Cruise Stocks Took a Devastating Hit in 2020 - Five Years Later, Is It Finally Time for Bold Investors to Reconsider?

The cruise industry got absolutely wrecked in 2020 - we're talking Titanic-meets-iceberg levels of devastation. Now, half a decade later, those ghost ships are starting to look like potential treasure galleons.

From Floating Ghost Towns to Revenue Machines

Remember when cruise ships became the world's most expensive paperweights? Five years of brutal restructuring, fleet modernization, and consumer psychology shifts have transformed these former pariahs. The numbers don't lie - occupancy rates are climbing faster than a drunk tourist on a rock-climbing wall.

The Pandemic Hangover Is Finally Fading

Travel appetite's come roaring back with a vengeance. People aren't just taking vacations - they're making up for lost time with premium experiences. Cruise operators have leveraged this pent-up demand to implement dynamic pricing models that would make airline executives blush.

Smart Money's Already Boarding

Institutional investors have been quietly accumulating positions while retail investors were still worrying about norovirus outbreaks. The smart play? Betting on companies that used the crisis to jettison outdated vessels and debt - turns out near-death experiences are great for corporate fitness.

Of course, this could all sink faster than a casino buffet shrimp cocktail if another black swan event hits. But that's the thing about contrarian plays - they make you look like a genius or get you laughed out of the yacht club. Typical finance - where 'calculated risk' often means 'gambling with better vocabulary'.

Image source: Getty Images.

Demand is stronger than ever

When cruising returned to a sense of semi-normalcy in 2022, cruise volume rebounded from virtually nothing to 84% of pre-pandemic (2019) levels. And beyond that, we've seen a remarkable surge in demand.

The year 2023 set a new all-time record, with 16.9 million cruise passengers in the United States, 2.7 million more than in 2019. Then in 2024, 18.2 million Americans set sail on cruise ships, fueled by the introduction of several huge ships to the fleets of major cruise lines. And 2025 is expected to be the third consecutive year of record high passenger volume.

To be sure, cruising is certainly a cyclical business -- usually. But we really haven't seen consumers pumping the brakes on cruise spending as they have with other forms of travel and tourism, even in the uncertain economic times of the past few years.

Are cruise stocks worth a look right now?

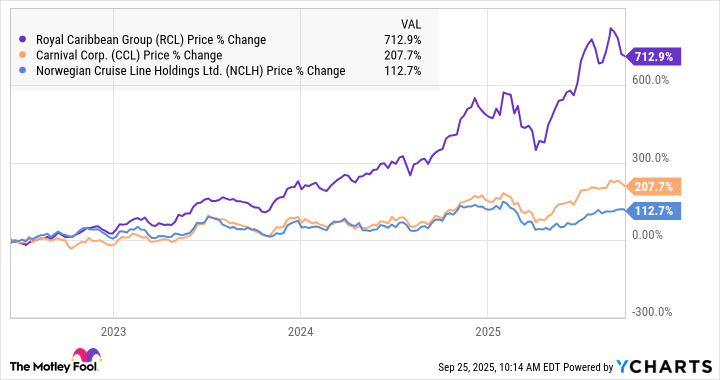

As you might expect, all of the major cruise lines' stocks have rebounded sharply from the pandemic-era lows. Since the bottom in mid-June 2022, before it was clear that cruise demand was roaring back, shares of (NCLH 0.26%) are up by 112%, and that's the worst performer of the three major cruise lines.

In the same time period, the stock of (CCL 0.46%) has more than tripled. And(RCL 0.62%) has been the biggest winner by far, with an outstanding 711% gain. In a nutshell, Royal Caribbean's new megaships -- especially the Icon of the Seas, launched in 2024 -- have been wildly successful, and demand for them has resulted in incredible profit growth.

RCL data by YCharts.

With that in mind, here's a snapshot of where the three major cruise lines stand today:

|

Royal Caribbean |

$17.2 billion |

10.4% |

19.5 |

$88.5 billion/$19 billion |

|

Carnival |

$26 billion |

9.5% |

14.5 |

$39.9 billion/$28.7 billion |

|

Norwegian Cruise Line |

$9.56 billion |

6.1% |

10.8 |

$11.3 billion/$14.9 billion |

Data source: Company financials, CNBC. P/E ratios and market caps as of Sept. 25; TTM = trailing 12 months.

Which cruise stock is the best buy now?

To be clear, assuming that cruise demand stays strong (and this is a big assumption), all three look rather attractive right now. But even after its big move, if I were to buy one of the three today, it WOULD be Royal Caribbean. It has (by far) the healthiest balance sheet of the group, and although it is the most richly valued, it also has the highest growth rate.

Plus, management is doing a great job of executing, and with its next megaship and several new destinations coming over the next year, it wouldn't be a shock to see revenue growth accelerate a bit.