Cathie Wood’s Ark Invest Doubles Down: Bitcoin Could Hit $1.48M in Bull Case

Ark Invest’s latest report sends shockwaves through traditional finance—predicting Bitcoin could surge 5,800% in their most aggressive scenario. The firm cites institutional adoption, ETF inflows, and Bitcoin’s scarcity as key drivers.

Meanwhile, Wall Street analysts scramble to explain why their 2% bond yields suddenly look prehistoric.

Love it or hate it, Wood’s audacious call forces the question: Is crypto eating the world—or just the lunch of overpaid fund managers?

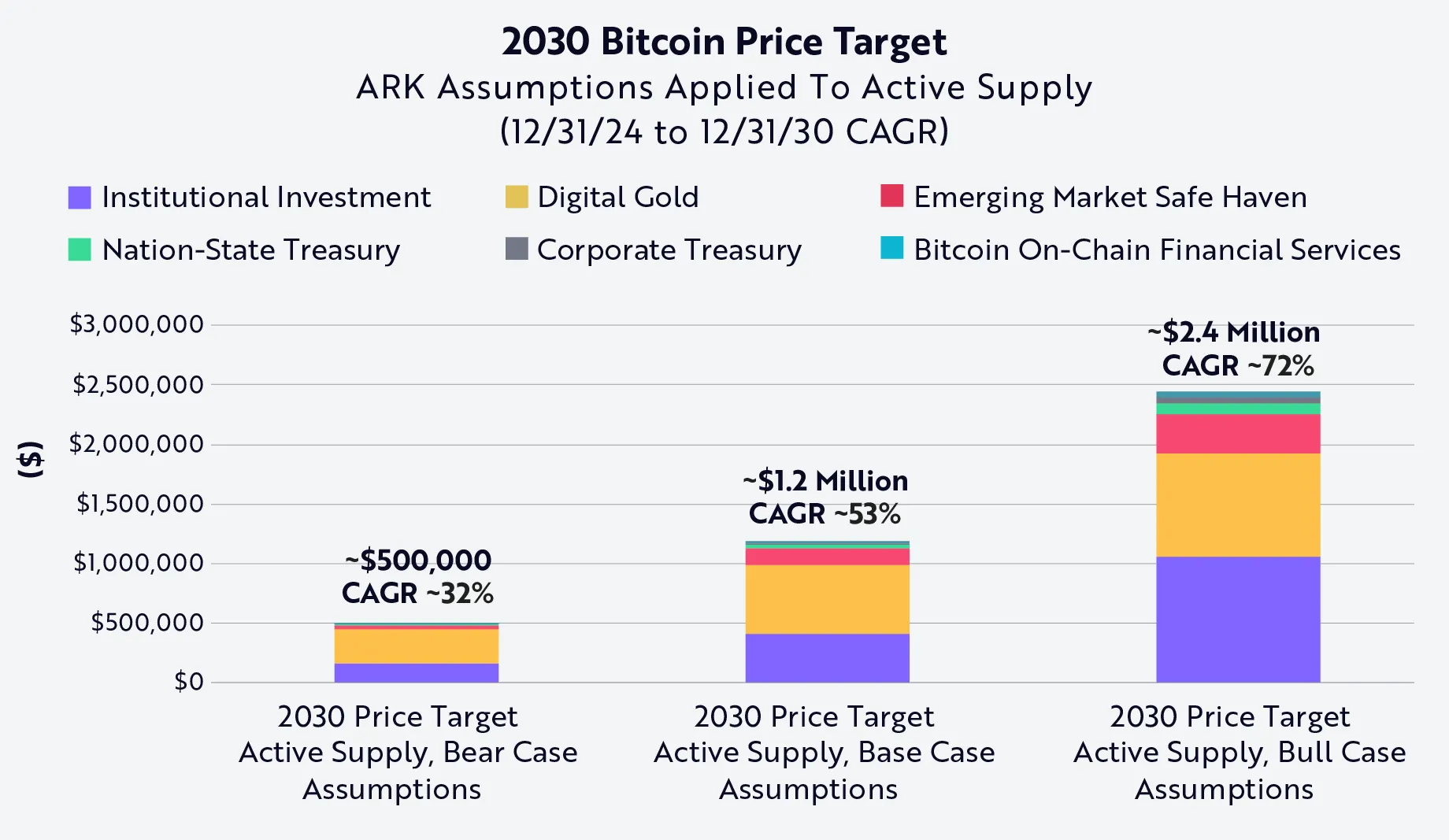

When accounting for active supply, Ark Invest predicts a bear case—or the most negative view—of around $500,000 per BTC. The bull case? A Bitcoin price of $2.4 million per coin.

Contributing to its potential growth, the report highlights the major inputs for its TAM and penetration rate data, which include its standing as a “digital gold,” institutional investment in spot ETFs, emerging market investors seeking a safe haven asset, and corporate treasuries continuing to diversify with Bitcoin.

Ark is not the only Bitcoin proponent to suggest a price appreciation above $1 million per coin. In September Strategy Chairman and co-founder Michael Saylor predicted the leading crypto asset would reach $13 million per coin over the next 21 years. In January, Coinbase CEO Brian Armstrong said he thinks it will reach the “multiple millions price range” as well.

Bitcoin topped $95,000 for the first time in two months earlier Friday, but still remains down from its all-time peak price of nearly $109,000 set in January.

Edited by Andrew Hayward