Bold Prediction: This AI Semiconductor Stock Will Join Nvidia, Microsoft, Apple, Alphabet, and Amazon in the $2 Trillion Club by 2028 (Hint: Not Broadcom)

The Next Trillion-Dollar AI Powerhouse Emerges

While Wall Street analysts chase yesterday's winners, one semiconductor company quietly builds the infrastructure for tomorrow's AI revolution. This isn't another Broadcom story—this is about the chipmaker positioning itself as the backbone of artificial intelligence computing.

The Path to $2 Trillion by 2028

Four years might seem aggressive for reaching the exclusive $2 trillion club currently occupied by tech titans like Nvidia and Microsoft. But this company's AI semiconductor technology cuts through traditional processing limitations, bypassing legacy architecture constraints that hamper competitors. Their chips don't just enable AI—they accelerate it at scales previously unimaginable.

Market analysts who dismissed similar projections for Nvidia back in 2023 now scramble to adjust their models. The pattern repeats: underestimate AI infrastructure demand at your own portfolio's peril. Meanwhile, traditional valuation models struggle to price exponential growth—but then again, most financial models still treat AI like a niche sector rather than the platform shift it represents.

The semiconductor space undergoes its most significant transformation since the smartphone era. This company's technology doesn't merely compete—it redefines the playing field. As AI workloads explode beyond data centers into edge computing, autonomous systems, and generative applications, their chips become the indispensable engine powering the transition.

By 2028, joining the $2 trillion club requires more than incremental growth—it demands capturing the entire AI infrastructure wave. This semiconductor player positions itself not as another chip supplier, but as the fundamental building block for the next decade of computing. Sometimes the market rewards the obvious leaders; sometimes it massively underestimates the infrastructure providers making those leaders possible. Smart money bets on both.

Image source: Taiwan Semiconductor Manufacturing.

At the time of this writing, TSMC's market cap is around $1.4 trillion. To hit the $2 trillion mark by 2028, it WOULD need to average around 14% annual returns over the next few years. You should never use past performances to predict future ones, but given the company's growth prospects and its 29% average annual returns over the past decade, I'm confident it can happen.

TSMC's role in the AI ecosystem

TSMC isn't your typical artificial intelligence (AI) stock in the sense that it has a generative AI app or other software people interact with. Yet its role in the AI ecosystem is as important as almost any stock you can name.

Companies like,, andall design chips and other hardware that power data centers, which are essentially the backbones of training and developing AI models. Yet most of this wouldn't be possible without TSMC's advanced manufacturing ability.

When it comes to manufacturing advanced AI chips, TSMC is essentially the only go-to. Without it, you could make a valid argument that data centers would be less efficient, which means that AI training would be less efficient, which means many of the AI applications we interact with today would be less capable and scalable.

TSMC is improving its profit and margins

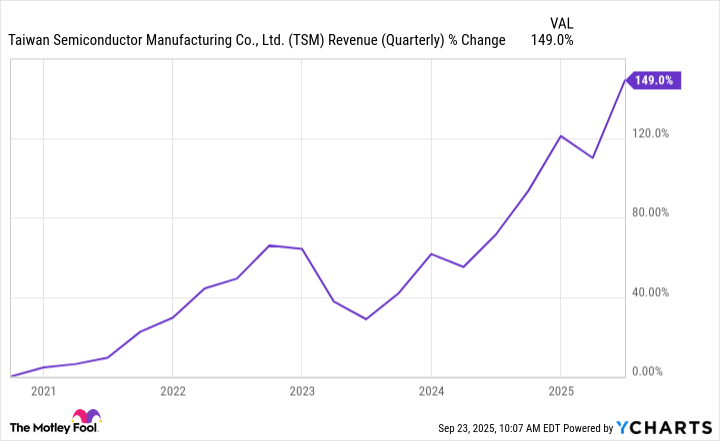

TSMC has long been an impressive moneymaker, but it has stepped it up a lot in the past few years. In the second quarter, it made $30 billion in revenue, which was up 44% year over year and close to 18% higher than the first quarter. If its third-quarter revenue falls between $31.8 billion and $33 billion, as it predicts, that will represent between 35% and 40% year-over-year growth.

In Nvidia's latest earnings report, it noted that it expects $3 trillion to $4 trillion in AI infrastructure through 2030. With TSMC being a key part of AI infrastructure, this should be music to the company's ears.

TSM Revenue (Quarterly) data by YCharts

The revenue growth is impressive, but TSMC's expanding margins may be the most noteworthy. Since last year, its profit margin has expanded from 36.8% to 42.7%, gross margin has expanded from 53.2% to 56.8%, and operating margin has expanded from 42.5% to 49.6%.

These expanding margins are a testament to TSMC's ability to command premium pricing because of its advanced manufacturing ability, and its customers knowing that it's essentially their only choice if they want the most powerful chips.

TSMC is trading at a good value for long-term investors

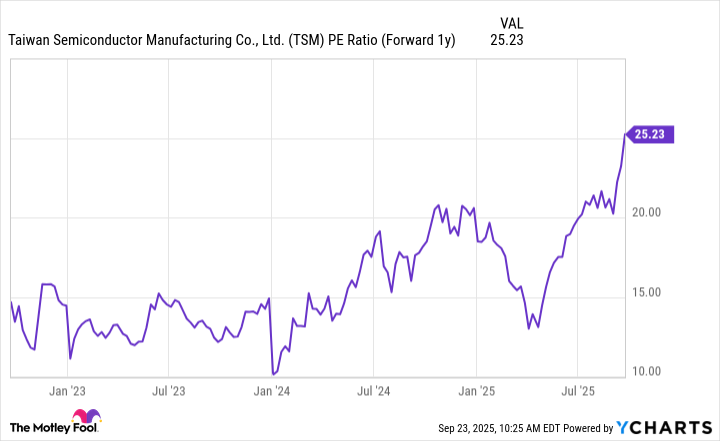

TSMC is currently trading at around 23.5 times its projected earnings for the next 12 months. It's not "cheap" by most standards, but it also seems like a good value for a company that's as dominant as TSMC and has its growth potential.

TSM PE Ratio (Forward 1y) data by YCharts

TSMC's advanced manufacturing ability isn't something that can be easily caught up to and replicated because it takes many years of experience and billions invested into research and equipment. That gives it a competitive advantage that's likely to last for quite a while, especially because it's not easy for its customers to switch manufacturers without risking performance or reliability.

That edge gives me confidence that TSMC can enter the $2 trillion club within the next few years.