2 Must-Buy Tech Stocks Set to Dominate 2025

Tech investors hunting for alpha in a volatile market just found their roadmap.

AI Infrastructure Plays

Companies building the picks and shovels for the AI gold rush aren't just surviving—they're printing money. While crypto bros chase the next meme coin, smart money backs the silicon brains powering everything from autonomous vehicles to quantum computing.

Cloud Security Frontrunners

As data breaches make headlines weekly, firms offering bulletproof digital fortresses command premium valuations. They're the silent guardians profiting from corporate paranoia—because nothing sells like fear in the boardroom.

Forget betting on fleeting trends. These established tech titans combine innovation with revenue streams solid enough to survive even the Fed's next mood swing.

Image source: Getty Images.

1. Tempus AI

First up is(TEM 1.49%). To start, there's no shame in not knowing Tempus AI or what they do. Tempus is a relatively small company with a market cap of $15 billion, and its stock has only been public for a little over a year.

The company was founded in 2015 and specializes in healthcare technology. It focuses on sequencing, molecular genotyping, and pathology testing that is of use to drug-makers in particular. Indeed, the company sits at the crossroads of two fast-growing and state-of-the-art technologies: artificial intelligence (AI) and genomics.

As a result, there is plenty to like about Tempus' long-term prospects, particularly as AI continues to improve and offers the ability to treat disease. However, Tempus is already showing signs of financial growth. As of the company's latest quarter (ended on June 30), Tempus reported:

- $315 million in revenue, up 90% year over year

- $195 million in gross profit, representing a gross margin of 61%

- $(43) million in net loss, an improvement over its net loss of $(552) million one year ago

The company's genomics testing business generated $242 million, or 77%, of its revenue. At the same time, $73 million, or 23%, of the company's revenue came from its data and services business, mostly from licensing.

In summary, Tempus remains a young company with plenty of room to grow. Its next challenge will be consistent profitability, paired with maintaining its rapid revenue growth. Given its place at the nexus of genomics and AI, I'm bullish on the company's chances to pull it off.

2. Oracle

Next is(ORCL -2.72%). The reason Oracle makes the cut as one of the best tech stocks to own right now is simple. The stock has outperformed recently, and it has several catalysts that I expect will continue to power it higher.

It may come as a surprise that Oracle stock has outperformed of late. After all, many people remember the stock for its big collapse following the dot-com bubble more than 20 years ago. And while it's true that Oracle's stock took about 15 years to regain its pre-dot-com bubble highs, the stock has simply been on fire for the last five years.

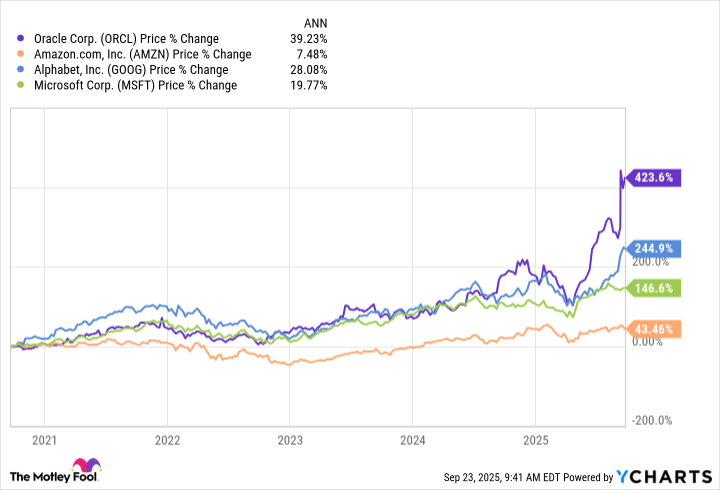

Indeed, Oracle stock has outperformed many high-profile big tech stocks over that period -- in some cases, by a huge margin. For example, Oracle stock has generated a compound annual growth rate (CAGR) of 39% over the last five years. That beats,, and.

ORCL data by YCharts

This resurgence is thanks to Oracle's big push to provide cloud services to companies within the red-hot AI sector. In short, the organizations that want to dominate the AI space require enormous cloud resources to train and run their models, and Oracle is stepping up to supply the data centers to meet the surging demand.

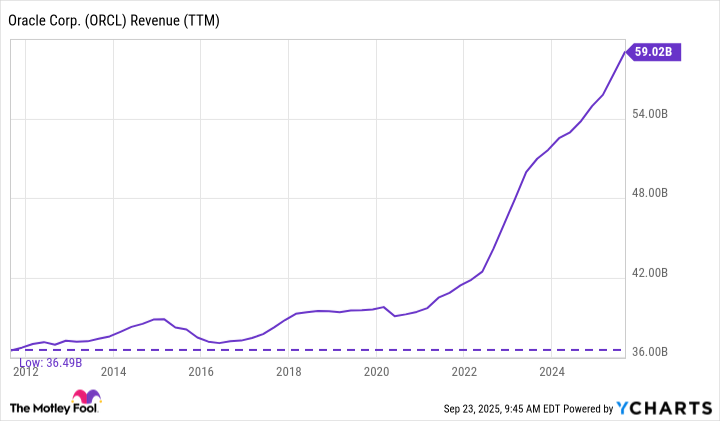

As a result, Oracle's revenue has grown by about 46% over the last five years, jumping from $39 billion to $59 billion. That's key, as the company struggled with sluggish revenue growth for a decade between 2011 and 2021. Indeed, during those years, Oracle's revenue bounced between $35 billion and $40 billion, before significantly breaking out in 2022.

ORCL Revenue (TTM) data by YCharts

Considering the rapid growth and demand for AI applications, I think Oracle's strategy is sound. Investors looking for AI exposure shouldn't overlook the company's stock.