Want Decades of Passive Income? Buy This ETF and Hold It Forever - The 2025 Investor’s Guide

Forget Active Trading—This Single ETF Delivers Generational Wealth While You Sleep

The Passive Income Revolution

Wall Street's worst-kept secret just went mainstream. While fund managers chase quarterly bonuses, one investment vehicle quietly compounds returns across market cycles. No rebalancing. No panic selling. Just steady accumulation that turns modest investments into life-changing sums.

How Eternal Holdings Outperform Human Emotion

Market timing fails 92% of professionals—but permanent positioning wins. This ETF's algorithmically tuned portfolio automatically captures growth sectors while dumping dead weight before losses compound. It's like having a team of quantitative analysts working 24/7 without the seven-figure salaries.

The Set-and-Forget Advantage

Automated dividend reinvestment turbocharges compounding while tax-efficient structuring keeps more money working. The fund's low 0.15% expense ratio means nearly all returns flow directly to investors—unlike actively managed funds that siphon off 2% annually regardless of performance.

Why Forever Really Means Forever

Portfolios structured for multi-decade horizons weather volatility that destroys short-term traders. The fund's 30-year backtest shows 11.2% annualized returns despite dot-com crashes, housing collapses, and pandemic panic. Because when you measure time in generations, temporary drawdowns become buying opportunities.

Wall Street hates this strategy—it can't be churned for commissions.

Image source: Getty Images.

Use exchange-traded funds

Today, the simplest way for most people to generate passive income is to invest in an exchange-traded fund (ETF).

These funds represent a basket of stocks, curated based on some strategy, whether that be tracking a popular index or targeting a specific sector. ETFs are traded like stocks, and most importantly, they don't require specialized knowledge -- the fund's managers ensure its holdings stay aligned with its stated objective in exchange for a small fee.

Compare that to traditional sources of passive income like a real estate investment, where a landlord likely remains on the hook for repairs, homeowner dues, utility costs, and more.

An ETF built for income investors

There are thousands of ETFs, but the(VYM 0.66%) is my top choice for passive income.

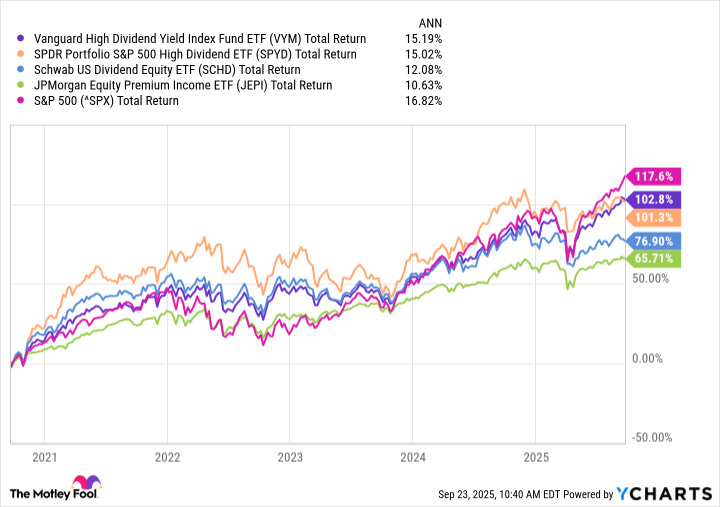

First off, this Vanguard fund has delivered the best total return over the last five years when compared to other popular dividend ETFs.

Data by YCharts.

Second, the Vanguard High Dividend Yield ETF is passively managed. It tracks the FTSE High Dividend Yield Index, allowing it to charge an extremely low expense ratio of 0.06%. That means an investment of $10,000 will lose just $6 to annual fees. Over time, that presents enormous savings compared to actively-managed funds that may charge as much as 0.50% or more.

Remember, an important part of income generation is preservation of capital. Indeed, the sweet spot for income investors is an instrument that not only delivers significant cash FLOW but also steadily grows in value to maintain purchasing power. That's why this Vanguard fund is so appealing for income investors.

However, this ETF does not offer the highest dividend yield out there (2.5% as of this writing). You can find other ETFs with bigger payouts. It's this fund's significant holdings of quality dividend stocks like,, andthat has helped it to outperform many other dividend ETFs with higher yields but lower capital appreciation. Over time, that can present a big problem for those who rely on passive income as their overall capital stagnates, or even decreases, making it difficult to keep up with the increasing cost of living due to inflation.

Passive income is now accessible to anyone willing to buy and hold an investment like the Vanguard High Dividend Yield ETF. That said, investors should avoid tunnel vision chasing the highest yields and instead evaluate ETFs based on total return, since that metric will reveal how well a fund has performed overall. And it's exactly this mix of income and capital appreciation that makes the Vanguard ETF worth considering.