The Ultimate Dividend King Drug Stock to Buy With $1,000 Right Now

Pharma Giant Delivers Returns That Make Crypto Look Like Child's Play

Forget chasing meme coins—this healthcare titan pays you to hold. While crypto bros pray for the next pump, dividend investors collect quarterly checks like clockwork.

The Steady Hand in Volatile Markets

This drug stock operates in the one sector that never goes out of style: keeping people alive. Prescription demand stays strong whether we're in a bull market, bear market, or zombie apocalypse.

Dividend Aristocrat Status

Twenty-five consecutive years of dividend increases separates the real royalty from Wall Street's flash-in-the-pan hype stocks. This company actually makes money instead of promising future profits.

Defensive Positioning Meets Growth

Patent-protected drugs create moats wider than Bitcoin maximalists' confidence. Pipeline innovations ensure the dividend gravy train keeps rolling while speculators fight over dog-themed tokens.

The $1,000 Entry Point Advantage

Perfect for investors tired of watching their portfolio swing 20% on Elon Musk's latest tweet. Steady compounding beats frantic chart-watching every time—even your accountant will approve.

Because sometimes the most revolutionary investment strategy is the one that's been working for decades while finfluencers were still in diapers.

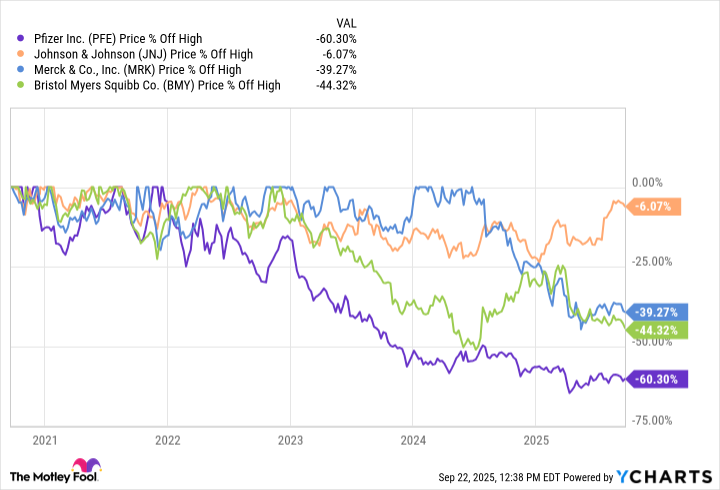

Data by YCharts.

While a price drop isn't necessarily a great thing for the current shareholders of these stocks, it does present an opportunity for investors who like to buy for the long-term potential to get access to some great stocks for dividend-paying pharmaceutical giants while their dividend yields have risen to very attractive levels.

But, as always, the buyer should beware. If you're a dividend lover, you'll want to make sure you consider more than just the dividend yield of the companies you are looking at. Even with those caveats, here's why(JNJ -1.10%) is the ultimate Dividend King drug stock right now.

What are you getting with that yield?

As Warren Buffett has noted, the biggest determinant of an investor's success isn't likely to be their intelligence. It's far more likely to be their emotions, or their ability to control their impulses, to extrapolate a little from the Oracle of Omaha. When it comes to dividend investing, the big risk is getting so enamored of a high dividend yield that you overlook other characteristics of a company.

Image source: Getty Images.

For a great example of this today, compare Johnson & Johnson (often just called J&J) and(PFE 0.04%). Pfizer, one of the world's largest drug companies, has a dividend yield of 7.1% right now. J&J, which makes drugs and medical devices, has a yield of 3%. If all you care about is dividend yield, Pfizer is the obvious choice here.

But is it the better investment for someone who's hoping to live on their dividends in retirement? The yield alone doesn't give you enough information to make a call like that.

Why dividend lovers will prefer J&J over Pfizer

From a top-level view, both Pfizer and J&J are pharmaceutical makers. They are both exposed to the ups and downs of the business, including the political headwinds affecting things today. They both have to spend heavily on research and development to offset the hit when each of their drug patents expires, known as a patent cliff.

But they're not identical, because Johnson & Johnson also has a large medical devices business. There are dynamics in the medical device space that are similar to the drug arena, and different ones, too. But the key is that devices provide additional diversification to J&J, and are a business that Pfizer lacks.

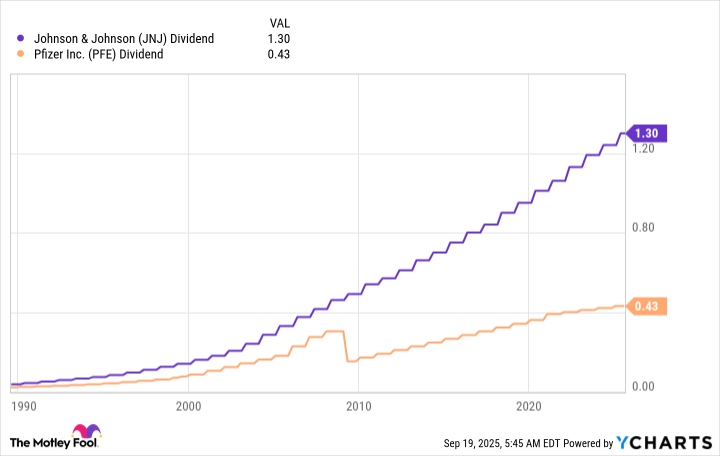

Data by YCharts.

Then there's the issue of dividend history. Pfizer has increased its dividend for 15 consecutive years, which is good. But it cut its dividend in 2009 when it acquired Wyeth. The acquisition was a big deal, coming with a $68 billion price tag, so a dividend cut probably made sense. But if you were counting on that dividend to help pay your bills, you'd have been sorely disappointed by the board of directors' choice to cut the dividend.

Johnson & Johnson, in contrast, has increased its dividend annually for over six decades. Clearly, if dividend reliability is important to you, J&J will be the better option. But how much better?

For starters, having a dividend streak longer than 50 years makes Johnson & Johnson a Dividend King. That's a highly elite group of companies that have proven they place a high value on returning a growing dividend to their shareholders. You can't do that for 50 straight years (or more) without operating a strong business and doing it well.

But there's another wrinkle here. J&J has the longest dividend streak of any healthcare company; it's the undisputed leader of the healthcare Dividend Kings. The runner-up iswith 53 annual increases. And that's it -- there are no other healthcare stocks in this group. (, with 48 increases, is closing in on Dividend King status, but it isn't there yet.) Johnson & Johnson stands out as a dividend stock for a very good reason.

The lower yield is probably the better choice for income investors

Benjamin Graham, the man who helped train Warren Buffett, liked to compare investments to highlight important differences between stocks. This comparison between Pfizer and JNJ is basically the same idea. And the dividend winner looks like Johnson & Johnson.

But there's one more dividend metric to consider here to seal the deal. J&J's trailing-12-month dividend payout ratio is around 55%, which is completely reasonable. Pfizer's payout ratio is in the 90% range, which is worryingly high. Simply put, J&J's dividend has far more room for adversity before a cut WOULD be in the cards.

If you have $1,000 of your hard-earned dollars to invest, would you rather buy around 40 shares of a company like Pfizer with a high payout ratio, little business diversification, and a history that includes a dividend cut? Or would you prefer to put that $1,000 into roughly five shares of Johnson & Johnson, which has a more diversified business, a better dividend history, and a reasonable payout ratio? Sure, with J&J you'd have to step down on yield, but if you're counting on your dividends to pay your bills, the step up in quality is likely to be worth it.