Don’t Miss These Once-in-a-Decade Crypto Opportunities: 2 Unstoppable Digital Assets to Buy and Hold Forever

Market cycles create generational buying windows—and we're staring at one right now.

The Digital Gold Standard Reinvented

Bitcoin continues defying traditional finance logic, cutting through market noise while legacy institutions scramble to catch up. The original cryptocurrency bypasses banking gatekeepers with mathematical certainty—no boardroom approvals needed.

The Ecosystem Powerhouse

Ethereum's smart contract dominance keeps expanding, swallowing entire industries into its decentralized orbit. Developers flock to its network effect while traditional tech giants play blockchain catch-up—a full cycle behind.

These assets operate on internet time while Wall Street still runs on quarterly reports. The infrastructure shift happening beneath surface-level price movements will redefine global finance—whether traditional players admit it or not.

Timing market bottoms proves impossible, but recognizing structural opportunities separates crypto natives from tourists. The current setup mirrors previous cycle foundations before parabolic moves.

Remember when skeptics called Bitcoin 'digital fairy dust'? Now they're quietly allocating pension funds to it—the ultimate institutional surrender.

CrowdStrike: Cybersecurity for AI

Cybersecurity juggernaut(CRWD 1.65%) saw its stock price drop by nearly 50% after it rolled out a flawed software update that triggered a global IT outage in July 2024.

At the time, many investors and analysts (rightfully) worried about the repercussions for CrowdStrike in terms of retaining customers -- let alone attracting new ones. However, just over a year after that debacle, the company's shares have doubled in value, powered by reaccelerating sales growth in its latest quarter.

In a weird way, the outage served as a stress test of the moat around CrowdStrike's business. And, quite frankly, it passed with flying colors.

The post-outage period offered customers a perfect opportunity to switch to rival cybersecurity providers, but for the most part, they didn't really jump ship. This stability highlights the switching cost moat surrounding CrowdStrike's operations. Now, distanced from the fiasco, the company is diving into today's biggest megatrend: artificial intelligence (AI). And specifically, securing AI.

Image source: CrowdStrike.

Thanks to its recently announced acquisition of AI security leader Pangea, CrowdStrike now offers an AI detection and response module, similar to its existing endpoint detection and response capabilities.

Now securing all things AI, from large language models (LLMs) to AI agents, CrowdStrike will block prompt injection attacks, prevent risky AI use, and trace AI agents back to their human creators.

Kicking off its foray into defending the AI world, CrowdStrike partnered with, a customer relationship management juggernaut, to provide security for its AI agents and applications.

The opportunity from deals like these could be massive for CrowdStrike. Currently, the company believes there are 5 billion addressable assets (cloud workloads, endpoint devices, and human identities) available for it to protect.

However, management predicts that the rise of agentic AI alone could bring in more than 150 billion assets that will need to be secured, creating what CEO and co-founder George Kurtz believes is a "100x" opportunity.

Today, CrowdStrike is trading at 115 times free cash FLOW and 27 times sales, so the company will need to deliver significant growth to justify its valuation.

However, numerous research firms project that the market for agentic AI will grow roughly sevenfold between 2025 and 2030. If CrowdStrike can become the leader in this new niche (as it already has in its established cybersecurity specialties), it could quickly outgrow what looks like a lofty valuation today.

Kinsale's once-in-a-decade valuation

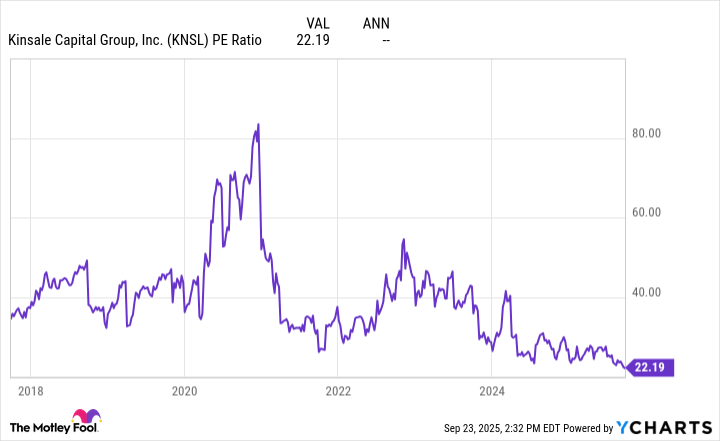

Whereas CrowdStrike's current valuation has a lot of Optimism for the future baked into it, excess and surplus (E&S) insurer(KNSL 1.20%) is trading at the cheapest P/E ratios in its history.

KNSL PE Ratio data by YCharts.

Typically, bargain-bin valuations like these come alongside some pretty serious risks. But that doesn't appear to be the case with Kinsale.

While the company's growth in gross written premiums may have slowed to just 5% in the most recent quarter, earnings per share ROSE 28%. In fact, Kinsale's combined ratio remained strong at 76%, indicating that the company remains the most profitable insurer in the E&S niche. A combined ratio below 100% means that an insurance company is profitable on its underwriting, and Kinsale's mark of 76% is exceptional. For comparison, its closest peers in the E&S industry averaged a lofty 92% ratio between 2022 and 2024.

Kinsale achieves this unusual profitability by focusing on smaller E&S accounts with hard-to-assess risks -- a category of clientele that its massive insurance peers are less APT to pursue.

However, that doesn't mean that the industry's giants won't occasionally venture into Kinsale's E&S niche when the pricing looks right. Over the past few years, premiums for these types of policies have steadily increased, drawing the attention of larger insurers. As a result, there is now excessive price competition in the niche. That prompted Kinsale to pull back in certain areas, which resulted in the slowdown in premium growth.

Sometimes, when insurance juggernauts stampede into Kinsale's niche with deeply discounted prices, it only makes sense for it to stand back and preserve its profitability, rather than try to undercut them and risk underwriting clients at a loss.

CEO and founder Michael Kehoe gave an example of this at an investing conference in 2023, explaining:

We lost an account earlier this year. ... It was a firearms manufacturer. We quoted the renewal policy at a $170,000 premium. ... We lost that to an MGA [managing general agent] that wrote it for $57,000. ... They wrote it at the low price because they misclassified it. They considered it a sporting goods distributor instead of what the business actually did, which was manufacture firearms.This story is an oversimplified way to show that investors shouldn't panic about Kinsale's decelerating premium growth. It operates in a cyclical industry, and pricing competition fluctuates over time.

Was it reasonable for the market to bid down Kinsale's share price in response to its slowing growth? Probably -- Kinsale's prior valuations had become lofty. However, it remains the best underwriter in the E&S space, and continues to capture market share steadily.

Image source: Kinsale Investor Presentation.

Despite that, Kinsale's market share in the E&S industry remains a mere 1.4%, leaving it with decades of growth potential ahead.

Should it maintain its status as the most profitable insurer in its niche, Kinsale will likely return to its market-beating ways, especially from today's once-in-a-decade low valuation.