts and AI ambitions might scream 'stable growth,' but recent volatility suggests otherwise. The company's blockchain-esque data tracking technology suddenly feels less revolutionary when shares tumble.

WHY CRYPTO INVESTORS ARE WATCHING

Traditional finance analysts see risk—crypto natives see pattern recognition. That 7% drop mirrors the kind of shakeouts that separate diamond hands from paper hands in digital asset markets. Palantir's secretive data mining operations could either be the next big thing or another overhyped tech story—sound familiar, NFT collectors?

THE BOTTOM LINE

While Wall Street debates Palantir's fundamentals, crypto-minded investors are already calculating risk-reward ratios. That 7% discount might look tempting, but remember: in both tech stocks and crypto, sometimes the 'dip' keeps dipping. Another day, another chance to outperform traditional portfolio managers who still think Bitcoin is a fad.

Image source: Getty Images

The rise of an AI star

Most people are familiar with Palantir Technologies due to the stock's success, if nothing else, but they are often uncertain about what the company actually does. Essentially, it develops custom software applications that leverage artificial intelligence (AI) and machine learning to analyze vast amounts of data, providing actionable insights.

The company worked closely with the U.S. government in its early years, but it has expanded significantly since AI went mainstream, helping corporations that are seeking ways to use AI.

Palantir's appeal lies in its flexibility. Its software works for almost any industry or application. For instance, it's helping hospitals with scheduling, banks detect fraud and money laundering, and manufacturers optimize supply chains. And that's just scratching the surface.

It continues to collaborate closely with the U.S. government and its allies across various departments on a range of tasks, including support for military missions and facilitating vaccine distribution during the pandemic.

Accelerating growth with a long runway

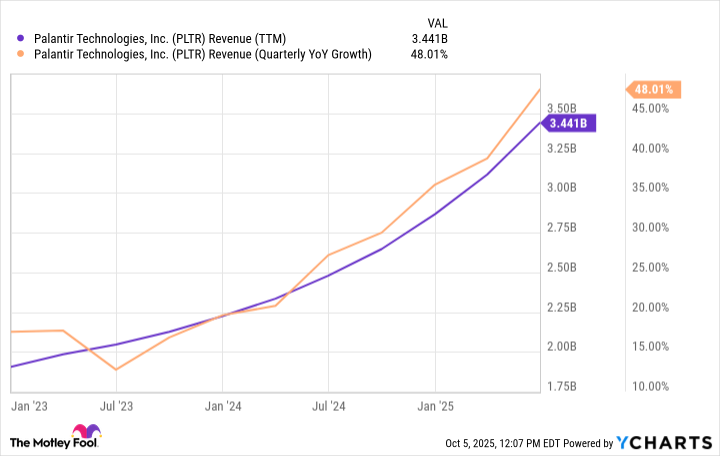

Palantir's success is evident in its results. The company launched its Artificial Intelligence Platform (AIP) in mid-2023, and revenue growth has continually accelerated since then:

Data by YCharts; TTM = trailing 12 months.

Remarkably, Palantir could still be just getting started. The company had just 692 commercial customers at the end of its second quarter of 2025. There are about 20,000 large companies (those with 500 or more employees) in the U.S. alone.

Not every company out there wants Palantir or can afford its software. However, it's feasible that it could eventually have several thousand customers in the commercial sector. It received 55% of its revenue from government contracts over the first six months of 2025, so the commercial opportunities add significant upside to broader long-term growth.

Should investors buy this dip?

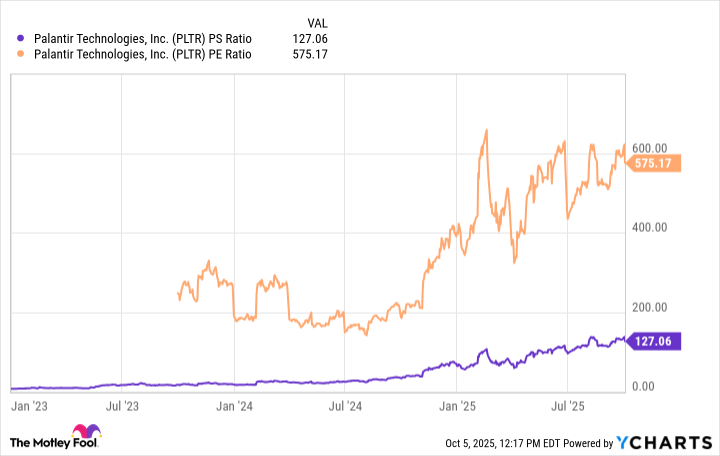

In short, no. As impressive as Palantir's growth and business performance have been over the past few years, the stock has risen even faster. As a result, the valuation has become a bubble that has inflated to epic proportions.

Whether you look at the stock's price-to-sales ratio (P/S) or price-to-earnings ratio (P/E), it is abhorrently expensive. To put these numbers into perspective, Palantir, which has generated about $3.4 billion in revenue over the past four quarters, has a market capitalization of $410 billion. It's already one of the world's largest companies by market value.

Data by YCharts.

In other words, Palantir's share price reflects a company with revenue and profits that rank among the largest businesses in the world. Of course, that's what investors hope the company can become one day, but it hasn't happened yet.

When stocks become this disconnected from the underlying businesses, severe declines are often not a matter of if, but when. Such excessive valuations set similarly high expectations. It's like a rubber band stretched to its limits: The slightest pluck can dramatically affect it and even risk snapping it.

Palantir's stock is similarly stretched. A deceleration in revenue growth or an external factor, such as a broader market decline, could cause it to plummet. That doesn't mean it will happen, but it seems there is more potential downside than upside at this point, to put it mildly.

I don't say this to incite panic, but as a cautionary tale that bubbles have happened throughout investing history. Unfortunately, bubbles almost always end with a burst. Palantir is well on its way to becoming a world-class company. However, the stock has risen to valuations that create the conditions for a potential collapse.

Remember: Stock prices can seem like they only go up. But when that changes, it can happen quickly.