Prediction: This No-Brainer Artificial Intelligence (AI) Stock Could Surpass Apple and Palantir Combined by 2030

The sleeping giant of AI just woke up—and Wall Street hasn't noticed yet.

Forget chasing yesterday's winners. This under-the-radar play harnesses AI's raw potential without the hype-cycle baggage. It's building the infrastructure that'll power everything from autonomous systems to predictive analytics.

Why This Stock Defies Conventional Wisdom

While Apple perfects incremental upgrades and Palantir courts government contracts, this company solves foundational problems. Its technology cuts through data noise, bypasses computational bottlenecks, and delivers insights that reshape entire industries.

The math gets compelling when you realize most analysts still measure AI growth with pre-2020 metrics. They're counting trees while missing the forest fire of adoption coming by 2030.

Market projections? Conservative. Disruption potential? Underestimated. The only thing growing faster than their tech stack might be institutional regret for overlooking this opportunity.

One cynical take: If history repeats, the same finance firms now dismissing this stock will be overpaying for it once it's already mooned—classic Wall Street timing.

Image source: Getty Images.

A couple of massive markets could send this tech giant soaring in the next five years

(AMZN -0.28%) is the world's fifth-largest company with a market cap of $2.35 trillion. So its market cap right now is 82% short of Palantir and Apple's combined value. However, it won't be surprising to see Amazon bridge this gap in the next five years, thanks to a combination of limited upside potential that Apple and Palantir could witness, as well as the lucrative e-commerce and cloud computing markets that are boosting Amazon's growth.

Amazon dominates both of these markets. It is the largest e-commerce company in many key regions across the globe, and is the largest cloud computing provider by market share. The company is now taking advantage of the adoption of AI in both areas.

From deploying generative AI-powered shopping assistants on its e-commerce platform to using AI robots in its fulfillment centers to sort packages, Amazon's use of this technology can help it win more business from customers and also improve operational efficiency. These efforts are bearing fruit.

Amazon management points out that it "increased the share of orders moving through direct lanes where packages go straight from fulfillment [to] delivery without extra stops by over 40% year over year" in Q2. That's not surprising as Amazon now has 1 million robots across its fulfillment centers worldwide, and it continues to push the envelope to further improve delivery times and reduce operational costs.

Amazon's 30% share of the global cloud computing market is going to be another massive tailwind for the company. The global cloud computing market is expected to generate a whopping $2 trillion in revenue by 2030, with generative AI projected to account for 20% to 30% of that opportunity.

Amazon's cloud business is clocking an annual revenue run rate of $123 billion, suggesting that the company still has a lot of room for growth in this space. Importantly, the revenue pipeline of the Amazon Web Services (AWS) segment is improving rapidly. The company's revenue from AWS stood at a massive $195 billion at the end of Q2, an increase of 25% from the year-ago period.

That was higher than the 17% revenue growth clocked by AWS last quarter. The faster growth in the backlog is an indication that Amazon's cloud business is on track to accelerate. The company is offering several AI-focused services customers can use to build and deploy applications using both in-house chips developed by Amazon as well as powerful graphics cards from the likes of.

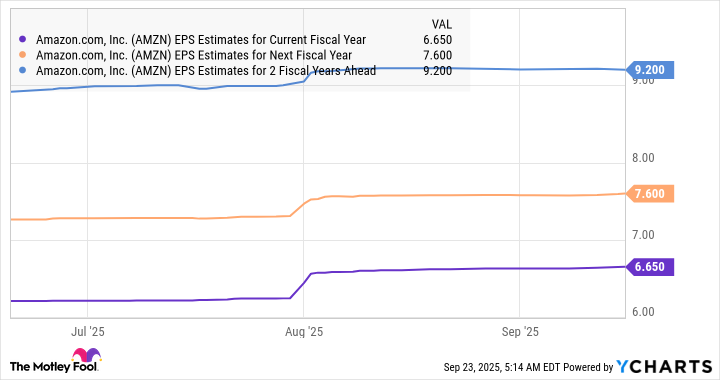

In all, the combined opportunity in the e-commerce and cloud AI markets could eventually translate into stronger bottom-line growth for Amazon. This is precisely what analysts are expecting from the company.

AMZN EPS Estimates for Current Fiscal Year data by YCharts

How much upside can Amazon deliver over the next five years?

Amazon's earnings growth rate could improve from an estimated 14% in 2026 to 21% in 2027. Assuming that the company can increase its bottom line at an annual rate of even 15% in the three years following 2027, its earnings could hit $13.84 per share in 2030.

If Amazon stock is trading at 33 times earnings at that time, in line with theindex's average earnings multiple, its price could jump to $457. That WOULD be double Amazon's current stock price, suggesting that the company has the ability to hit a $5 trillion market cap in 2030 and overtake Palantir and Apple's combined value.

Given that Amazon is now trading at 30 times forward earnings, investors are getting a good deal on this AI stock which has the ability to deliver impressive gains in the next five years.